Samsung Elec shares regain momentum after narrower chip loss in Q2

The South Korean memory chip leader posted 670 billion won in Q2 operating profit, above its guidance of 600 billion won

By Jul 27, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co. reaffirmed the recovery in the global chip market in the latter half of this year after confirming a downward trend in memory chip inventories and reporting a narrower loss in the chip business on solid demand for high-end memory products in the second quarter.

Its shares rose 2.7% on Thursday to close at 71,700 won ($56.10).

“The average selling price of DRAM chips is forecast to rebound for the first time in seven quarters in the third quarter, driven by the launch of new advanced memory chip products and the anticipated ease in memory oversupply thanks to the wafer input cut,” Kim Dong-won, an analyst at KB Securities Co., said in a Samsung Electronics’ stock report.

Kim noted that the price of HBM3 chips for artificial intelligence servers is six times higher than that of conventional memory chips, which is expected to lead to a rise in Samsung Electronics’ profit.

EXPECTATIONS FOR RECOVERY IN H2

Samsung Electronics expects its parts business will lead the upturn in earnings of its businesses across the board, despite lingering uncertainty over the global macro economy.

Some analysts forecast Samsung Electronics would see a turnaround in the third quarter with an operating profit above 1 trillion won on a slash in chip output and launches of premium smartphones.

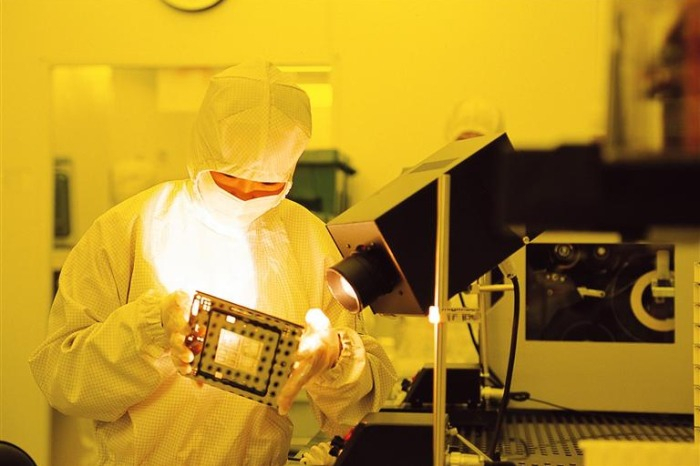

Samsung Electronics said it will focus on high-end memory chip products such as DDR5, LPDDR5x and HBM3 and aim to secure more new orders of those products later this year to ride the anticipated recovery.

Samsung Electronics will continue to invest in chip production infrastructure, research and development, packaging and GAA fabrication, it added.

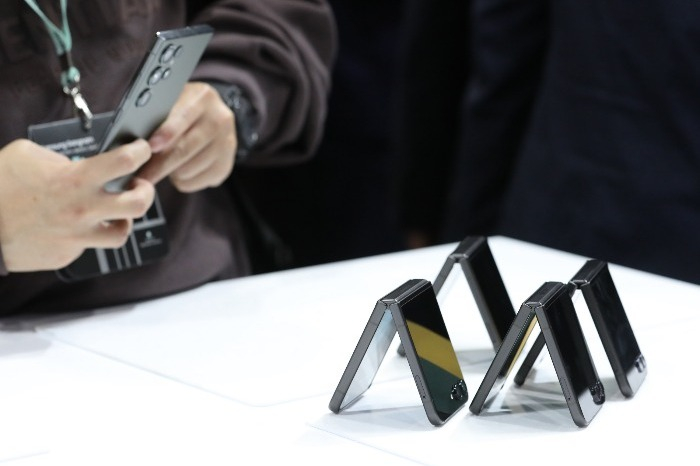

It also plans to expand sales of premium TV sets and appliances to improve profitability while betting big on its new foldable smartphones, tablet PCs and wearable devices slated to launch in the second half of this year.

The company unveiled two phones in the new flagship Galaxy Z foldable series -- Galaxy Z Flip 5 and Fold 5 -- in Seoul yesterday.

Samsung Electronics spent 7.2 trillion won on R&D in the second quarter, its new quarterly record for R&D investment. It also invested 14.5 trillion won in facility expansion, the most for a second quarter, the company said.

NARROWER LOSS IN CHIP BUSINESS

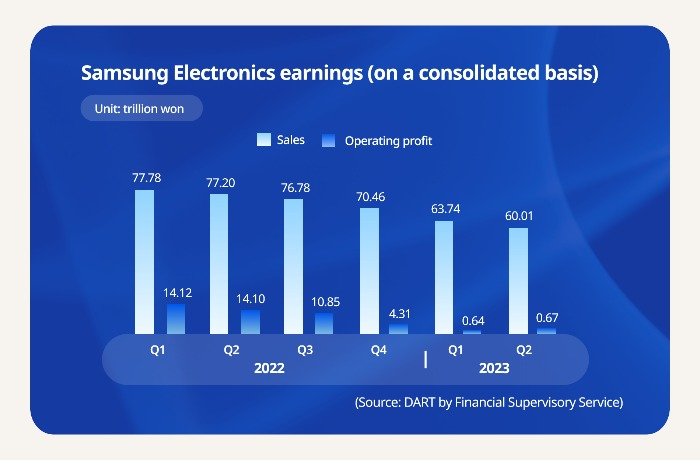

The world’s biggest memory chip producer earlier Thursday announced that its operating income stood at 670 billion won ($526.9 million) on a consolidated basis in the April-June period, down 95.3% from the same period of last year but up 4.4% from the previous quarter.

The result exceeds its earlier guidance of 600 billion won announced in early July.

Its sales in the cited quarter contracted 22.3% on-year to 60.01 trillion won, nearly unchanged from the preliminary figure of 60.00 trillion won.

The reduced loss in its Device Solutions (DS) division in charge of Samsung Electronics’ semiconductor business offset decreased smartphone shipments in the second quarter, allowing the company to post a higher operating profit than the previous quarter, the company said in a news release on Thursday.

The company saw an improvement in its businesses across the board, except in the mobile division.

The weaker Korean won currency against the US dollar and other foreign currencies in the second quarter also contributed to a rise in the operating income of most parts and set businesses, the company added.

DS FARES BETTER THAN EXPECTED

The DS division reported an operating loss of 4.36 trillion won in the second quarter on sales of 14.73 trillion won. It logged a loss of 4.60 trillion won in the first quarter.

Its dynamic random access memory (DRAM) chip shipments surpassed its earlier projections in the second quarter thanks to strong demand for advanced memory chips for artificial intelligence technology, such as DDR5 and high bandwidth memory (HBM), Samsung Electronics said.

The company said memory chip inventories are confirmed to have peaked in May, suggesting that the oversupply in the memory chip market will ease later this year.

Samsung Electronics in April joined its peers to cut wafer input to counter growing inventories and falling chip prices, a move that seems to have taken effect in the global memory market.

Its fabless business, the System LSI Division, is also expected to see a recovery in demand for its system on chip (SoC) and mobile display driver IC (DDI) products later this year as its clients, especially mobile phone makers, are projected to complete inventory adjustment soon, and the peak season for information technology (IT) devices has begun, the company said.

The wafer input slash and the stagnant mobile device demand slowed its foundry business in the second quarter, but Samsung Electronics projects a gradual recovery in the foundry industry going forward.

Samsung Electronics plans to improve the 3-nanometer Gate-All-Around (GAA) fabrication process and secure major global clients to accelerate the recovery of its foundry business.

DISPLAYS, TVS AND APPLIANCES OFFSET SMARTPHONE SLOWDOWN

Its Device eXperience (DX) division posted 3.83 trillion won in operating income in the second quarter on sales of 40.21 trillion won.

The result was smaller than a quarterly profit of 3.94 trillion won in the first quarter when it launched its flagship Galaxy S23 series.

Coupled with weaker demand for premium smartphones, a delayed recovery in demand for budget and mid-range smartphones due to the global economic slowdown walloped Samsung Electronics’ smartphone business, the company said.

Its smartphone sales in key markets such as the US and Japan also declined in the second quarter, added the company.

But other divisions dealing with displays, TVs and home appliances did better.

Its small- and medium-sized organic light-emitting displays (OLED) were well received by premium mobile device producers, while its large-size displays enhanced its position as a premium display maker thanks to its advanced QD-OLED display technology.

The display division expected an improvement in earnings in the second half on the anticipated releases of new smartphones by its global clients.

Samsung Electronics projected a recovery in overall TV demand in the peak season late this year but expected fierce competition in the segment amid the lingering uncertainty about the global economy.

It plans to roll out 83- and 77-inch OLED TVs, as well as 98-inch 8K and QLED TVs later this year as part of its efforts to diversify the premium TV lineup, according to the company’s earnings conference call on Thursday. It will also add a 89-inch microLED TV.

It will continue to focus on the sale of AI-backed eco-friendly and high-energy-efficient appliances with premium value in the latter half to sustain growth momentum in its appliance division, said the company.

(Updated with a new lede after adding more memory chip market outlook for the rest of the year, detailed performance by division and their respective market outlooks, as well as updated stock price)

Write to Jeong-Soo Hwang at hjs@hankyung.com

Sookyung Seo edited this article.

-

-

Corporate investmentS.Korea relies heavily on Samsung Elec for R&D spending: FKI

Corporate investmentS.Korea relies heavily on Samsung Elec for R&D spending: FKIJul 25, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung chip turnaround likely in second half after dismal Q2

EarningsSamsung chip turnaround likely in second half after dismal Q2Jul 07, 2023 (Gmt+09:00)

3 Min read