Economy

Korea’s inflation eases to 25-mo low, but poised to rebound in H2

An on-year plunge in oil prices cooled the country’s inflation below 3% for two straight months

By Aug 02, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s headline inflation rose at the slowest pace in 25 months in July on still-low international oil prices but is projected to reaccelerate in the second half on higher oil and agricultural prices, justifying another rate hike by the central bank before the end of this year.

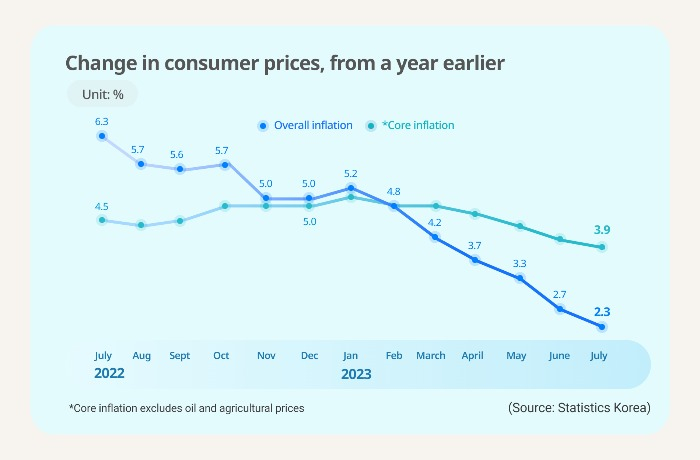

Consumer prices added 2.3% in July from the same month of last year, the slowest on-year increase since June 2021 with a 2.3% gain, according to Statistics Korea on Wednesday.

This is the second straight month for the country’s inflation to ease below 3% since June’s 2.7%, and it has cooled for six consecutive months. After hitting 5.2% in January, inflation slowed to 4.8% in February, 4.2% in March, 3.7% in April and 3.3% in May.

A tumble in petroleum prices largely curbed inflation in July, according to government data. They declined 25.9% from the same month a year earlier, the biggest on-year retreat since the government started compiling the related data in January 1985.

Diesel and gasoline prices dropped 33.4% and 22.8%, respectively, while automotive liquid petroleum gas (LPG) fell 17.9%.

Core inflation, which excludes oil and agricultural prices, climbed 3.9% on-year in July, the lowest since April last year when it added 3.6%.

Core inflation less food and energy prices by the Organization for Economic Co-operation and Development (OECD) dropped 3.3% in July, also the slowest in 15 months.

The easing inflation is mainly due to a high base effect a year ago when consumer prices jumped 6.3%, according to the government, warning that inflationary pressure is building on a rebound in agricultural prices, as well as a recovery in the Brent crude oil price to about $85 per barrel this month.

The crude oil price has hovered below $80 since the beginning of this year.

INFLATION ACCELERATION ON HIGHER AGRICULTURAL PRICES

“Such a high-base effect will likely dissipate nearly completely starting August, which means that the current slowdown trend in inflation would not be extended,” Kim Bo-kyung, a senior official at Statistics Korea, said during a press briefing on Wednesday.

Kim Woong, the deputy governor of the Bank of Korea (BOK), on the same day also reaffirmed the central bank’s previous anticipation of a reacceleration in inflation in August to head to around 3% by year-end.

Especially, agricultural prices could climb further depending on the extreme heat waves currently hitting the county after the end of the summer monsoon season last month.

Vegetable prices dropped 5.3% in July from the same month last year when their prices skyrocketed due to the heavy flooding.

But on a monthly basis, vegetable prices jumped 7.1% in July due to this year’s floods that took a heavy toll on the country’s agricultural industry again. Lettuce, spinach and cucumber prices zoomed 83.3%, 66.9% and 23.2% on-month, respectively.

Processed food prices also gained 6.8% on-year in July and dining-out costs were up 5.9%, extending their growth streak.

EFFORTS TO COOL INFLATION

The Korean Ministry for Food, Agriculture, Forestry and Fisheries on Wednesday asked retail store operators to restrain from unnecessary price increases and take measures, such as discount events, to stabilize agricultural prices.

With a projection for a rebound in inflation at around 3% through the end of this year, the Korean central bank is expected to maintain its monetary tightening stance for some time despite lingering uncertainty over the Korean economy.

Bank of Korea Governor Rhee Chang-yong already said that the central bank needs to leave the door open for another interest rate hike this year, possibly to 3.75%, after the bank kept the rate steady at 3.50% during a monetary policy meeting in July.

The central bank left the policy borrowing cost unchanged for four consecutive meetings last month.

The country’s growing household debts were one of the main reasons for another rate hike in Korea this year, Rhee said.

The BOK expected inflation to slow to around 2% in 2024, the BOK governor said last month.

Write to Se-Min Huh at semin@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Central bankBOK warns of household lending risk on growth, inequality

Central bankBOK warns of household lending risk on growth, inequalityJul 17, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK keeps door open for another rate hike on Fed, debts

Central bankBOK keeps door open for another rate hike on Fed, debtsJul 13, 2023 (Gmt+09:00)

3 Min read -

-

EconomyKorea inflation at 19-mth low; casts doubts over rate hike

EconomyKorea inflation at 19-mth low; casts doubts over rate hikeJun 02, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN