The KED View

Jury still out on Korean chipmakers’ tech upgrades in China

Whether chipmakers can take EUV equipment to China is a key test of the impact of the US CHIPS Act on Korean firms

By Mar 24, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

When the US Commerce Department announced the guardrail clauses on the CHIPS and Science Act earlier this week, South Korea’s government officials wasted no time figuring out what the requirements mean for their chipmakers’ business in China.

Their conclusion: Restrictions of course. But not as bad as feared.

Seoul officials even went as far as to say there won’t be significant disruptions to Korean chip factories in China. They stressed that they understand there would be no restrictions on technology upgrades.

Industry executives are not resting assured, however.

For them, how they foresee their fate in China is still a tough call as they haven’t heard what they want to hear.

The vast and unconventional conditions, or safeguards as some would say, attached to the CHIPS Act, didn’t contain any clear statement that technology upgrades to existing facilities in China are allowed.

It was just a handful of Washington officials that said grant recipients can do so as long as they receive approval from the US Commerce Department.

“Who would dare bring state-of-the-art DRAM and NAND chip manufacturing equipment to China when the US is desperate to deny its chief adversary access to the cutting-edge technology?,” said an executive at a Korean chipmaker.

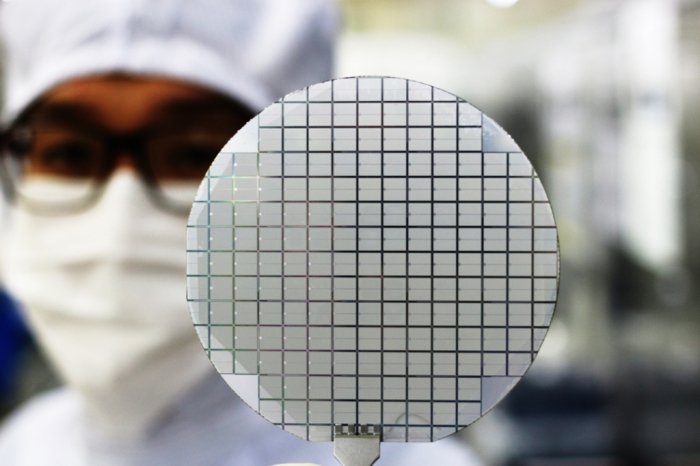

Samsung Electronics Co. and SK Hynix Inc., the world’s two largest memory chipmakers, run chip factories across the globe, including in Korea and China.

In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

DILEMMA OVER CHINA OPERATIONS

The companies are facing a dilemma over how to manage their operations in China after the US last year restricted exports to China of advanced chips and the equipment used to produce them.

While the US government granted global chipmakers such as Samsung and SK one-year exemptions from those rules, Washington hasn’t definitively said what would happen at the end of that period.

There’s a hint though.

Undersecretary of Commerce for Industry and Security Alan Estevez said last month that the US is likely to put a cap on the chipmakers’ chip production in China beyond a specified technology level.

After all, every October Korean chipmakers still have to go to the US government to obtain a one-year permit to import equipment into their Chinese factories.

For Samsung and SK Hynix to maintain their technological prowess and market leadership, bringing advanced chip manufacturing equipment, called extreme ultraviolet (EUV) lithography machines, to China is a must to upgrade their facilities there.

Admittedly, Korea’s government officials did their best to minimize the negative impact of the CHIPS Act on Korean chipmakers.

Nevertheless, Seoul’s optimism about its chipmakers’ business in China is hasty.

Samsung, SK Hynix and many other chip-related domestic companies are walking on a tightrope, caught between the US and China over semiconductor supremacy.

The companies would nod in agreement only when they see cutting-edge semiconductor equipment such as EUV equipment brought into their Chinese factories.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes lead

Business & PoliticsSouth Korea eyes $261 billion chip cluster; Samsung takes leadMar 15, 2023 (Gmt+09:00)

4 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractive

Business & PoliticsConcerned about CHIPS Act, Korea says US investment less attractiveMar 06, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN