Batteries

Samsung SDI in talks with multiple carmakers for 4680 type battery supply

The company also posted record Q2 revenue and operating profit, driven by robust EV battery sales

By Jul 29, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

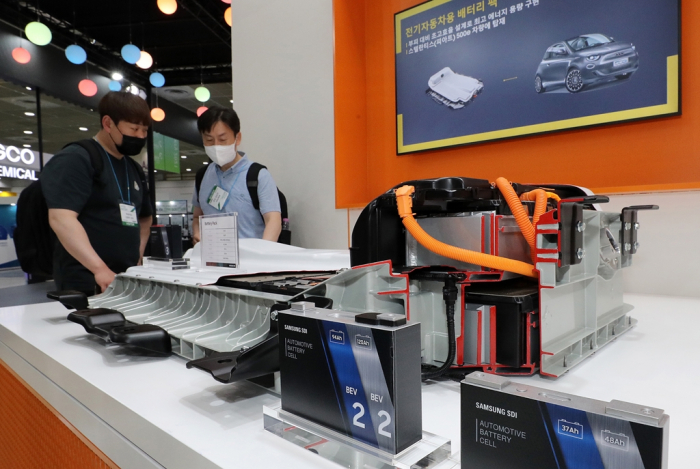

Samsung SDI Co., a major South Korean battery maker, said on Friday that it is in talks with multiple automakers around the world to supply a next-generation cylindrical battery with a 4680 cell form factor.

During a second-quarter earnings call with analysts, Michael Sohn, vice president of the company’s strategic marketing division, said several global carmakers have expressed the intention to equip their electric vehicles with Samsung's new battery cells to cut costs.

“We’re executing our planned investment to build a pilot line for the 4680 battery at our Cheonan plant,” he said during the conference call.

It’s the first time that a Samsung SDI battery executive has confirmed media reports that the company is developing such a battery for electric vehicle makers.

Last month, people with knowledge of the matter told The Korea Economic Daily that Samsung is ramping up facilities for cylindrical batteries to supply its products to Tesla Inc. and other electric vehicle makers.

The sources said at the time that the battery-making unit of Korea’s top conglomerate Samsung is expanding production lines for smaller batteries at its Cheonan plant, some of which will be converted to pilot facilities to make bigger batteries for electric cars.

Samsung SDI is testing two types of large-size cylindrical batteries. One is the so-called 4680 battery, which is 46 millimeters in diameter and 80 mm in length, while the other one has the same diameter but is longer, the sources said.

By producing both types with minimal changes to production lines, the company will also be able to cut manufacturing costs, they said.

Samsung SDI’s battery clients include BMW, Volkswagen, Audi and Volvo in Europe as well as Ford Motor in the US.

POTENTIAL GAME-CHANGER

Samsung is known to be spending about 150 billion won ($116 million) to build the pilot line for the 46xx-type battery.

“The new cylindrical battery under development will be safer with longer battery life and a faster charging speed,” said a Samsung SDI official.

The 4680 type is seen as a game-changer in the battery industry as it is said to increase energy density by five times and output by six times compared to the conventional 2170 type and boost electric vehicles' mileage by 16% on average.

If all goes to plan, Samsung will be able to produce battery samples in the first half of next year and start mass production in 2025, sources said in mid-June.

Tesla, the world's largest electric car manufacturer and lithium-ion battery consumer, is using the 4680 cell made in-house for its EV models but seeking to secure more of the type from other suppliers as it increases EV production.

Industry watchers said Samsung SDI’s 4680 form factor is for Tesla but plans to develop different lengths to win over multiple customers besides Tesla.

Currently, Samsung produces cylindrical batteries of the 2170 and 1865 types for smartphones and other smaller electronic devices.

RECORD Q2 SALES AND PROFIT

Meanwhile, Samsung SDI reported its highest-ever quarterly sales and operating profit in the second quarter.

Sales in the April-June period reached 4.74 trillion won, up 42.2% from the year-earlier period, while operating profit gained 34.3% to 429 billion won.

Its battery business posted an operating profit margin of 6%, it said.

Second-quarter net profit increased 42% on year to 409.2 billion won.

Samsung’s crosstown battery rival SK On Co. also reported its second-quarter results on Friday.

SK On, spun off from its parent SK Innovation Co. last October, posted 1.29 trillion won in second-quarter sales, a 28.1 billion won increase from the first quarter.

Its operating loss widened to 326.6 billion won from 273.4 billion won in the prior quarter.

The company said it expects to break even in the fourth quarter of this year.

SK On said it aims to complete the development of its lithium iron phosphate (LFP) battery by the end of this year and is in talks with its clients to supply the new battery.

With low energy density and higher thermal stability, LFP cells are cheaper to make compared to other types such as nickel-cobalt-manganese (NCM) batteries. The LFP-type batteries are increasingly becoming the standard for entry-level EVs.

Regarding pre-IPO fundraising, the company said the process is behind schedule as some foreign private equity firms have slashed the company's enterprise value to around 30 trillion-35 trillion won, citing its widening operating loss.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesSamsung SDI to build new battery plant in Malaysia by 2025

BatteriesSamsung SDI to build new battery plant in Malaysia by 2025Jul 21, 2022 (Gmt+09:00)

2 Min read -

BatteriesSamsung SDI to develop cylindrical batteries for Tesla, other EV makers

BatteriesSamsung SDI to develop cylindrical batteries for Tesla, other EV makersJun 16, 2022 (Gmt+09:00)

3 Min read -

BatteriesSamsung SDI, Stellantis pick Indiana for US EV battery plant

BatteriesSamsung SDI, Stellantis pick Indiana for US EV battery plantMay 24, 2022 (Gmt+09:00)

1 Min read -

BatteriesSamsung SDI in talks with global automaker for battery joint venture

BatteriesSamsung SDI in talks with global automaker for battery joint ventureJan 28, 2022 (Gmt+09:00)

2 Min read -

EarningsSamsung SDI Q1 sales at all-time high, says VW’s battery move long shot

EarningsSamsung SDI Q1 sales at all-time high, says VW’s battery move long shotApr 27, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN