The KED View

Time for South Korea's answer to the US battery subsidy act

Just like the CHIPS Act, EV tax credit rules come with strings attached for LG, SK and Samsung

By Apr 04, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The latest guidelines on US subsidies for electric vehicles under the Inflation Reduction Act come as a relief in every sense to South Korean battery makers.

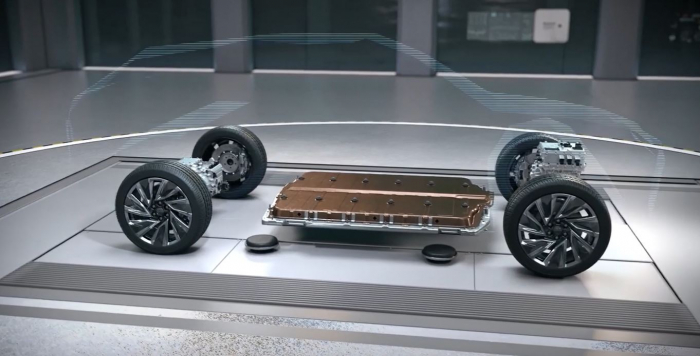

While Korea’s battery trio – LG Energy Solution Ltd., Samsung SDI Co. and SK On Co. – heavily depends on China for mineral procurement, they all process raw materials and assemble them into cells at their plants in Korea or North America, making vehicles running on their batteries eligible for US tax benefits.

Korea’s company executives and government officials breathed a sigh of relief, welcoming the IRA development as one that “substantially reflected” the opinion of the Korean battery industry – proof that the Korean battery makers are indispensable to the EV battery ecosystem.

Indeed, many US carmakers simply can’t live without them.

The three Korean companies are dominant players in the global battery market, supplying cells to most US EV manufacturers, including GM, Ford and Tesla.

LG, Samsung and SK have already received orders that are combined set to reach more than 100 trillion won ($76.4 billion) by year-end, industry data showed.

BARREN SOIL FOR BATTERIES

Up until the early 1990s, Korea wasn’t heard of in the battery industry.

In April 1996, LG Chem Ltd., the parent of LG Energy, gave a special mission to its battery researchers, who were still struggling to make workable EV batteries: produce lithium-ion batteries in large quantities by the end of 1999.

By multiple measures, the job would take at least five years, from research to construction of facilities, test production and then mass production.

They bought batteries from existing makers and disassembled them to study the batteries' four main ingredients – the cathode, anode, separator and electrolyte.

The researchers also had to find out about the battery manufacturing equipment supplied to Japanese rivals such as Sony and Matsushita, then industry leaders.

Their strenuous efforts resulted in making the prototype in November 1997 – the world's highest-capacity (1800 mAh) and the lightest (150 Wh/kg) battery at the time. LG began mass production in Korea in January 1999.

Such efforts were emulated by Samsung and SK, which together emerged as significant players by the late 2010s.

Over the past decade, LG has spent 5.3 trillion won on battery R&D projects, resulting in 26,000 related patents.

The three Korean battery makers are now setting their sights on solid-state batteries, touted as dream batteries, given that they are safer and have higher energy density than lithium-ion models.

TIME TO ACT

Just like the US CHIPS and Science Act, however, the EV tax credit rules also come with several strings attached.

Beginning in 2027, the critical mineral requirement will rise to 80% to be eligible for a tax credit. The applicable percentage of battery components will go up to 100% by 2029.

According to market tracker SNE Research, the global EV battery market is forecast to grow at an annual average rate of 30% to 500 trillion won by 2030.

In Korea, batteries are often referred to as something next to semiconductors, which have led the Korean economy to what it is now, akin to rice – the staple food for Koreans – of the nation’s future industries.

Nevertheless, there’s a severe lack of government support in training and nurturing battery talent compared to semiconductor experts.

Last month, President Yoon Suk Yeol announced a 550 trillion won mega project to nurture six major industries – chips, displays, batteries, biotech, future cars and robots – as key growth drivers of the Korean economy, Asia’s fourth-largest.

Of the spending plan, to be funded by companies, not by the government, the lion’s share goes to semiconductors. Government officials say 39 trillion won is earmarked for rechargeable batteries.

To keep the Korean battery trio indispensable throughout the supply chain, Korea must work out its version of the US IRA sooner rather than later.

It’s easier said than done but the government must cut the administrative red tape and act now to help the country's battery companies stay ahead of their rivals.

Write to Jung-Hwan Seo at ceoseo@hankyung.com

In-Soo Nam edited this column.

More to Read

-

BatteriesLG Energy tops global EV battery market excluding China

BatteriesLG Energy tops global EV battery market excluding ChinaApr 03, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

BatteriesKorean battery firms seek benefits from US EV incentive details

BatteriesKorean battery firms seek benefits from US EV incentive detailsMar 27, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023

BatteriesLG Energy, SK On to showcase LFP battery prototypes at InterBattery 2023Mar 09, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issues

Business & PoliticsYoon’s US visit to test Biden’s trust as ally over chip, battery issuesMar 08, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN