Korean chipmakers

Samsung, SK Hynix face collateral damage from Micron chip ban

With China’s move, its domestic chipmakers such as YMTC and CXMT could rise swiftly, analysts say

By May 22, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s two major chipmakers — Samsung Electronics Co. and SK Hynix Inc. — are feeling the heat as they are dragged further into the power struggle between the world’s two largest economies.

China’s decision on Sunday to ban its key infrastructure operators from buying products from US chipmaker Micron Technology Inc. has heightened uncertainty for Korea, already torn between the US, its traditional ally, and its largest trade partner China.

While some pundits expect Samsung and SK to benefit from China's moves by filling the void left by Micron, the majority view is that the two Korean chipmakers will find themselves between a rock and a hard place.

China’s cyberspace regulator said late on Sunday that Micron had failed its network security review and warned Chinese operators of key infrastructure against buying the US company’s goods.

The Cyberspace Administration of China (CAC) neither provided details on what risks it had found nor what products from the world’s No. 3 memory maker would be affected.

The move instantly met with opposition from Washington.

“We firmly oppose the restrictions that have no basis in fact,” the US Commerce Department said in a statement.

Memory chips aren’t generally considered a cybersecurity risk, so Beijing’s decision is seen as retaliation against President Joe Biden's actions to prevent China from obtaining or producing advanced semiconductors.

CHINA TO NURTURE OWN CHIPMAKERS

With the CAC’s move, industry watchers said Chinese companies such as Yangtze Memory Technologies Corp. (YMTC), a NAND flash memory maker, and ChangXin Memory Technologies Inc. (CXMT), which specializes in DRAM chips, will likely fill Micron’s vacancy.

“YMTC's NAND flash competitiveness has risen to a fairly high level, and CXMT is also rapidly strengthening its technology. If China’s infrastructure operators are forced to find alternatives to Micron, they’ll turn to domestic players such as YMTC and CXMT,” said an industry official.

As a result, Korean players, which operate their own chipmaking plants in China, will likely see their Chinese market share decline, he said.

The semiconductor sector has become a key battlefield over national security between Washington and Beijing, with the US having already blacklisted Chinese tech firms.

Last October, the US government unveiled sweeping chip-related export controls on China, while granting Korean companies a one-year reprieve to allow them to upgrade their facilities there.

Samsung and SK Hynix, the world’s two largest memory chipmakers, have since halted new investments in China while awaiting Washington’s next move given the approaching end of the one-year grace period.

Earlier this month, industry sources said the US Commerce Department is in talks with Korean officials to work out separate equipment import standards to enhance non-Chinese chipmakers’ business predictability and minimize global supply chain disruptions.

But industry officials said the US may ratchet up its semiconductor supremacy war with China, further tightening its grip on foreign chipmakers dealing with Chinese companies.

COLLATERAL DAMAGE

The ceaseless Sino-US faceoff is posing a growing risk for Samsung and SK Hynix as China along with Hong Kong account for nearly two-thirds of their export market.

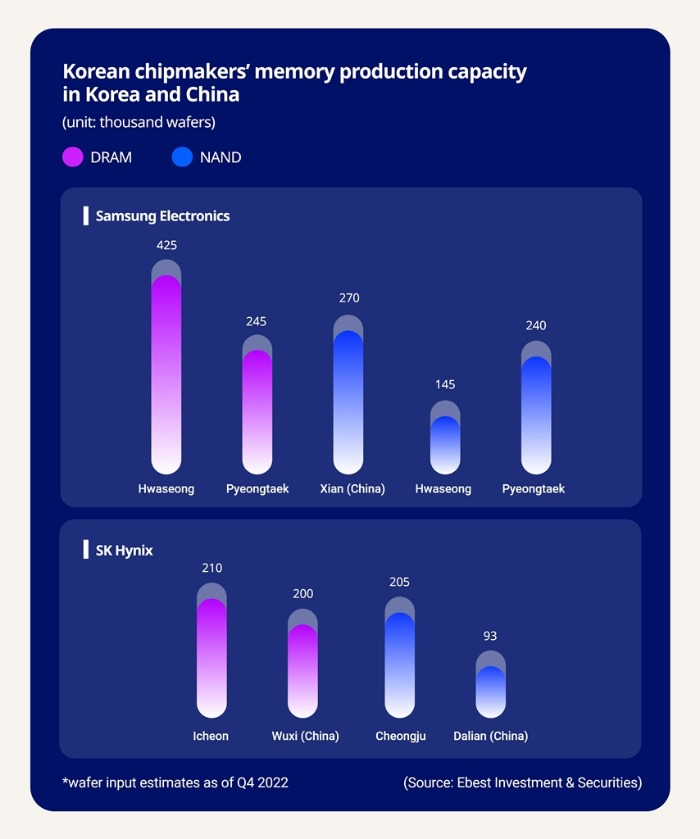

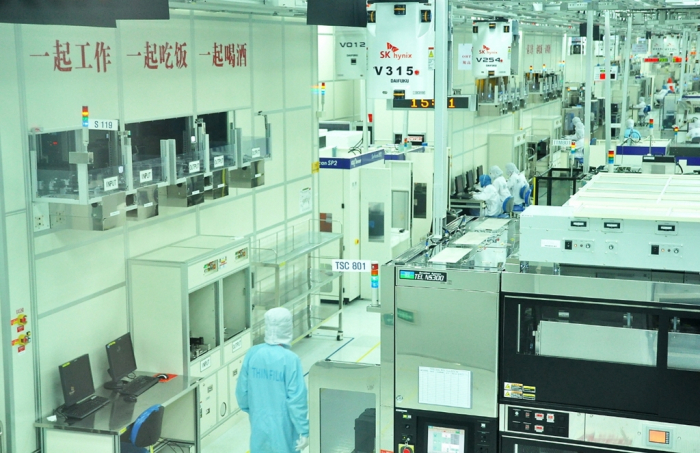

In China, Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s global NAND production while SK Hynix’s Wuxi plant produces 48% of its global DRAM output.

Last year, Samsung generated 31.5 trillion won ($23.9 billion) in revenue from China, while SK Hynix’s sales in China reached 16.3 trillion won.

The US last month warned Korean chipmakers against taking advantage of China’s retaliatory action.

The Financial Times in late April reported that the White House had asked Seoul to urge its chipmakers not to fill in for China shortfalls if Beijing bans Micron chips.

Micron generated $4.98 billion in revenue from mainland China and Hong Kong in its 2022 fiscal year, accounting for 16.2% of its total sales of $30.7 billion.

China’s latest decision comes as memory chipmakers are reeling from an industry glut, which in the first quarter triggered a 25% decline in the price of DRAM chips, used widely from TVs to phones.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsUS eyes new rules for Samsung, SK to bring chip machines to China

Business & PoliticsUS eyes new rules for Samsung, SK to bring chip machines to ChinaMay 10, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsS.Korea wary of tougher US anti-China moves for chipmakers

Business & PoliticsS.Korea wary of tougher US anti-China moves for chipmakersApr 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

The KED ViewJury still out on Korean chipmakers’ tech upgrades in China

The KED ViewJury still out on Korean chipmakers’ tech upgrades in ChinaMar 24, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN