S.Korea’s factory output, consumption dwindle in October

The country’s overall industrial activity also declined, reversing course from a rebound in the previous two months

By Nov 30, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s factory activity waned last month, snapping a recovery streak in the previous two months, largely due to a drop in chip production and shipments and causing the country’s industrial output to slow, government data showed.

As the country’s retail sales and facility investment also contracted last month, concerns are growing over the outlook for Asia's fourth-largest economy.

According to data released on Thursday by Statistics Korea, the seasonally adjusted mining and manufacturing output in October dropped 3.5% from the previous month, snapping its growth streak in August and September with gains of 1.9% and 5.3%, respectively.

The statistics office blamed the retreat on fewer working days in October due to a substitute holiday on Oct. 2 and the high base effect over the previous two months.

The main culprit behind the weak manufacturing activity, however, was a contraction in chip production and shipments, data showed.

Korea's microchip output dropped 11.4% on-month in October, marking its biggest decline in eight months following gains of 13.5% and 12.8% in August and September.

Shipments of chips decreased 29% while chip inventories declined 9.6% on the back of the double-digit fall in chip output.

Kim Bo-kyung, a senior official at Statistics Korea, said at a briefing Thursday that a recovery in chip demand is expected thanks to industry-wide chip wafer reduction efforts, resulting in a rise in the prices of dynamic random access and flash memory chips in recent months.

Korea’s semiconductor exports increased during the first 10 days of November, reversing a 13-month downward trend, the recent data showed, raising expectations for a global demand recovery for the country’s largest export item.

WEAK INDUSTRIAL ACTIVITY, CONSUMPTION, FACILITY INVESTMENT

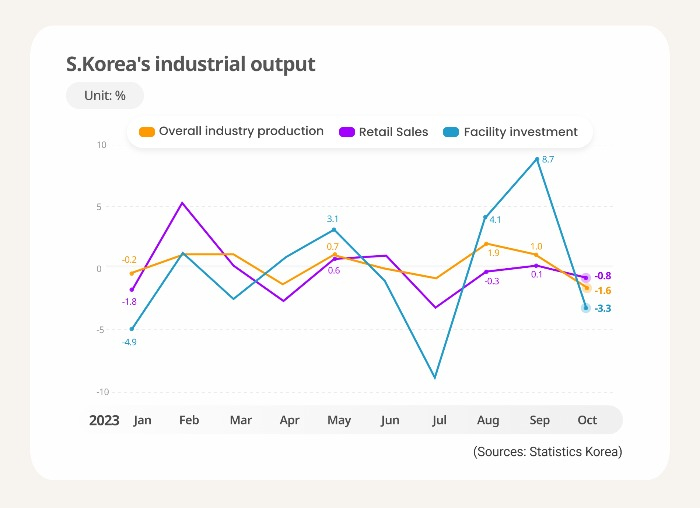

The factory activity slowdown led Korea’s overall industrial production to weaken 1.6% in October from a month earlier, its biggest decline since April 2020, according to the data. It posted on-month growth in August and September.

Retail sales, a gauge of private consumption, also shrank 0.8% over the same period, reversing course only one month after snapping a three-month losing streak in September.

The weakening consumption comes despite the government’s efforts to boost private spending by designating a substitute holiday earlier last month.

Kim noted that private consumption has shown signs of softening.

Sales of non-durable goods like food and groceries fell 3.1% on-month in October, while sales of semi-durables like clothing added 4.3% and durable goods like home appliances rose 1.0%.

Facility investment also slowed, declining 3.3% from a month ago, as spending on machinery, as well as automobiles and transport equipment all decreased.

This runs counter to the government’s expectation of further improvement in facility investment on a recovery in exports after a turnaround in September.

The cyclical component of the composite coincident index, which measures current economic activity, dropped 0.1 point from the previous month to 99.1 in October, indicating weakness.

The cyclical component of the composite leading indicator, which predicts the turning point in the business cycle, added 0.3 point to 99.7, suggesting potential improvement to come.

Write to Sang-Yong Park at yourpencil@hankyung.com

Sookyung Seo edited this article.

-

EconomyS.Korea’s semiconductor exports rebound in 1st 10 days of November

EconomyS.Korea’s semiconductor exports rebound in 1st 10 days of NovemberNov 13, 2023 (Gmt+09:00)

1 Min read -

EconomyKorea exports snap year-long slide as chips regain momentum

EconomyKorea exports snap year-long slide as chips regain momentumNov 01, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s Q3 GDP up 0.6% on-quarter on recovery in exports

EconomyS.Korea’s Q3 GDP up 0.6% on-quarter on recovery in exportsOct 26, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief says inflation may ease more slowly than expected

Central bankBOK chief says inflation may ease more slowly than expectedOct 19, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea’s July factory output slows at fastest pace since February

EconomyKorea’s July factory output slows at fastest pace since FebruaryAug 31, 2023 (Gmt+09:00)

3 Min read