S.Korea wary of tougher US anti-China moves for chipmakers

The US request could add momentum to Korean chipmakers’ China-exit strategies

By Apr 24, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

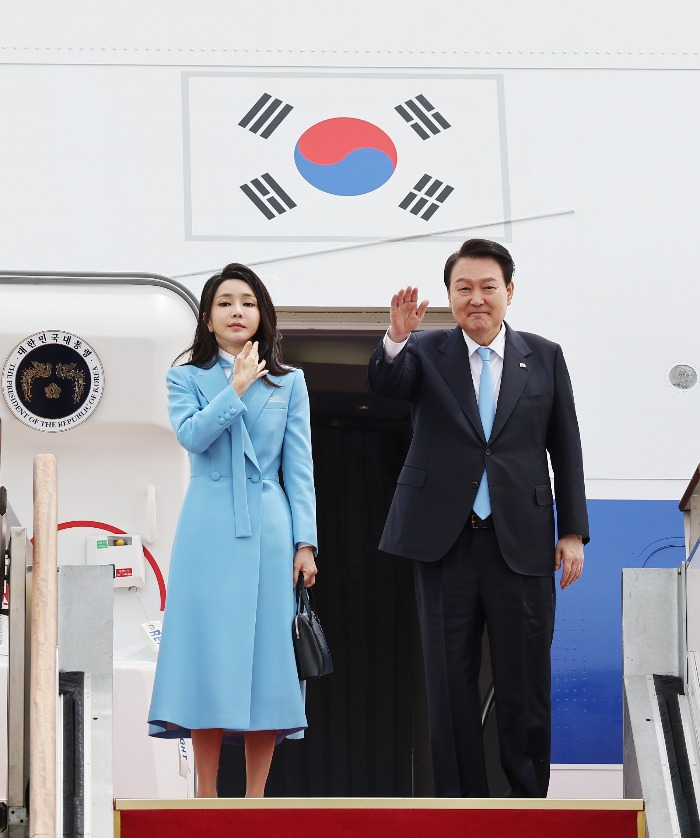

South Korean President Yoon Suk Yeol on Monday kicked off a six-day state visit to the US with a tough assignment: finding diplomatic solutions for Korean chipmakers caught in the escalating faceoff between Washington and Beijing.

Making his diplomatic efforts more complicated, the Financial Times on Monday reported that the White House has asked Seoul to urge its chipmakers not to fill any market gaps in China if Beijing bans Micron Technology Inc. from selling chips.

It is the first known occasion that Washington has asked an ally to take specific action to align with its steps to block China from obtaining or producing advanced semiconductors.

The request also could be regarded as a warning against any move by Korean chipmakers such as Samsung Electronics Co. and SK Hynix Inc. to take advantage of China’s possible retaliatory action against US companies.

As Beijing launched a national security review this month of Micron, the world’s No. 3 memory chipmaker, the Financial Times report indicates that Korean companies are being dragged further into the power struggle between the world’s two largest economies.

Furthermore, industry observers warned that the US request could eventually end up containing Korean chipmakers’ entire Chinese operations.

Last October, the US unveiled sweeping chip-related export controls on China, while granting a one-year reprieve to Korean companies to allow them to upgrade their facilities there.

But Korean chipmakers have almost halted new investments in the neighboring country because of uncertainty over Washington’s policies.

During the April 24-30 visit, Yoon is scheduled for a summit meeting with US President Joe Biden on April 26.

Industry observers said Yoon should make the most of their bilateral talks to minimize the negative impact of the rivalry between Washington and Beijing.

It is the first state visit to the US by a South Korean president in 11 years.

The scheduled summit is viewed as a litmus test for Biden’s “unwavering commitment” to one of its key allies over tricky semiconductor and battery issues involving the CHIPS and Science Act and the Inflation Reduction Act (IRA).

The CHIPS Act contains a $39 billion package of subsidies for chipmakers. But to qualify for the benefits, recipients cannot make new, high-tech investments in China or other “countries of concern” for at least a decade.

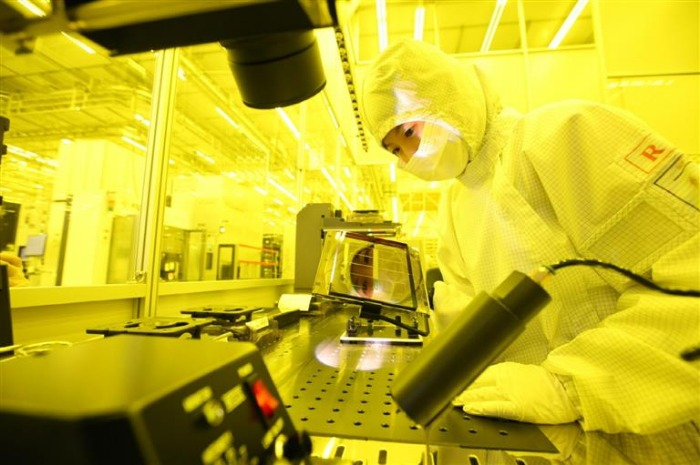

A parallel could be drawn between the latest US request to South Korea and its proposal to the Netherlands in November 2019 not to export ASML Holding's photolithography machines to China.

The machines can draw the most elaborate and detailed patterns on semiconductor wafers to manufacture advanced chips.

Since then, ASML has hardly shipped its extreme ultraviolet lithography machines, priced at about 300 billion won ($225 million) apiece, to China. Last year, the US again proposed restrictions on ASML’s exports to China.

In 2022, China accounted for 14% of the Dutch company’s sales, down from 18% in 2020.

Samsung and SK Hynix were caught off guard by the report and said they have not been informed of such requests. Both companies declined to comment on the report.

As it becomes increasingly difficult to find a middle ground between the two world powers, they may pursue China-exit strategies, according to industry watchers.

But China remains one of South Korea’s largest markets. South Korean chipmakers have invested 70 trillion won ($53 billion) in China in total.

Samsung produces 40% of its NAND Flash chips from its Xi’an plant in China and sells most of them in the local market. SK Hynix’s Chinese plants account for 40% of its DRAM chip production.

Last year, Samsung generated 31.5 trillion won in revenue from China, with SK Hynix’s sales in China amounting to 16.3 trillion won.

Write to Jeong-Soo Hwang and Seo-Woo Jang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

Business & PoliticsSamsung’s Lee likely to meet Apple, Google, MS CEOs during US trip

Business & PoliticsSamsung’s Lee likely to meet Apple, Google, MS CEOs during US tripApr 20, 2023 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai Motor seeks remedies after GV70 exclusion from US subsidies

Electric vehiclesHyundai Motor seeks remedies after GV70 exclusion from US subsidiesApr 18, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK seek dialogue with China at Boao Forum

Korean chipmakersSamsung, SK seek dialogue with China at Boao ForumMar 28, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

The KED ViewJury still out on Korean chipmakers’ tech upgrades in China

The KED ViewJury still out on Korean chipmakers’ tech upgrades in ChinaMar 24, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung walks tightrope on US investment; invited to White House talks

Korean chipmakersSamsung walks tightrope on US investment; invited to White House talksApr 12, 2021 (Gmt+09:00)

4 Min read