SK Hynix sharply narrows gap with Samsung’s market cap

The share price of SK Hynix has soared 32% year-to-date, compared with a 0.2% gain in Samsung shares

By Jan 22, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Hynix Inc. has significantly raised its value by bolstering its presence in the artificial intelligence memory market, threatening Samsung Electronics Co.’ leadership in the semiconductor industry.

This month, its market capitalization surpassed half that of Samsung Electronics, South Korea’s most valuable company, for the first time.

SK Hynix, the world’s No. 2 memory chipmaker, has been at the fore of developing high-bandwidth memory (HBM) as a key supplier of Nvidia Corp, the world’s largest AI chip designer.

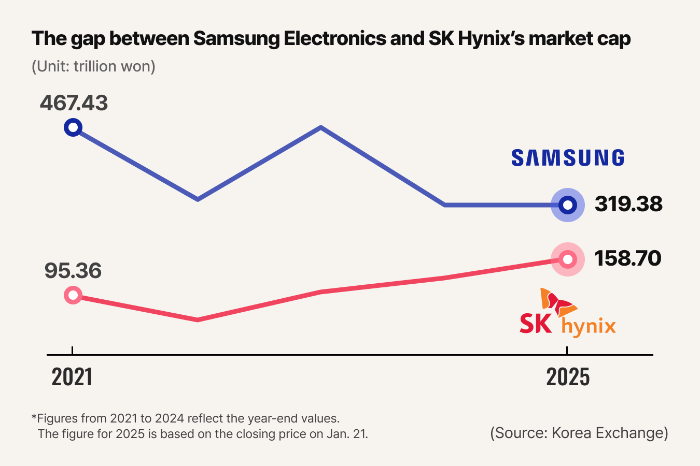

As of Jan. 21, SK Hynix’s market cap stood at 158.70 trillion won ($111 billion), more than half of Samsung Electronics’ 319.38 trillion won, according to the Korea Exchange.

That marked the narrowest gap between the two companies’ market value and a 10-percentage-point decrease in the difference since the start of this year.

At the end of 2024, SK Hynix’s market cap was equivalent to 39% of that of Samsung Electronics, the world’s No. 1 memory chipmaker — up from 21% the year prior and 16% at the end of 2022.

A decade ago, at the end of 2015, SK Hynix’s market value represented just 12% of Samsung Electronics'.

On Wednesday afternoon, their market cap narrowed further, with SK Hynix's shares up 3.67% to 226,000 won, its highest point since July 2024, while Samsung shares stayed flat at 53,500 won.

Fund managers said SK will further cement its leadership in the market of HBM optimized for AI applications.

“Samsung Electronics is far behind SK Hynix in terms of HBM technology,” said a fund manager at a Korean asset management company.

“Even if it (Samsung) supplies HBM to Nvidia, they will be used for low-end AI chips. It may find it difficult to challenge SK Hynix (in the HBM market),” he added.

UNDERVALUED

Analysts said SK Hynix is still undervalued.

According to data provider FnGuide, SK Hynix’s share price is trading at 6.11 times forward earnings for the next 12 months as of Jan. 20. That is half that of Samsung’s forward 12-month price-earnings ratio of 11.36.

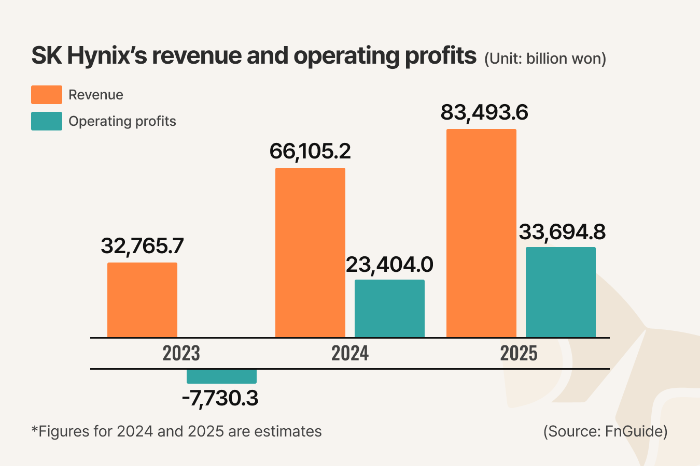

In the fourth quarter of 2024, SK Hynix is estimated to have earned 8 trillion won, marking its record-high operating profit for a quarter. HBM, which produces higher margins than legacy chips, account for more than 40% of its DRAM sales.

For all of 2024, SK Hynix’s operating profits are estimated to have exceeded 23 trillion won. That far outstripped the estimated 15 trillion won in fourth-quarter operating profit from Samsung’s Device Solutions division, which oversees the semiconductor business.

Last year, SK Hynix succeeded in mass-producing 12-layer HBM3E, the newest generation of advanced chips for supply to Nvidia.

Analysts said Samsung’s struggle in the HBM market will keep its share price climb in check.

“Until it is confirmed that Samsung supplies (HBM) to Nvidia, its share price will remain within a boxed range,” said Roh Geun-chang, research head at Hyundai Motor Securities Co.

Samsung will likely ship 12-layer HBM3E to Nvidia starting from the third quarter of this year, according to JPMorgan. That schedule is about a half year later than SK Hynix.

The US bank forecast the HBM market expanding to $58 billion in 2026 from $38 billion in 2025, with Google, Amazon and Meta joining Nvidia in switching to advanced chips.

Write to Han-Shin Park and Si-Eun Lee at phs@hankyung.com

Yeonhee Kim edited this article.

-

Korean Innovators at CES 2025SK Hynix to collaborate with Nvidia on Cosmos physical AI platform: Chey

Korean Innovators at CES 2025SK Hynix to collaborate with Nvidia on Cosmos physical AI platform: CheyJan 09, 2025 (Gmt+09:00)

3 Min read -

-

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025Dec 03, 2024 (Gmt+09:00)

2 Min read -

Executive reshufflesSamsung reshuffles top brass; Co-CEO to control memory business

Executive reshufflesSamsung reshuffles top brass; Co-CEO to control memory businessNov 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersTesla asks Samsung, SK Hynix to supply HBM4 chip samples

Korean chipmakersTesla asks Samsung, SK Hynix to supply HBM4 chip samplesNov 19, 2024 (Gmt+09:00)

3 Min read -

Shareholder valueSamsung Electronics to buy back $7.2 bn in shares

Shareholder valueSamsung Electronics to buy back $7.2 bn in sharesNov 17, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 months

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 monthsNov 04, 2024 (Gmt+09:00)

2 Min read -

EarningsSamsung’s memory business fares better in Q3; more HBM sales ahead

EarningsSamsung’s memory business fares better in Q3; more HBM sales aheadOct 31, 2024 (Gmt+09:00)

5 Min read -

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soars

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soarsOct 23, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix mass-produces 12-layer HBM3E for Q4 shipment

Korean chipmakersSK Hynix mass-produces 12-layer HBM3E for Q4 shipmentSep 26, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung tipped to supply HBM3 to Nvidia for Chinese market

Korean chipmakersSamsung tipped to supply HBM3 to Nvidia for Chinese marketJul 24, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to mass-produce HBM4 on 4 nm foundry process

Korean chipmakersSamsung to mass-produce HBM4 on 4 nm foundry processJul 15, 2024 (Gmt+09:00)

3 Min read