Economy

Korea exports snap year-long slide as chips regain momentum

Semiconductor exports dip at the slowest pace of decline since August 2022; Samsung, SK Hynix shares rally

By Nov 01, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean exports rose in October for the first time in 13 months as semiconductors, the country’s top export item, are on course to regain momentum, raising hopes for a faster recovery in Asia’s fourth-largest economy.

Overseas sales grew 5.1% to $55.1 billion last month from a year earlier, marking the first year-on-year growth since September 2022, showed data from the Ministry of Trade, Industry and Energy on Wednesday. Imports lost 9.7% on-year to $53.5 billion, resulting in a trade surplus of $1.6 billion.

“Exports are expected to lead the economic growth from now on,” Minister of Trade, Industry and Energy Bang Moon Kyu said in a statement.

The country reported an export drop in September for the 12th straight month, adding to concerns that the economy may miss the central bank’s growth target of 1.4% for this year. The economy expanded 0.6% in the third quarter from the previous three months on a seasonally adjusted basis, according to the Bank of Korea’s advance estimates last month.

Concerns have eased as October exports rebounded amid signs that overseas sales of semiconductors are poised to recover in the near term.

HOPES FOR SEMICONDUCTOR EXPORT RECOVERY

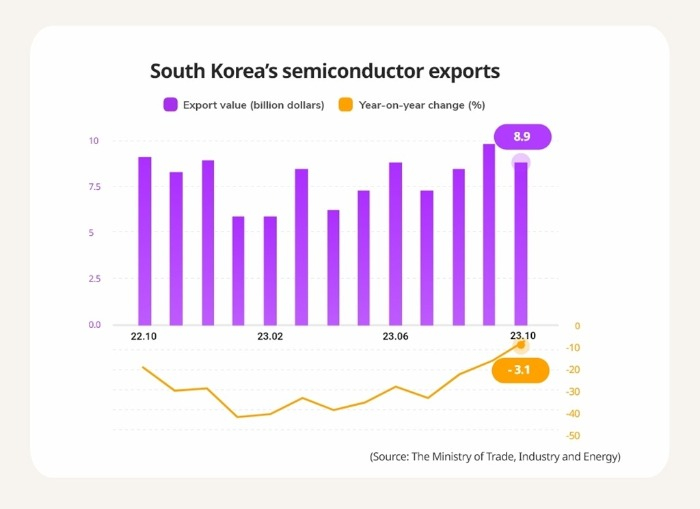

Semiconductor exports dipped 3.1% to $8.9 billion in October from a year earlier. The drop was the smallest since August 2022, the ministry said. South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

Global semiconductor market conditions are predicted to improve further on the impact of output cuts by major companies, new smartphones and growing demand for high-performance products used for artificial intelligence servers and other high-tech devices, the ministry said. Chip prices also rose last month, according to the ministry.

The data and bullish expectations powered the share prices of the two tech giants. Samsung ended up 2.5% at 68,600 won ($50.5) in the South Korean stock market, while SK Hynix jumped 3.4% to close at 120,300 won. The benchmark Kospi closed up 1%.

“We believe that Korean chip makers will benefit the most from recent strong demand for AI investment, and chip exports will likely rebound by the end of the year,” Min Joo Kang, ING senior economist for South Korea and Japan, said in a client note.

Exports of other products such as cars, refined fuel and ships contributed to the rebound in overall overseas sales.

Automobile exports rose 19.8% to $5.9 billion with overseas sales of electric vehicles up 36% on strong demand for sport utility vehicles and eco-friendly cars in North America and Europe. Exports of petroleum products grew 18% to $5.3 billion, logging their first growth since February, while those of vessels more than doubled to $2.8 billion.

ROBUST DEMAND FROM US

Exports to the US, the world’s top economy, soared 17.3% to $10.1 billion, the largest since July 2022, on strong sales of key products such as automobiles, machinery and wireless communication devices.

Sales to China, South Korea’s largest overseas market, fell 9.5% to $11 billion, marking the smallest drop since September of last year.

Shipments of some products such as PCs to the mainland improved on supply shortages and rising demand ahead of year-end but steel and display exports skidded, the ministry said.

Exports to Southeast Asia rose for the first time in 13 months with sales to the Association of Southeast Asian Nations up 14.3%, while sales to India, Asia’s third-largest economy, grew 9.2% to $1.5 billion.

Write to Han-Shin Park and Sul-Gi Lee at phs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyS.Korea’s Q3 GDP up 0.6% on-quarter on recovery in exports

EconomyS.Korea’s Q3 GDP up 0.6% on-quarter on recovery in exportsOct 26, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea’s exports set to snap 12-month losing streak in October

EconomyKorea’s exports set to snap 12-month losing streak in OctoberOct 23, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK chief says inflation may ease more slowly than expected

Central bankBOK chief says inflation may ease more slowly than expectedOct 19, 2023 (Gmt+09:00)

2 Min read -

EconomyKorean Sept export drop eases as chip sales hit 1-year high

EconomyKorean Sept export drop eases as chip sales hit 1-year highOct 02, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN