Economy

Korea sales set to China to fall for 15th straight mth on property crisis

Growing risks of a serial default of Chinese property developers are likely to hurt KoreaŌĆÖs exports further; BOK to keep rate this week

By Aug 21, 2023 (Gmt+09:00)

3

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

NPS to commit $1.1 billion to external managers in 2024

Samsung shifts to emergency mode with 6-day work week for executives

Samsung Heavy Industries succeeds autonomous vessel navigation

Korean battery maker SK On expects business turnaround in H2

South KoreaŌĆÖs exports to China are poised to slide for a 15th straight month with an expected deeper drop in August amid a faltering economic recovery on the mainland, indicating AsiaŌĆÖs fourth-largest economy is unlikely to find support from overseas sales in the near term.

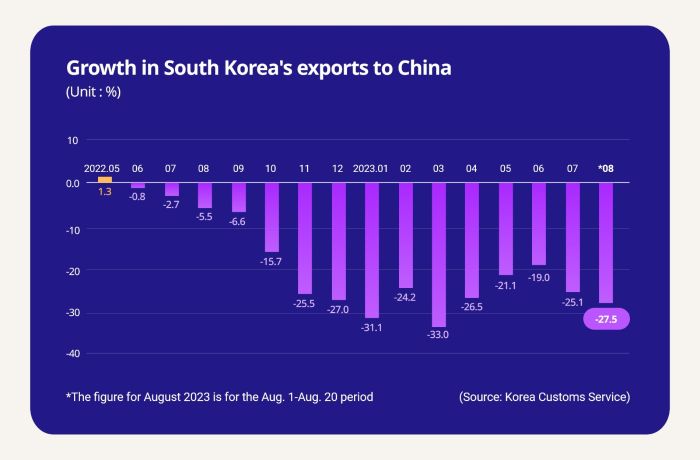

Shipments to China, the worldŌĆÖs No. 2 economy, fell 27.5% to $5.9 billion in the first 20 days of the month from a year earlier, customs data showed on Monday. Sales to South KoreaŌĆÖs top overseas market, which have been falling since June 2022, skidded 25.1% and 19% in July and June of this year, respectively.

Total exports declined 16.5% to $27.9 billion in the Aug. 1-20 period on-year, while imports slid 27.9% to $31.4 billion, resulting in a trade deficit of $3.6 billion. That compared with surpluses of $1.7 billion for all of July and $1.2 billion in June.┬Ā

ŌĆ£Sales to China tumbled and the trade deficit widened as exports concentrated on a few items such as semiconductors and displays,ŌĆØ said Lee Seung-suk, a research fellow of the Korea Economic Research Institute.

Semiconductor and display exports to China in July fell 40.8% and 30.2%, respectively.

The falling demand from the information technology sector amid a slow industry recovery and the sluggish consumption of premium electronics devices in China hurt their exports, a South Korean trade ministry source said.

Given the latest sluggish trade data, the Bank of Korea is unlikely to raise its policy interest rate from the current 3.50% later this week despite the monetary authorityŌĆÖs hawkish stance, a potential rebound in inflation and a weaker won currency, analysts said. The BOK is scheduled to hold an interest rate policy meeting on Thursday.

FALTERING CHINESE ECONOMY

ChinaŌĆÖs central bank earlier on Monday cut one of its key interest rates for the second time in three months as the economy struggles to recover from COVID-19 amid the deepening property crisis.

South KoreaŌĆÖs exports are more sensitive to ChinaŌĆÖs property market and capital expenditures than overseas sales of other countries, the BOK said in a report published last month.

ŌĆ£Exports of intermediate goods such as steel make up more than 70% of South KoreaŌĆÖs total exports,ŌĆØ said a BOK official. ŌĆ£So, exports will inevitably be affected by construction demand in China.ŌĆØ

The countryŌĆÖs property crisis is expected to prevent South Korea from meeting its goal for a structural trade surplus from September, experts said.

ŌĆ£It is premature to be optimistic that a trade balance will turn to a surplus in the second half, given growing risks of serial defaults by Chinese property developers,ŌĆØ said Seok Byoung Hoon, an economics professor at Ewha Womans University in Seoul.

NOT YET OUT OF WOODS

The gloomy predictions on exports are likely to delay South KoreaŌĆÖs economic recovery, analysts said, although the government and the central bank expected the trade-dependent economy to speed up the rebound in the second half.

ŌĆ£A further slowdown in the Chinese economy due to the sluggish property sector could further hurt South KoreaŌĆÖs exports of key items such as semiconductors,ŌĆØ said Chon Sora, an associate fellow at the Korea Development Institute.

ŌĆ£Chinese tourists are unlikely to spend as much as before,ŌĆØ Chon said. Beijing decided to lift the ban on group tours to South Korea earlier this month, ending a six-year hiatus caused by frayed relations following the deployment of a US missile defense system to the peninsular.

Total overseas sales of semiconductors, South KoreaŌĆÖs top export item, tumbled 24.7% in the first 20 days of August. The country is home to the worldŌĆÖs two largest memory chipmakers ŌĆō Samsung Electronics Co. and SK Hynix Inc.

South KoreaŌĆÖs exports to other major economies also slumped during the period. Sales to the US, the worldŌĆÖs largest economy, and the European Union dropped 7.2% and 7.1%, respectively, while exports to Vietnam slid 7.7%.

Shipments of petroleum products and steel slumped 41.7% and 20.5%, respectively.

On the other hand, automobile exports rose 20.2% while overseas sales of vessels jumped 54.9%.

Write to Kyung-Min Kang and Sul-Gi Lee at kkm1026@hankyung.com

┬Ā

Jongwoo Cheon edited this article.

More to Read

-

RetailKoreaŌĆÖs tourism industry pins high hopes on return of Chinese big spenders

RetailKoreaŌĆÖs tourism industry pins high hopes on return of Chinese big spendersAug 10, 2023 (Gmt+09:00)

3 Min read -

EconomyKoreaŌĆÖs inflation eases to 25-mo low, but poised to rebound in H2

EconomyKoreaŌĆÖs inflation eases to 25-mo low, but poised to rebound in H2Aug 02, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea exports down the most in 3 years; BOK may keep rates

EconomyKorea exports down the most in 3 years; BOK may keep ratesAug 01, 2023 (Gmt+09:00)

1 Min read -

Central bankBOK keeps door open for another rate hike on Fed, debts

Central bankBOK keeps door open for another rate hike on Fed, debtsJul 13, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN