Central bank

BOK keeps door open for another rate hike on Fed, debts

BOK Governor Rhee Chang-yong says authorities will deal with surge in household debts through rates, macroprudential regulations

By Jul 13, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

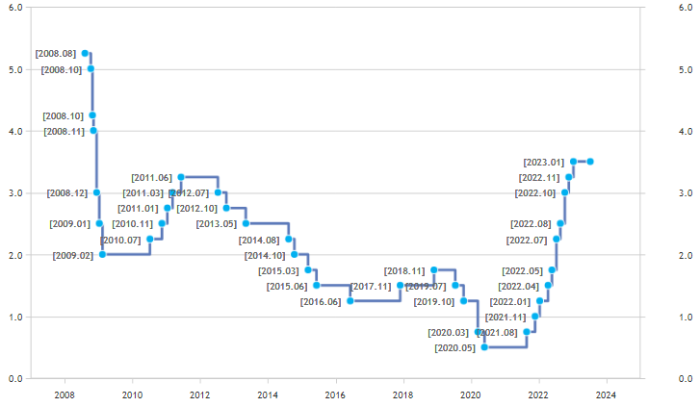

South Korea’s central bank on Thursday kept the door open for another interest rate hike after leaving the policy borrowing cost unchanged for a fourth consecutive meeting, given expectations of further tightening by the US Federal Reserve and the risks of growing household lending.

Bank of Korea Governor Rhee Chang-yong told reporters that six of its seven-member monetary policy board, which he chairs, said the central bank needs to leave the door open to raise the base interest rate to 3.75% after they unanimously decided to hold the rate steady at 3.50% as expected.

“It is uncertain for how many times the Fed will raise interest rates despite lower US CPI inflation and we need to keep an eye on its impact on the foreign exchange market,” Rhee said in a press conference after the decision.

US consumer prices rose by a lower-than-expected 3% last month from a year earlier, the slowest pace since March 2021, Washington data showed on Wednesday. But the data is unlikely to keep the Fed from raising interest rates later this month, analysts said.

RISING HOUSEHOLD DEBTS

Rhee also said the South Korean authorities will deal with an unexpected surge in household debts through various policy options including not only the interest rate policy but also macroprudential regulations.

“I am worried about the rapid growth in household debts. Many monetary policy board members expressed much concern over their increases,” Rhee said.

Local banks’ household loans rose by 5.9 trillion won ($4.6 billion) in June from the previous month, the largest increase since September 2021, as mortgage lending jumped by 7 trillion won, the largest in 40 months, amid the government’s policies to revive the ailing property sector, according to central bank data.

Rhee’s remarks came after financial market investors and analysts expected the central bank not to raise interest rates further with inflationary pressure easing to accelerate recovery in Asia’s fourth-largest economy.

INFLATIONARY PRESSURE

Headline inflation in June dropped for a fifth straight month to a 21-month low of 2.7%.

“Our baseline is that inflation will accelerate again after August to head to around 3% by year-end and we expect inflation to slow to around 2% next year,” Rhee said.

“So, it is hard to discuss a rate cut within this year,” he said. “We will talk about a cut when we are confident enough that inflation is heading to our (long-term) target of 2%.”

Rhee has repeatedly pledged not to turn its monetary policy easier this year despite calls for a rate reduction to boost economic growth.

The BOK said the monetary policy board will maintain a restrictive policy stance for a considerable time with an emphasis on ensuring price stability.

“The board will make a judgment regarding the need to raise the base rate further, while thoroughly assessing the pace of inflation slowdown, financial stability risks, economic downside risks, the effects of the base rate raises, and monetary policy changes in major countries,” the central bank said.

Economists and analysts still expect the BOK to lower its policy rate later.

S&P Global Market Intelligence Asia-Pacific Chief Economist Rajiv Biswas said on Wednesday said the central bank is likely to reduce the rate by one percentage point in 2024.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyS&P expects BOK to cut rate by 100 bps in 2024 for growth

EconomyS&P expects BOK to cut rate by 100 bps in 2024 for growthJul 12, 2023 (Gmt+09:00)

2 Min read -

-

Comment 0

LOG IN