Earnings

LG EnergyŌĆÖs Q1 profit soars on gains from US battery tax credits

LG is one of the key IRA beneficiaries as it runs the worldŌĆÖs largest battery manufacturing capacity in the US

By Apr 07, 2023 (Gmt+09:00)

2

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

Samsung shifts to emergency mode with 6-day work week for executives

NPS to commit $1.1 billion to external managers in 2024

HD Hyundai Marine IPO sees strong demand from retail investors

Navigating choppy waters: Dollar-won FX forecasting ┬Ā

LG Energy Solution Ltd., the worldŌĆÖs second-largest battery maker, said on Friday its first-quarter operating profit likely more than doubled, buoyed by growing demand for electric vehicles worldwide.

The South Korean company said it also benefited from US tax breaks under the Inflation Reduction Act (IRA), which took effect Jan. 1.

Its preliminary operating profit in the January-March quarter reached 633.2 billion won ($480 million), up 145% from 285.9 billion won in the year-earlier period, LG said in a regulatory filing.

The result came above the market consensus of 484.7 billion won.

The first-quarter profit, which amounts to more than half its entire 2022 operating profit of 1.21 trillion won, is close to its record quarterly operating profit of 724.3 billion won in the second quarter of 2021 when LG reflected hefty technology license fees and provisioning gains in its results.

Sales in the first quarter of this year also doubled to a record 8.75 billion won from 4.34 trillion won the year prior.

The company is due to release detailed results, including a divisional breakdown and net profit, later this month.

KEY BENEFICIARY OF US TAX CREDIT LAW

LG said its first-quarter operating profit included an estimated 100.3 billion won in tax credits it expects to receive from the US government with regard to its US battery manufacturing facilities and cells processed in Korea.

The IRA grants up to $7,500 per EV if the clean vehicle is assembled in the US and the battery's minerals are mined or processed in the US or countries that have free trade agreements with Washington.

ŌĆ£We included 100.3 billion won in our first-quarter operating profit after taking accounting and other financial rules into consideration,ŌĆØ said an LG Energy official.

With the implementation of the US tax credit rules, LG is expected to receive nearly 1 trillion won in such benefits for this year, analysts said.

Industry watchers said LG is one of the major beneficiaries of the IRA because it runs the largest battery manufacturing capacity among global battery players in the US.

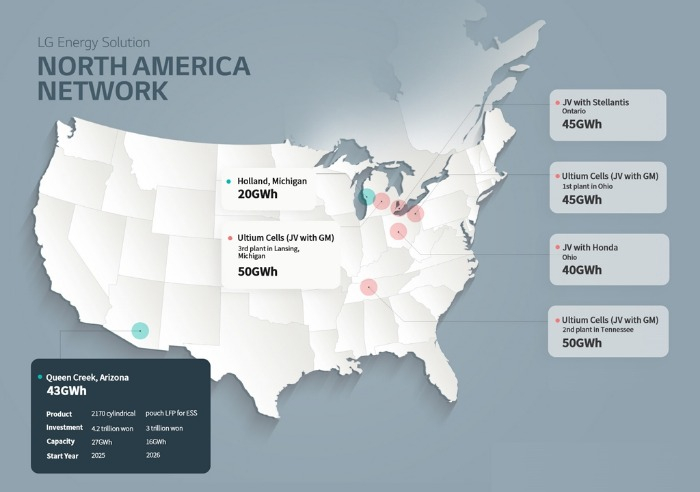

Last month, the company said it is investing 7.2 trillion won to build a battery complex in Queen Creek, Arizona to meet rising demand for clean cars in North America.

The complex consists of two manufacturing facilities ŌĆō one for cylindrical batteries used in electric vehicles and the other for lithium iron phosphate (LFP) pouch-type batteries used in energy storage systems (ESS).

The complex marks LGŌĆÖs single largest investment in constructing its own battery manufacturing facility in the US.

In addition to another standalone battery plant in Holland, Michigan, LG also operates a battery joint venture, Ultium Cells LCC, with its US partner General Motors Co.

Write to Nan-Sae Bin and Sungsu Bae at binthere@hankyung.com

In-Soo Nam edited this article.

More to Read

-

The KED ViewTime for South Korea's answer to the US battery subsidy act

The KED ViewTime for South Korea's answer to the US battery subsidy actApr 04, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023Mar 09, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsYoonŌĆÖs US visit to test BidenŌĆÖs trust as ally over chip, battery issues

Business & PoliticsYoonŌĆÖs US visit to test BidenŌĆÖs trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN