Central bank

BOK chief’s top mission: Soft landing for household debt

The Korean central bank cuts 2024 growth forecast to 2.2% on China’s property crisis, says 2023 growth could fall to 1.2%

By Aug 24, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s central bank chief on Thursday vowed to reduce household debt without causing a severe economic downturn as the Bank of Korea held its policy interest rate unchanged while lowering its forecast for 2024 growth in Asia’s fourth-largest economy due to the Chinese property crisis.

“A soft landing for household debt is one of the reasons for me to become BOK head,” said Governor Rhee Chang-yong, pledging to work toward this goal.

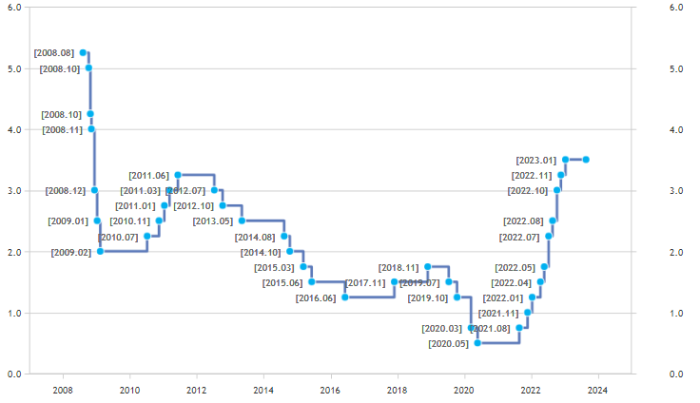

Rhee warned against investments with heavy debt in the domestic property market, saying days with low borrowing costs of near 0% or 1-2% are unlikely in the near term.

The balance of household credit stood at 1,862.8 trillion won ($1.4 trillion) as of end-June, up 9.5 trillion won from three months earlier as rising mortgage loan rates pushed up household lending by 10.1 trillion won, according to the central bank data.

“It is time to adjust property policies, which were eased to prevent the sector’s hard landing late last year,” Rhee said. ”We will consider macro policies if the adjustment through micro policies is not enough.”

He reiterated that the BOK will not cut the policy interest rate for the time being, adding that six of its seven-member monetary policy board, which he chairs, said the central bank needs to leave the door open to raising the base interest rate by 25 basis points (bps).

LOWER 2024 GROWTH FORECAST

Earlier in the day, the BOK kept the base interest rate at 3.50% for a fifth straight meeting, as was widely expected, in a unanimous decision.

“Inflation is easing but it is expected to take a considerable time to stabilize at around the target level,” Rhee told reporters after the decision, referring to its long-term target of 2%.

“We thought it is proper to keep the current tightening stance, given the increasing uncertainties over monetary policies and economic conditions in major economies. It is also necessary to closely monitor household debt trends.”

The BOK cut its economic growth forecast for the next year to 2.2% from the previous 2.3% published in May due to the sluggish recovery in China, South Korea’s top export market.

The central bank maintained the growth and inflation predictions for this year at 1.4% and 3.5%, respectively, but warned that they could fall to as low as 1.2% and 3.4% if the world’s second-largest economy slows further due to the property crisis.

The monetary authority’s dismal expectations pushed down most government bond yields. The highly liquid three-year debt yield dipped 1.2 bps to 3.759% and the five-year bond yield fell 2.2 bps to 3.803%, according to the Korea Financial Investment Association.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK head says Korea inflation to dip below mid-2% in H2 2024

Central bankBOK head says Korea inflation to dip below mid-2% in H2 2024Aug 22, 2023 (Gmt+09:00)

1 Min read -

EconomyKorea sales set to China to fall for 15th straight mth on property crisis

EconomyKorea sales set to China to fall for 15th straight mth on property crisisAug 21, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK warns of household lending risk on growth, inequality

Central bankBOK warns of household lending risk on growth, inequalityJul 17, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK leaves door open for another quarter-point rate rise

Central bankBOK leaves door open for another quarter-point rate riseMay 25, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN