Korean stock market

Foreign net buying of Samsung Elec at record high in 2023

Individual investors took the opposite position to turn net sellers of Samsung

By Jan 01, 2024 (Gmt+09:00)

2

Min read

Most Read

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

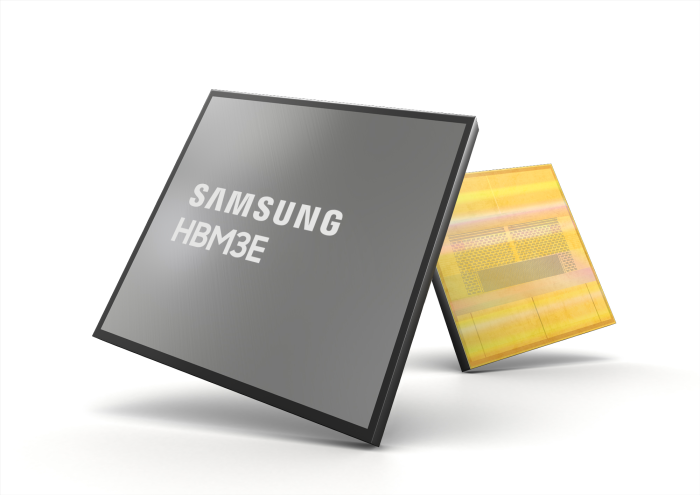

Foreign investors turned net buyers of Samsung Electronics Co. in 2023, reversing their selling spree of the stock over past three years, as the semiconductor industry shows signs of recovery with rising chip price and the launch of a series of advanced memory chips designed for artificial intelligence.

Their net buying of the worldŌĆÖs largest memory chipmaker reached 1.67 trillion won ($1.3 billion) last year, marking their largest-ever net purchases of the shares since the Korea Exchange started compiling the relevant data in 1999.

That was in stark contrast to individual investorsŌĆÖ dumping of the stock last year, amounting to a net 16.2 trillion won, as some analysts warned that expectations of a semiconductor market recovery had run their course.

Foreign ownership of Samsung Electronics has increased to 53.9% as of the end of last year, versus 49.6% at the end of 2022.

The share price of Samsung Electronics spiked 41% in 2023, more than double the 18% gain of the Kospi index over the same period. It closed at 78,500 won on Dec. 29.

Last year, Samsung was at the top of the stock list foreign investors bought in terms of net purchases. That marked a reversal from their net selling of Samsung in the three years prior.

In 2022 alone, Samsung was the most heavily net-sold stock by foreigners among those traded on the main bourse Kospi and the junior Kosdaq market.

Analysts said further gains in the share prices of Samsung and other semiconductor-related companies depend on how market expectations of their industry recovery will be realized.

┬Ā

Individual investors made the most of foreign buying to cash out of Samsung, one year after they built their largest net buying position for Samsung in 2022 among the stocks traded on the Korea Exchange.

They net sold 16.2 trillion won of Samsung shares in 2023 in their largest-ever amount of net selling of a single stock listed on the Kospi and Kosdaq markets in the same year.

SK HYNIX

By comparison, SK Hynix Inc. has surpassed its bigger rival Samsung Electronics in terms of foreign net buying.┬Ā

That reflects the solid outlook for high bandwidth memory (HBM) chips used to power generative AI devices, for which SK Hynix has been ahead of Samsung.

Foreign investors ramped up net purchases of SK Hynix to 2.8 trillion won in 2023, shrugging off its cumulative losses since the last quarter of 2022.

That is more than three times their net buying of 833.0 billion won of the stock in 2022 and marked their second consecutive year of net buying the worldŌĆÖs No. 2 memory chipmaker.

Write to Eui-Myung Park at eimyung@hankyung.com

┬Ā

Yeonhee Kim edited this article

More to Read

-

Korean chipmakersGlobal NAND chip sales up in Q3 amid Samsung output cut

Korean chipmakersGlobal NAND chip sales up in Q3 amid Samsung output cutDec 05, 2023 (Gmt+09:00)

1 Min read -

Korean stock marketChipmakers Samsung, SK Hynix among foreignersŌĆÖ top picks in Korea

Korean stock marketChipmakers Samsung, SK Hynix among foreignersŌĆÖ top picks in KoreaDec 04, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returns

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returnsNov 30, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to launch low-power, high-speed AI chips in 2024

Korean chipmakersSamsung to launch low-power, high-speed AI chips in 2024Nov 21, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chip

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chipNov 14, 2023 (Gmt+09:00)

2 Min read -

-

Foreign exchangeForeign buying of Korean stocks, bonds at record high, boosting won

Foreign exchangeForeign buying of Korean stocks, bonds at record high, boosting wonJun 13, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN