Korean chipmakers

Samsung eyes $8.8 billion 2024 chip profit: sources

The world’s No. 1 memory chipmaker is estimated to have lost about $10 billion in semiconductor business operations in 2023

By Jan 02, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. seeks to rake in 11.5 trillion won ($8.8 billion) in operating profit from its semiconductor business this year, swiveling from last year’s loss on a recovery in memory chip prices and demand from the output cut and artificial intelligence boom.

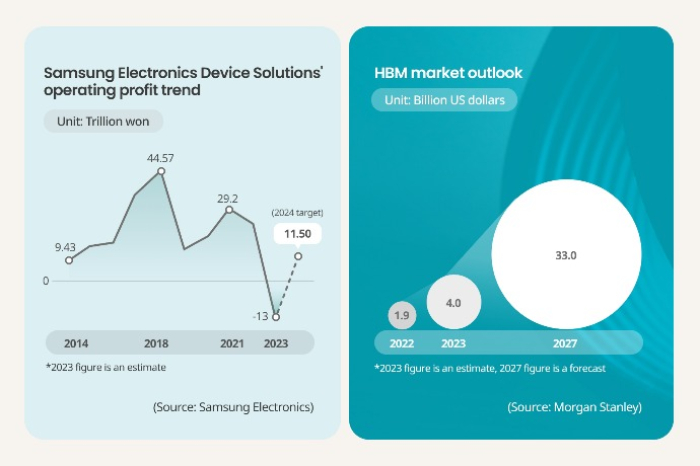

According to sources in the semiconductor industry on Monday, Samsung Electronics’ Device Solutions (DS) has set its operating profit target for 2024 at 11.5 trillion won, accounting for about one-third of the South Korean electronics behemoth’s total operating profit estimate for this year.

Local brokerage houses project Samsung Electronics’ total operating profit for 2024 at 33.8 trillion won.

Considering that its DS division is estimated to have posted an operating loss of 13 trillion won last year, the semiconductor division should earn about 25 trillion won in profit to meet the target.

Growing signs of the recovery in global memory chip demand are buttressing the company’s confidence in a turnaround.

Dynamic random-access memory (DRAM) and NAND flash memory chip prices consecutively rebounded from October to December, largely thanks to chipmakers’ orchestrated efforts to cut wafer input to ease a memory chip supply glut, which also helped lower overall inventories.

There are also signs of a recovery in memory demand from smartphones and PC makers.

Surging demand for highly performant memory products, such as high bandwidth memory (HBM) and computer express link (CXL) DRAM, also bodes well for a recovery in the Korean memory giant’s earnings this year.

Some industry observers consider Samsung DS division’s operating profit target for this year a bearish one, reflecting risks from still high memory chip inventories worth about 30 trillion won and lingering uncertainties over the global economy, especially the world’s No. 2 economy, China.

Samsung Electronics’ cautious target also underscores the initial recovery stage of the global semiconductor market, lagging far behind the so-called super cycle, which enabled the Korean chip giant to rake in 30 to 40 trillion won in annual operating profit from chip sales in the years preceding 2023.

SAMSUNG, KEY PLAYER IN THE HIGH-PERFORMANCE DRAM MARKET

Samsung Electronics pins high hopes on premium memory chip products for the recovery of its semiconductor business this year.

HBM vertically interconnects multiple DRAM chips, which dramatically increase data processing speed compared with earlier DRAM products.

The HBM series of DRAM is in growing demand as such chips power generative AI devices that operate on high-performance computing systems.

Thanks to the AI boom, suppliers have the upper hand in the global HBM market.

HBM buyers are said to be willing to pay up to $1 billion for each pre-order of HBMs, according to sources.

Morgan Stanley estimated that the global HBM market zoomed to $4 billion in 2023 from $1.9 billion in 2022. This year’s HBM market is forecast to more than double from last year.

The strong demand for HBM memory chips is a boon to Samsung Electronics, which is expected to command a 47-49% share of the global HBM market this year.

The world’s No. 1 memory chipmaker has also upped its supply of the latest double data rate 5 (DDR5) DRAM and is poised to accelerate mass production of other high-performance DRAM for AI devices, including CXL, processing in memory (PIM) and low-latency wide (LLW) memory chip products.

MEMORY OUTPUT CUT

Samsung Electronics’ chip business recovery is also expected to gain traction from the pickup in versatile memory chip prices.

TrendForce forecasts that global smartphone and PC markets, mainstay memory chip buyers, will see an on-year rise of 5% and 4% in sales, respectively, this year.

This year’s memory chip demand is projected to grow at a 20% rate, whereas the global memory supply is expected to rise 10%, suggesting tight memory supply through 2024.

Versatile DRAM prices jumped 26.9% in the last three months of 2023, and NAND flash prices added 13.4% over the same period.

MAYBE TOO BULLISH

The semiconductor industry largely shares the view that the market has entered a recovery cycle. Global chip market trackers such as Gartner and Omdia forecast the global DRAM market to peak in 2025.

But Samsung Electronics is wary of a too-bullish outlook for the market, according to sources.

Its high memory inventory worth about 33.7 trillion won as of the third quarter of 2023 is one risk that could slow the company’s chip business recovery.

Samsung Electronics may have to sell some of the mainly outdated models at discounted prices.

The outlook for NAND flash demand is also dim. The company is projected to log losses from its NAND flash business this year due to a supply glut.

The Korean chip player is expected to continue cutting NAND output until at least the second quarter of this year.

The outlook for its foundry business is mixed.

The utilization rate at its 3- to 5-nanometer processing lines is high thanks to strong demand for high-performance DRAM.

The utilization rate of its traditional 200-millimeter wafer-based lines, however, remains below 50%.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersSamsung Elec moves a step closer to CXL commercialization

Korean chipmakersSamsung Elec moves a step closer to CXL commercializationDec 27, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Electronics to up AI chip foundry sales to 50% by 2028

Korean chipmakersSamsung Electronics to up AI chip foundry sales to 50% by 2028Nov 20, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chips

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chipsOct 21, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung Electronics’ narrowed Q3 chip losses fuel more bullish outlook

EarningsSamsung Electronics’ narrowed Q3 chip losses fuel more bullish outlookOct 11, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Elec to launch HBM4 in 2025 to win war in AI sector

Korean chipmakersSamsung Elec to launch HBM4 in 2025 to win war in AI sectorOct 10, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIW

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIWSep 11, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN