Korean food, retail firms cut jobs as spending drops

Experts warn the wave of job cuts could place Asia’s No. 4 economy at risk of falling into a vicious circle

By Dec 04, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s food, cosmetics and retail companies, heavily reliant on domestic sales, are slimming down their workforce to survive a prolonged slump in domestic spending, in what some industry watchers say could be the harshest-ever series of job cuts since the 2008 global financial crisis.

They are fighting the triple whammy of declining consumption on persistent inflation and high interest rates, competition from low-priced Chinese goods and government pressure to curb price hikes.

The series of job cuts across the domestic sales-focused sectors could lead to a further decrease in private spending, placing Asia's No. 4 economy at risk of falling into a vicious circle, business experts warn.

Lotte Mart Co. has been receiving voluntary retirement applications since the end of last month from employees with more than 10 years with the company, according to the food and distribution industry on Sunday.

In 2021, the supermarket chain allowed 200 employees to take voluntary retirement.

At its affiliate Lotte Shopping Co., a total of 5,600 employees have left the company through early retirement programs over the past six years.

This year, many other domestic sales-oriented companies have already reduced their payroll through voluntary retirement, or are in the process of doing so.

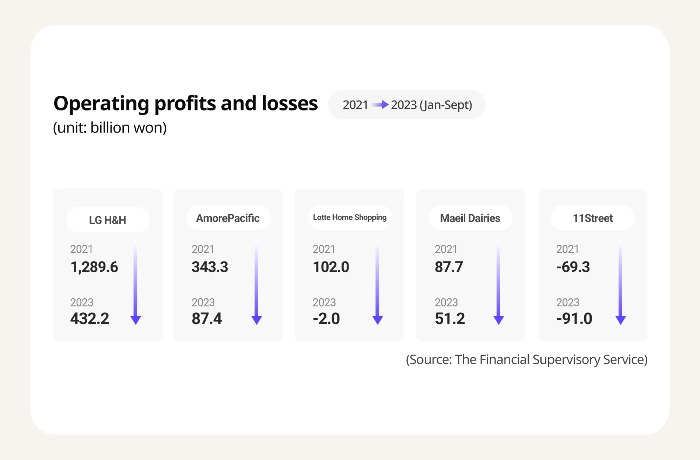

They include LG H&H Co., previously LG Household & Healthcare; AmorePacific Corp., a cosmetics brand; Lotte Home Shopping Inc.; Maeil Dairies Co.; Paris Croissant Co., a bakery and dessert chain; and 11Street Co., an online shopping platform.

LG H&H and AmorePacific, the country’s leading makers of cosmetics and bath products, suffered 20-40% drops in operating profit in the first nine months of this year from the same period last year. Lotte Home Shopping turned to the red.

SLOWEST CONSUMPTION GROWTH

The Bank of Korea forecasts private spending to edge up 1.9% on-year in 2023, the weakest figure since the 4.8% drop seen in 2020, at the height of COVID-19.

The Korea Chamber of Commerce & Industry said in its recently published “2024 Consumer Market Outlook Survey” that domestic retail sales are predicted to grow 1.6% on-year, about half the estimated 2.9% in 2023 due to deteriorating consumer sentiment and increased household debt.

“The series of job cuts could place our economy at risk of falling into a vicious circle, pushing consumption further lower, as domestic companies see greater employment effects than other industries,” said Seo Yong-gu, a professor at Sookmyung Women's University.

E-MART

Operating profit margins at E-Mart Inc., Korea's No. 1 supermarket chain, has remained flat or in the 1% range since 2019. In other words, it has earned only 10 won or less from the sale of 1,000 won worth of goods.

That is lower than Walmart’s 4.4%, the average of its profit margins over the past five years and 2.2% for Aeon in Japan.

In 2023, E-Mart's operating profit margin is expected to contract further to 0.3%, versus last year’s 0.4%, according to the FnGuide’s consensus forecast.

“Domestic companies, already in the low-margin business structure, are now being pushed to their limits, hit by a decline in consumption and competition from low-priced Chinese products,” said a retail industry official.

ON THE BRINK

AmorePacific recently carried out voluntary retirement for its door-to-door salesforce after its third-quarter operating profit sharply missed market expectations. It logged an operating profit of 17.2 billion won in the third quarter, about 52% below the consensus forecast of 36.6 billion won.

“It is beyond an earnings shock. It seems to be on the brink of a cliff,” said another industry official.

AmorePacific is predicted to log its history's poorest-ever operating profit of 133.3 billion won in 2023.

LG H&H slashed its workforce through voluntary retirement in June. It was the first time for the beauty and health brand to carry out job cuts in the middle of a year.

Its operating profit in 2023 is forecast to be less than half the 1.2 trillion won it recorded in 2020.

FOOD COMPANIES

CJ CHEILJEDANG Corp. and Daesang Corp., South Korea’s two leading food companies, are no exception. Both companies are predicted to report a 12-21% drop in operating profit in 2023, versus 2022.

That is in contrast to US food makers such as Conagra Brands and Kellanova, which have continued to report double-digit operating profit growth.

“The increase in raw material prices and labor costs have substantially reduced our profitability," said a food industry official.

"But we can’t pass on them to customers due to government pressure,” he said, referring to the Korean government’s requests that food companies join the government’s efforts to tame inflation.

DUTY-FREE SHOPS

Meanwhile, fewer-than-expected visitors from China have dealt a blow to duty-free shops, once viewed as one of the main beneficiaries of China’s lifting of travel restrictions this year.

According to the Hyundai Research Institute, the number of Chinese tourists visiting South Korea averaged 144,000 per month from January to September of this year.

This is significantly lower than the average of 416,000 per month between 2017 and 2019, when Chinese group tours to Korea were banned due to China’s protest against Seoul’s deployment of terminal high altitude area defense (THAAD) missile systems.

Accordingly, sales to foreigners at domestic duty-free stores plunged 34% to $810 million in October, compared to the same period last year, according to the Korea Duty Free Shop Association.

However, the prevailing view is that domestic demand is unlikely to pick up unless central banks shift from their tightening stance.

Write to Hun-Hyoung Ha and Ji-Yoon Yang at hhh@hankyung.com

Yeonhee Kim edited this article.

-

EconomyS.Korea’s chip exports rebound, ending 15-month losing streak

EconomyS.Korea’s chip exports rebound, ending 15-month losing streakDec 01, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief says rates need to stay high for over 6 months

Central bankBOK chief says rates need to stay high for over 6 monthsNov 30, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s factory output, consumption dwindle in October

EconomyS.Korea’s factory output, consumption dwindle in OctoberNov 30, 2023 (Gmt+09:00)

3 Min read -

Travel & LeisureForeign visitors to S.Korea on course to top 10 mn milestone

Travel & LeisureForeign visitors to S.Korea on course to top 10 mn milestoneNov 29, 2023 (Gmt+09:00)

1 Min read -

-

Executive reshufflesShinsegae axes E-Mart, department store CEOs amid weak sales

Executive reshufflesShinsegae axes E-Mart, department store CEOs amid weak salesSep 20, 2023 (Gmt+09:00)

3 Min read -

EarningsBrokerages cut E-Mart’s share price target after disappointing Q2

EarningsBrokerages cut E-Mart’s share price target after disappointing Q2Aug 16, 2023 (Gmt+09:00)

2 Min read -

RetailAlibaba launches express ships to S.Korea as orders surge

RetailAlibaba launches express ships to S.Korea as orders surgeJul 20, 2023 (Gmt+09:00)

3 Min read