Batteries

LG Energy to build $5.6 billion battery complex in Arizona

LG, reviving a project put on hold due to adverse economic conditions, is focusing on capacity expansion in the US

By Mar 24, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Energy Solution Ltd., the world’s second-largest battery maker, said on Friday it is investing 7.2 trillion won ($5.6 billion) to build a battery complex in Queen Creek, Arizona to meet rising demand for clean cars in North America.

The South Korean battery maker said the complex consists of two manufacturing facilities – one for cylindrical batteries used in electric vehicles and the other for lithium iron phosphate (LFP) pouch-type batteries used in energy storage systems (ESS).

The complex marks LG’s single largest investment in constructing its own battery manufacturing facility in the US.

The project is also more than four times the 1.7 trillion won investment plan announced last year but put on hold three months later due to adverse economic conditions such as inflation, it said.

Of the 7.2 trillion won investment, LG plans to spend 4.2 trillion won on building the cylindrical battery plant with an annual production capacity of 27 gigawatt-hours (GWh), enough to power 350,000 electric vehicles. It aims to begin mass production in 2025.

LG will invest 3 trillion won in building an LFP battery plant with an annual capacity of 16 GWh. The factory will start mass production in 2026. LG said the plant will be the world’s first ESS-exclusive battery facility.

Both factories will break ground sometime this year.

“Our decision to invest in Arizona demonstrates our strategic initiative to continue expanding our global production network, which is already the world’s largest,” Chief Executive Kwon Young-soo said. “It’s the right move at the right time to empower the clean energy transition in the US.”

At the new Arizona plant, LG plans to manufacture 2170-type cylindrical batteries for Tesla Inc. and EV startups such as Lucid, Nikola, Proterra and Rivian.

In China, Tesla has been supplied the 2170 type from LG and Contemporary Amperex Technology Company Ltd. (CATL), the world’s No. 1 battery player.

In the US, however, Tesla has so far received such batteries from Panasonic.

Industry sources said LG is also considering manufacturing the 4680 batteries with an energy density five times higher than that of the 2170 type in the second half.

The company may build a new 4680 battery production line at the Arizona factory, they said.

SECOND STANDALONE BATTERY PLANT

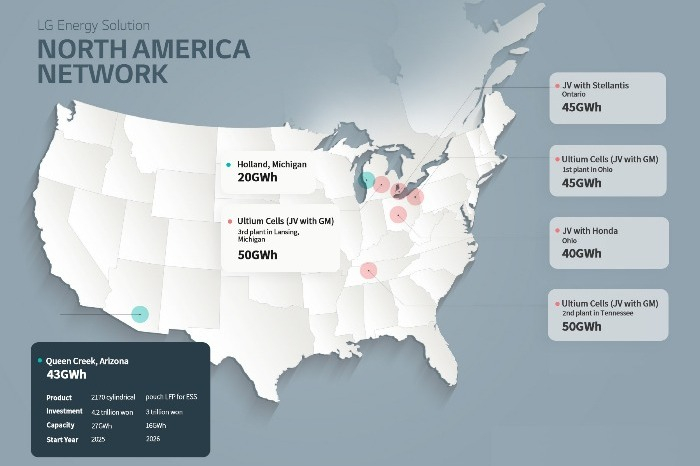

The new Arizona complex will be LG Energy’s second standalone battery facility in the US.

LG runs its own battery plant in Holland, Michigan, and last year it said it is spending $1.7 billion to expand annual battery production capacity at the plant by fivefold to 25 GWh by 2025 from 5 GWh.

LG Energy Solution Michigan Inc., which began operations in 2012, has been supplying batteries to major US automakers, including General Motors Co., Ford Motor Co. and Chrysler.

Separately, LG Energy is running a battery joint venture, Ultium Cells LCC, with its US partner GM.

In January of last year, LG and GM announced a $2.6 billion project to build their third EV battery plant in Lansing, Michigan, with a capacity of up to 50 GWh, enough for 700,000 EVs that can drive 500 km on a full charge.

LG and GM are also considering a fourth plant, with an expected annual production capacity of 30 GWh.

In Canada, LG last year joined hands with multinational automaker Stellantis N.V. to build a $1.4 billion battery plant in Ontario.

LG Energy said it plans to bring in smart factory systems to both the Arizona plant and the JV with Stellantis to improve productivity.

Korean battery makers, which have been concentrating on expensive nickel-cobalt-manganese (NCM) cells, are now shifting gears to also produce low-end LFP cells on growing demand.

Earlier this month, LG showcased an LFP battery prototype at InterBattery 2023, Korea’s largest battery show.

Write to Han-Shin Park and Hyung-Kyu Kim at phs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesKorea EV cell makers unveil new products to expand market

BatteriesKorea EV cell makers unveil new products to expand marketMar 16, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023Mar 09, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliers

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliersSep 23, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in Canada

BatteriesLG Energy, Stellantis to build $4.1 billion battery plant in CanadaMar 24, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN