Central bank

BOK warns of household lending risks on growth, inequality

To lower household debts, BOK proposes strengthening macroprudential steps, mulling financial stability for monetary policy

By Jul 17, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s central bank warned that household lending jumped to the world’s third highest and could hurt long-term economic growth and deteriorate wealth inequality, days after its chief left the door open for another interest rate hike on the loan despite continuous calls for a cut.

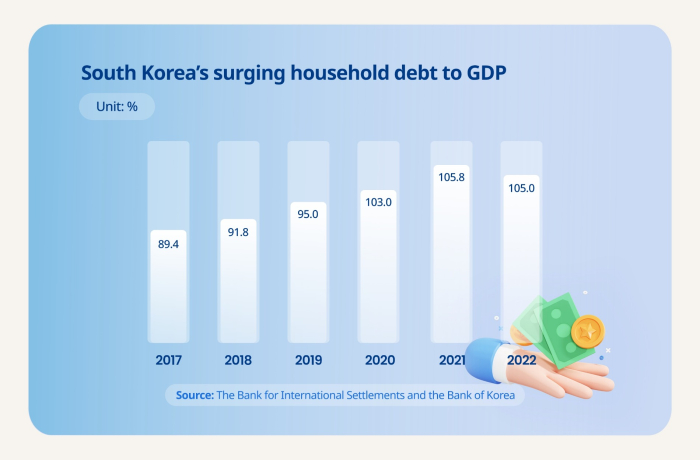

The Bank of Korea said on Monday in a report that the country’s household debt sat at 105% of the country’s gross domestic product as of end-2022, compared with 89.4% in 2017. The latest debt-to-GDP ratio ranked No. 3 after Switzerland with 128.3% and Australia with 111.8% among 43 major countries across the world, according to the BOK and the Bank for International Settlements. South Korea was at No. 14 on the list in 2012 with the ratio of 77.3%.

The debt service ratio (DSR) in the country rose by 0.8 percentage point to 13.6% last year, the second highest after Australia with 14.7%.

Asia’s fourth-largest economy is expected to lose growth momentum if the household debt to GDP ratio stays above 100% for the longer term, weakening private consumption and the efficiency of resource allocation through the finance sector, the BOK said. The household lending is also likely to worsen wealth inequality as net assets of families without debts grew more than those of households with loans, the monetary authority said.

“It will take a considerable time to bring down household lending below GDP,” said Lee Kyeongtae, an economist at the BOK Economic Research Institute’s financial & monetary economics team. “It is important to achieve gradual deleveraging while managing the increase in household debts within the nominal GDP growth.”

TO TAKE MORE THAN DECADE

South Korea’s household debt ratio to GDP was expected to fall to around 90% in 2039 if nominal GDP expands by 4% with the loans up by only 3%, according to the central bank report.

The household lending has risen by an average of 7.5% a year since 2003, according to data, which the BOK started compiling in 2022. The debts hit a record high of 1,757 trillion won ($1.4 trillion) as of end-2021 before easing to 1,750 trillion won at the end of 2022.

The Netherlands, which had reported the ratio of higher than 100% from 2003 to 2021, spent more than 18 years pushing down the ratio below the threshold, while Switzerland has been struggling to cut the ratio lower than the level since 1999.

Last week, BOK Governor Rhee Chang-yong said the South Korean authorities will deal with an unexpected surge in household debts through various policy options including not only the interest rate policy but also macroprudential regulations.

Local banks’ household loans rose by 5.9 trillion won in June from the previous month, the largest increase since September 2021, as mortgage lending jumped by 7 trillion won, the largest in 40 months, amid the government’s policies to revive the ailing property sector, according to central bank data.

HIGH PROFITABILITY FOR BANKS, WEAK REGULATIONS

The BOK said local banks have been concentrating on household loans as they are relatively more profitable and stable due to their lower delinquency rates than corporate lending. Interest incomes account for more than 80% of domestic lenders’ profits.

Regulations have also been looser with DSR rules linked to borrowers’ incomes introduced in late 2019, later than major countries, which implemented such regulations in 2012-2014, according to the central bank.

Households took advantage of the trend of low interest rates, which started from the 2008-09 global financial crisis, to invest in assets such as homes and stocks, the BOK added.

To lower household lending, the BOK proposed strengthening macroprudential measures such as the reduction of exemptions in the DSR regulations while considering the financial stability for the country’s monetary policy, which mainly focuses on inflation currently.

Write to Jin-gyu Kang at joseph@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK keeps door open for another rate hike on Fed, debts

Central bankBOK keeps door open for another rate hike on Fed, debtsJul 13, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief nominee to curb household debt through interest rates

Central bankBOK chief nominee to curb household debt through interest ratesApr 01, 2022 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN