Central bank

BOK chief says rates need to stay high for over 6 months

S.Korea's c.bank head defies rate cut calls although it slashes 2024 growth forecast; BOK raises 2023, 2024 inflation forecasts

By Nov 30, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s central bank chief on Thursday said interest rates will have to stay high for more than six months, leaving the door open for another hike, as the Bank of Korea raised its inflation forecasts for this year and the next while cutting its prediction for 2024 growth in Asia’s fourth-largest economy.

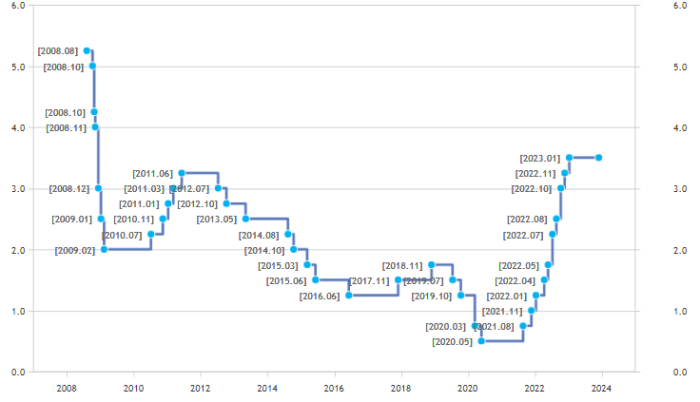

The BOK kept its policy interest rate at 3.50% in a unanimous decision for a seventh straight meeting as widely expected.

The central bank, however, said the monetary policy board members will maintain a restrictive policy stance for a “sufficiently long period of time,” replacing “for a considerable time,” used in the previous statements, which analysts say indicates six months.

“We plan to maintain the tightening bias for long enough until we are confident that inflation will converge at the target level,” BOK Governor Rhee Chang-yong told reporters when asked about the change in its policy statement. “It could take more than six months, I think at this point.”

Rhee said four policymakers out of six excluding himself said the BOK needs to keep the door open to raise the base interest rate to 3.75%, given increasing inflationary pressure.

None of them suggested a potential rate cut at the BOK’s last policy meeting for this year, while one policymaker, who had said the central bank needed to consider a slash in October, withdrew his opinion, Rhee added.

After the comments, most government bond yields rose. The highly liquid three-year bond yield advanced 2.9 basis points (bps) to 3.583%, while the five-year debt yield gained 4.3 bps to 3.621% in the domestic bond market, according to the Korea Financial Investment Association. The 10-year note yield grew 5.8 bps to 3.699%.

RAISES INFLATION FORECASTS

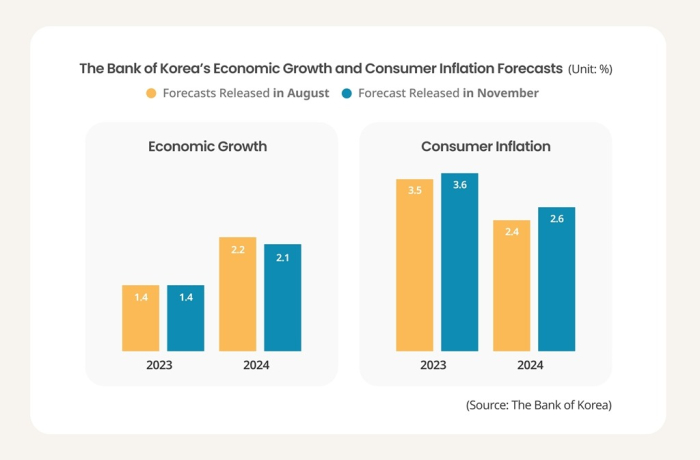

The BOK ramped up its consumer inflation forecasts to 3.6% for 2023 and 2.6% for 2024 by 0.1 percentage point and 0.2 percentage point, respectively, from its prior expectations released in August.

Consumer prices grew 3.8% in October from a year earlier, their fastest pace since March, led by higher costs of agricultural products and industrial goods, government data showed.

“Inflation is expected to slow to the low-2% level around the end of next year or early 2025, according to the current growth and inflation forecasts,” Rhee said when asked when consumer inflation is predicted to head to its long-term target of 2%.

The monetary policy authority forecasts consumer inflation in 2025 at 2.1%.

On the other hand, the BOK lowered its economic growth forecast for 2024 to 2.1% from the previous 2.2% while maintaining its prediction for this year at 1.4%.

“The economy will continue to improve on a recovery in exports and capital expenditures next year but the growth is likely to be lower than the prior forecast due to a weaker recovery momentum in domestic demand,” the BOK said in its economic outlook report.

The country’s factory activity waned last month, snapping its recovery streak of the previous two months largely due to a drop in chip production and shipments and leading the overall industrial output to slow, separate government data showed.

NO RATE CUT YET

Rhee, however, reiterated that the weaker growth does not guarantee a rate cut. Financial market analysts expected the BOK to lower interest rates next year to boost economic growth.

“It is not desirable,” he said when asked if the BOK needs to lower rates to bolster economic growth. “A rash policy to support the economy could boost property prices only. Economic growth is a mid- to long-term issue, which should not be handled by fiscal or monetary policies. We need to structurally approach it.”

Rhee also said expectations for a policy shift were premature despite growing views that central banks in developed countries such as the US Federal Reserve are likely to slash their borrowing costs in 2024.

“I am well aware of views that interest rate cut cycles may start in the US and the UK soon,” he said. “Markets may have got ahead of themselves. When I talked to other central bank chiefs, they did not seem to think so.”

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyS.Korea’s factory output, consumption dwindle in October

EconomyS.Korea’s factory output, consumption dwindle in OctoberNov 30, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief says inflation may ease more slowly than expected

Central bankBOK chief says inflation may ease more slowly than expectedOct 19, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN