Korean chipmakers

Global NAND chip sales up in Q3 amid Samsung output cut

SK Hynix and its subsidiary Solidigm win back the global No. 2 NAND flash chip maker position from Kioxia

By Dec 05, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

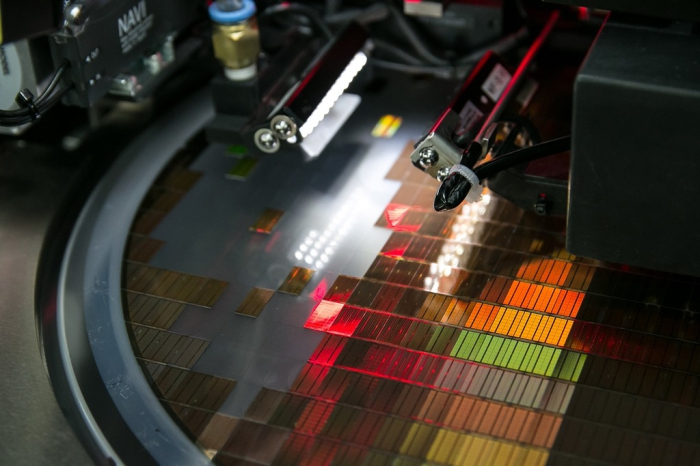

Global sales of NAND flash chips slightly grew in the third quarter as industry leaders such as Samsung Electronics Co. cut output, a report showed on Tuesday.

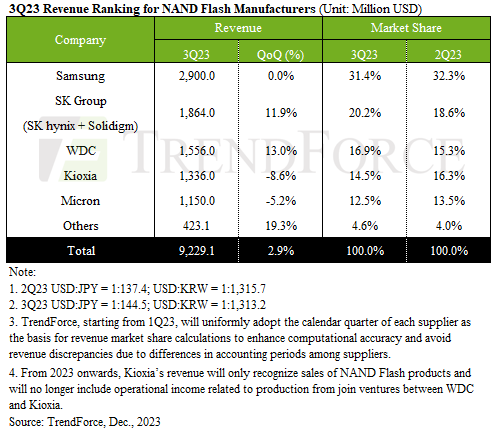

Total revenue of NAND flash chips rose 2.9% to $9.2 billion in the July-September period from the previous three months, according to the Taiwanese technology industry analysts firm TrendForce Corp.

“As market leaders like Samsung implemented substantial production cuts, buyers’ attitudes shifted toward a more aggressive procurement strategy in anticipation of a market supply decrease,” TrendForce said in a research note. “This led to a stabilization and even an uptick in NAND flash contract prices by quarter-end.”

Samsung, the world’s largest memory chipmaker, logged NAND flash chip revenue of $2.9 billion in the third quarter, similar to sales in the second, keeping its leadership in the segment although its market share dipped to 31.4% from 32.3%, TrendForce said.

SK HYNIX RECLAIMS NO. 2 FROM KIOXIA

SK Hynix Inc. and its NAND flash-making subsidiary Solidigm won back the No. 2 position in the world’s NAND flash chip market from Kioxia Holdings Corp., according to the analysis firm.

SK Hynix and Solidigm reported a combined NAND flash chip sales of $1.9 billion in the July-September period, up 11.9% on-quarter while increasing their market share to 20.2% from 18.6%.

Kioxia, which had been the second-largest NAND flash chip maker since the third quarter of 2022, slipped to No. 4 with its market share down to 14.5% from 16.3%. The Japanese chipmaker’s sales of NAND flash chips fell 8.6% to $1.3 billion due to a delay in orders from US smartphone makers, TrendForce said.

US-based Western Digital Corp. ranked No. 3 as its NAND flash chip revenue advanced 13% to $1.6 billion with its market shares up to 16.9% from 15.3%.

“Other industry giants like SK Group (SK Hynix & Solidigm) and WDC rode the wave of renewed demand in consumer electronics,” TrendForce said, referring to Western Digital Corp.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Korean stock marketChipmakers Samsung, SK Hynix among foreigners’ top picks in Korea

Korean stock marketChipmakers Samsung, SK Hynix among foreigners’ top picks in KoreaDec 04, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returns

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returnsNov 30, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slow

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slowNov 09, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN