Samsung hikes memory chip prices on depleting client inventories

Mobile chip sales rise on higher demand from smartphone makers while PC chips remain weak

By Sep 12, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

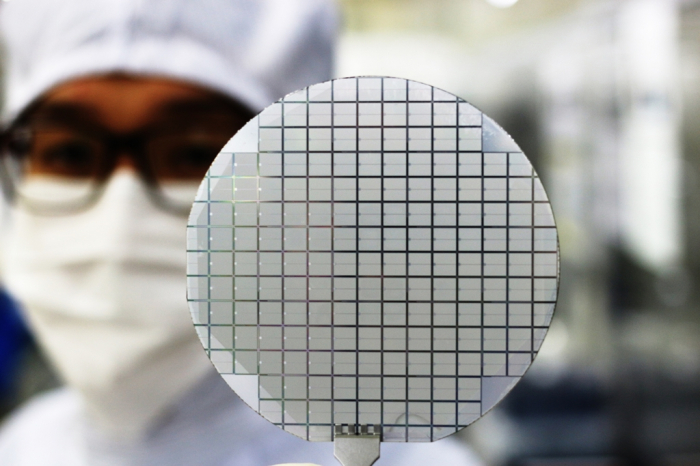

There are signs of a memory chip market recovery, particularly in the mobile DRAM chip segment, although demand for personal computer chips remains weak, chipmakers and industry analysts said.

The Suwon, South Korea-based chipmaker also plans to supply memory chips to the company’s mobile business division that makes the Galaxy line of smartphones at higher prices to reflect the rising mobile chip price trend, sources said.

“We understand Chinese clients have agreed to accept Samsung’s request for higher chip prices as they expect an increase in smartphone sales, particularly in overseas markets,” said one of the people.

Industry watchers said chip inventory levels at smartphone makers have come down following the chip industry’s drastic output cuts from the end of 2022.

Mobile DRAM price trend and outlook

Unit: dollars

*Price in terms of LPDDR5X 16 GB DRAM

(Source: TrendForce)

A Samsung official said the company expects the supply-demand balance in the memory chip market to tilt toward a supply shortage as early as the fourth quarter of this year.

In the DRAM market, chip prices are gradually increasing, led by the latest products for smartphones such as LPDDR5X.

Taiwan-based market tracker TrendForce said Samsung began reining in production in the second quarter with a further squeeze expected for the third quarter. With inventories set to thin out, price hikes loom on the horizon, possibly offering a remedy to the chronic supply-demand imbalance, it said.

The research firm said Korean memory chipmakers are determined to raise the prices of their latest chips and price hikes will likely continue into the fourth quarter.

In the NAND flash market, customers are no longer cutting their order volumes and have started to place more orders, industry officials said.

SMARTPHONES WITH HIGHER MEMORY CAPACITY

The world’s three largest memory makers – Samsung, SK Hynix Inc. and Micron Technologies Inc. – have slashed DRAM production volumes, including those of DDR4 chips, since the fourth quarter of last year.

More recently, chipmakers have also begun cutting their production volumes of NAND chips, industry officials said.

“Memory chipmakers are slashing their actual capital spending and wafer input volumes by more than half from their annual plans set out earlier this year,” said an industry official.

“For both DRAM and NAND flash, the bit growth on the supply side will likely decline by more than 10% this year,” he said.

Bit growth refers to the amount of memory produced. It is a key indicator to gauge chip demand.

Efforts by smartphone makers such as Samsung, Apple, Xiaomi, Oppo and Vivo to innovate their products are also driving up demand for advanced mobile chips, analysts said.

The chip industry expects the DRAM capacity used in smartphones to increase by at least 5% annually over the next few years.

“Smartphone shipments in the first half decreased by more than 10% compared to the year-earlier period. However, with the release of new smartphones that require higher memory capacity, chip inventories at smartphone makers have declined,” said a smartphone manufacturer.

PC CHIP DEMAND REMAINS WEAK

Memory chip demand from manufacturers of PCs and servers remains low.

During its earnings conference call last month, HP Inc. Chief Executive Enrique Lores said there are still a significant number of PCs throughout the distribution channel, signaling that memory chip prices for PCs will remain subdued for a while.

Chips for smartphones and servers account for about 35% of the memory market, respectively. PC chips account for about 15-20%.

The overall memory chip market is expected to see a meaningful rebound from the fourth quarter, industry executives said.

In a speech at the Korea Investment Week (KIW) forum held in Seoul on Monday, Samsung’s DRAM development division chief Hwang Sang-joon said: "The supply and demand of the memory chip market is expected to reach a balance in the third quarter. We’ll see rising demand in the fourth quarter and from next year, demand will lead supply.”

Write to Jeong-Soo Hwang and Ik-Hwan Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIW

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIWSep 11, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix leads DRAM industry’s Q2 revenue rebound, retakes No. 2 spot

Korean chipmakersSK Hynix leads DRAM industry’s Q2 revenue rebound, retakes No. 2 spotAug 25, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix’s latest 1b nm DDR5 DRAM chip under Intel test run

Korean chipmakersSK Hynix’s latest 1b nm DDR5 DRAM chip under Intel test runMay 30, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung rolls out industry’s finest 12 nm DDR5 DRAM chips

Korean chipmakersSamsung rolls out industry’s finest 12 nm DDR5 DRAM chipsMay 18, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyed

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyedApr 12, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix unveils industry’s fastest mobile DRAM chip LPDDR5T

Korean chipmakersSK Hynix unveils industry’s fastest mobile DRAM chip LPDDR5TJan 25, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung unveils industry’s first 12 nm DRAM, compatible with AMD

Korean chipmakersSamsung unveils industry’s first 12 nm DRAM, compatible with AMDDec 21, 2022 (Gmt+09:00)

2 Min read