Korean battery players LG, Samsung, SK sweep US EV tax credits

While Korean firms are set to solidify their positions, the inclusion of China’s CATL stirs controversy

By Apr 19, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

It has long been talked about and finally confirmed: South Korean battery companies are well-placed to benefit from the strengthened requirements of the US Inflation Reduction Act’s clean vehicle credits.

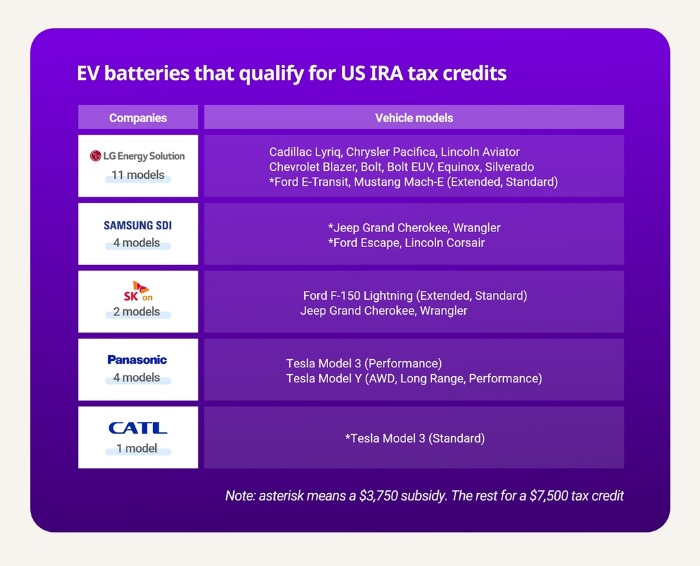

The new set of the IRA rules announced earlier this week showed Korea’s three major battery players – LG Energy Solution Ltd., Samsung SDI Co. and SK On Co. – are allowed to supply their battery cells to 17 of the 22 electric vehicles eligible for subsidies.

Of the 17 vehicles, LG Energy, the world’s second-largest battery manufacturer, will take the lion’s share, with its batteries installed on 11 models, including GM’s Cadillac and Chevrolet cars, the Stellantis Chrysler, Ford Motor’s Mustang Mach-E and the E-Transit, and the Lincoln Aviator.

According to the US announcement on Monday, not a single electric model from a foreign brand is eligible for subsidies. Hyundai Motor Co.’s Electrified GV70, assembled at its Alabama plant but using SK On’s batteries made in China, was also dropped from the subsidy list.

The 22 models, down from 39 electric or plug-in hybrid models previously, are eligible for a full or partial tax credit, based on new thresholds that require a certain percentage of the battery parts and minerals to come from a qualifying country.

The IRA requires that 50% of the value of battery components be produced or assembled in North America to qualify for a $3,750 subsidy. It also requires that 40% of the value of critical minerals be sourced from the US or a free trade partner for another $3,750 credit.

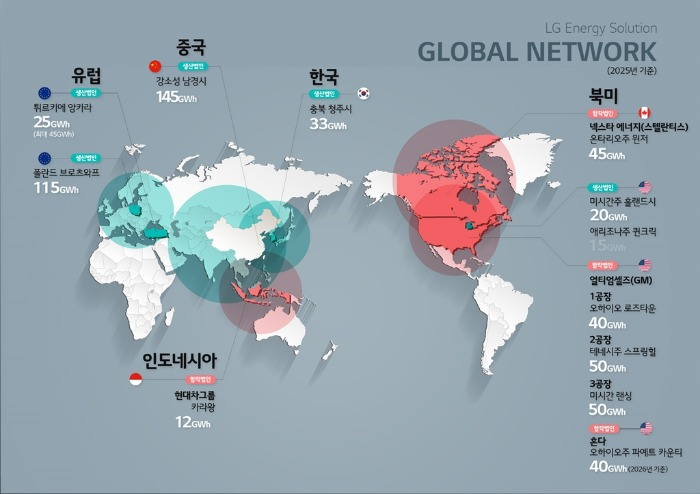

LG Energy said its batteries produced at its US and Poland plants qualify for tax credits.

