Samsung Electronics’ narrowed Q3 chip losses fuel more bullish outlook

The company sees light at the end of the tunnel, with analysts betting on a chip turnaround next year

By Oct 11, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co., the world’s largest maker of memory chips, smartphones and TVs, said on Wednesday it likely posted a 78% drop in its third-quarter operating profit from a year earlier, weighed by heavy losses from its chip business amid a protracted global supply glut.

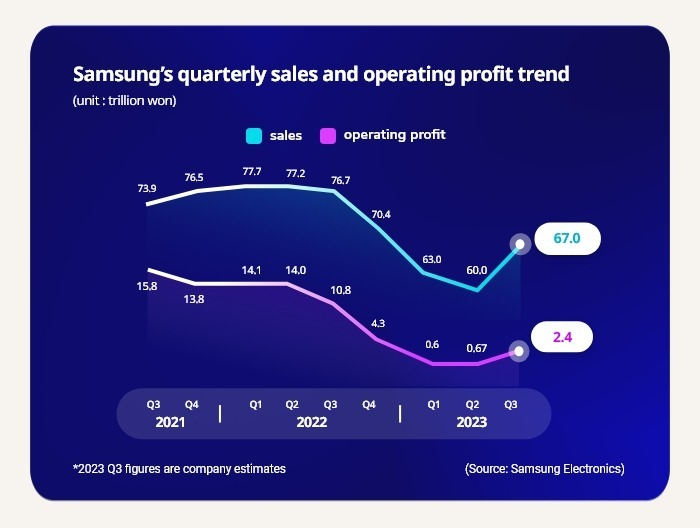

The Suwon, South Korea-based tech giant, however, is expected to see a turnaround in its semiconductor business as early as the first half of next year, analysts said.The company said it estimates its operating profit in the July-September quarter at 2.4 trillion won ($1.8 billion) on a consolidated basis, compared with 10.85 trillion won in the year-earlier period.

Sales likely declined 12.7% to 67 trillion won from 76.7 trillion won, the company said in a short preliminary earnings statement.

Samsung is due to release detailed results, including a divisional breakdown and net profit, on Oct. 31.

The third-quarter earnings estimates came in above the market consensus of 2.13 trillion won. Shares of Samsung finished Wednesday 2.7% higher at 68,200 won, outperforming the benchmark Kospi index’s 2% gain.

Compared with the second quarter, Samsung’s quarterly results improved significantly.

Samsung posted 670 billion won in operating profit on sales of 60 trillion won in the previous quarter.

CHIP BUSINESS LOSSES LIKELY NARROWED

Although Samsung didn’t provide divisional performance details, analysts said the company’s Device Solutions division, which oversees its chip business, continued to post losses, albeit on a smaller scale than in previous quarters.

Analysts said the company’s chip business likely posted a quarterly loss to the tune of 3.9 trillion won, narrowed from a loss of 4.36 trillion won in the second quarter and a shortfall of 4.6 trillion won in the first quarter.

Samsung focused on more profitable, high-end chips such as high bandwidth memory (HBM) chips used in artificial intelligence devices to offset the lower prices of general-purpose commodity memory chips, industry officials said.

While Samsung’s continued chip losses underscore the severity of the semiconductor industry downturn, most leading chipmakers have turned more bullish about a market recovery expected later this year.

Samsung executives said during a second-quarter earnings conference call that memory chip inventories peaked in May, suggesting that the oversupply in the memory chip market will ease before year-end.

Last month, Samsung signed memory chip supply deals with its clients, including Xiaomi, Oppo and Google, at prices 10-20% higher than their existing contracts for DRAM and NAND chips, according to industry sources.

Prices of DRAM chips began rebounding near the end of last quarter, while prices of NAND Flash chips are expected to start recovering as early as the current quarter, analysts said.

According to market tracker DRAMeXchange, the September contract price of DDR4 8Gb for PCs, one of the most common DRAM products, stayed at $1.3, unchanged from the previous month, putting an end to a four-month slide.

Losses incurred by Samsung’s chip business were likely offset by strong performance in its mobile and display divisions, thanks to the launch of its new Galaxy Z Flip5 and Fold5 smartphones during the third quarter.

Analysts said Samsung’s third-quarter mobile business likely posted about 3.5 trillion won in operating profit, up from the second-quarter profit of 3.04 trillion won.

Its display business likely saw a third-quarter operating profit of 1.8 trillion-1.9 trillion won, more than double the previous quarter’s profit of 790 billion won, analysts said.

Samsung pins high hopes on the fifth-generation flagship Galaxy Z foldable series smartphones, which are quickly catching on among young consumers.

In the second quarter, Samsung solidified its position as the world’s top smartphone vendor by volume, widening its sales gap with Apple Inc.

Samsung aims to sell more than 10 million foldable smartphones, led by its latest models, this year.

(Updated with Samsung’s business outlook for the rest of the year and analysts’ estimates for the company’s other business divisions)

Write to Jeong-Soo Hwang, Ik-Hwan Kim and Ye-Rin Choi at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung hikes memory chip prices on depleting client inventories

Korean chipmakersSamsung hikes memory chip prices on depleting client inventoriesSep 12, 2023 (Gmt+09:00)

4 Min read -

ElectronicsWith Samsung’s connected gadgets, it’s ‘home, smart home’

ElectronicsWith Samsung’s connected gadgets, it’s ‘home, smart home’Oct 06, 2023 (Gmt+09:00)

4 Min read -

ElectronicsSamsung Galaxy S23 FE: Affordable yet premium flagship smartphone

ElectronicsSamsung Galaxy S23 FE: Affordable yet premium flagship smartphoneOct 04, 2023 (Gmt+09:00)

3 Min read -

ElectronicsSamsung’s latest Galaxy smartphones, watches hit global markets

ElectronicsSamsung’s latest Galaxy smartphones, watches hit global marketsAug 11, 2023 (Gmt+09:00)

2 Min read -

EarningsSamsung Elec shares regain momentum after narrower chip loss in Q2

EarningsSamsung Elec shares regain momentum after narrower chip loss in Q2Jul 27, 2023 (Gmt+09:00)

6 Min read