Its US-made batteries meet both requirements, meaning car buyers looking to get a tax break on a new EV equipped with LG cells can receive a $7,500 subsidy, while electric cars with batteries made in Poland qualify for a $3,750 tax credit.

Samsung SDI will be supplying its batteries to four models – the Jeep Grand Cherokee, Jeep Wrangler, Ford Escape and Lincoln Corsair.

Cars with Samsung batteries will receive a $3,750 subsidy as those battery cells are manufactured at Samsung’s Hungary factory.

SK On, an affiliate of SK Innovation Co., will supply its batteries to two models of the Ford F-150 Lightning electric pickup, eligible for a full $7,500 tax credit as the batteries come from SK’s US plant.

HAVING THE UPPER HAND

The IRA rules underscore the significance of battery manufacturers’ ability to establish a local supply chain within North America.

Analysts said Korean battery makers, which are global heavyweights, are expected to further solidify their positions by expanding their facilities in the US through joint ventures with their partners.

Last month, LG said it is investing 7.2 trillion won ($5.6 billion) to build a battery complex in Queen Creek, Arizona to meet rising demand for clean cars.

BlueOval SK, a joint venture between SK and Ford, will spend a combined $11.4 billion to build an assembly and battery complex in Tennessee and two battery factories in Kentucky.

Samsung SDI and GM said they will build a $3.8 billion battery plant in Michigan, with an aim to start operations in 2026.

CATL’S INCLUSION STIRS CONTROVERSY

Under the latest IRA rules, Japan’s Panasonic will supply batteries to four Tesla vehicles, including the Model 3 and Model Y.

China’s Contemporary Amperex Technology Company Ltd. (CATL), the world's top EV battery maker, was also allowed to supply batteries produced in China for Tesla’s standard Model 3 car, stirring controversy and criticism from US members of Congress.

Ford’s prospective $3.5 billion plant in Michigan, where it will manufacture batteries using technology licensed from CATL, has been a source of ire for US lawmakers.

On Monday, Republican Representative Jason Smith from Missouri sent a letter of concern to Ford Chief Executive Jim Farley.

Smith, who chairs the House Ways and Means Committee, said in the letter: “This arrangement appears to leverage a loophole in the (IRA) rules regarding battery components manufactured or assembled by a foreign entity of concern.”

The rules are aimed at weaning the US off dependence on China for EV battery supply chains and are part of President Joe Biden’s effort to make 50% of US new vehicle sales by 2030 EVs or PHEVs.

Write to SungSu Bae, Il-Gue Kim and Nan-Sae Bin at baebae@hankyung.com

In-Soo Nam edited this article.

-

Electric vehiclesHyundai Motor seeks remedies after GV70 exclusion from US subsidies

Electric vehiclesHyundai Motor seeks remedies after GV70 exclusion from US subsidiesApr 18, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Chairman to refine strategy for EV battery production

BatteriesLG Chairman to refine strategy for EV battery productionApr 18, 2023 (Gmt+09:00)

3 Min read -

EarningsLG Energy’s Q1 profit soars on gains from US battery tax credits

EarningsLG Energy’s Q1 profit soars on gains from US battery tax creditsApr 07, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesSamsung SDI, GM to build $3.8 bn EV battery plant in US

BatteriesSamsung SDI, GM to build $3.8 bn EV battery plant in USMar 03, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in Kentucky

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in KentuckyDec 06, 2022 (Gmt+09:00)

3 Min read -

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JV

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JVSep 28, 2021 (Gmt+09:00)

3 Min read -

BatteriesSamsung SDI in talks with multiple carmakers for 4680 type battery supply

BatteriesSamsung SDI in talks with multiple carmakers for 4680 type battery supplyJul 29, 2022 (Gmt+09:00)

4 Min read -

BatteriesSamsung SDI to develop cylindrical batteries for Tesla, other EV makers

BatteriesSamsung SDI to develop cylindrical batteries for Tesla, other EV makersJun 16, 2022 (Gmt+09:00)

3 Min read