Economy

S.Korea’s chip exports rebound, ending 15-month losing streak

The country posted $3.8 billion in overall trade surplus, extending gains to a sixth straight month

By Dec 01, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean exports of semiconductors, the country’s top export item, rebounded in November, ending 15 months of declines and reinforcing expectations that a global chip industry upturn is in the offing.

The country’s overall exports to China and the US — its two largest export markets — also improved last month, indicating that Asia’s fourth-largest economy will likely fare better than expected next year.

Korea’s outbound chip shipments in November rose 12.9% from a year earlier to $9.5 billion, marking their first increase in 16 months, data from the Ministry of Trade, Industry and Energy showed on Friday.

In October, semiconductor exports fell 3.1% year on year to $8.9 billion. The drop was the smallest since August 2022.

"The performance indicates solid upward momentum for exports. The government will make an all-out effort to continue this momentum,” Minister Bang Moon-kyu said in a statement.

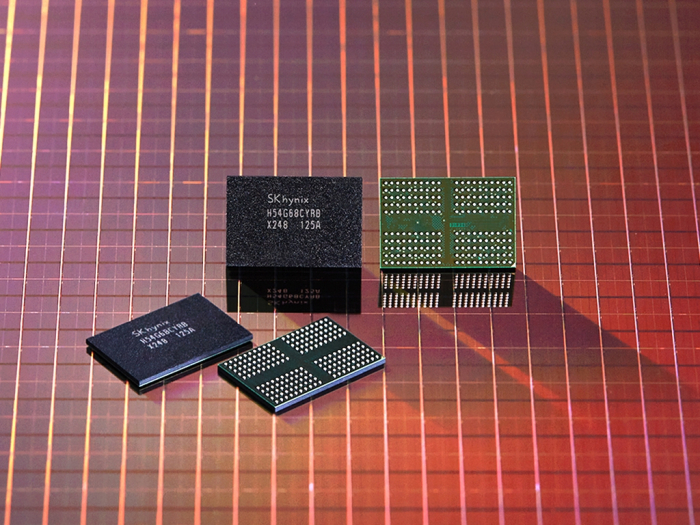

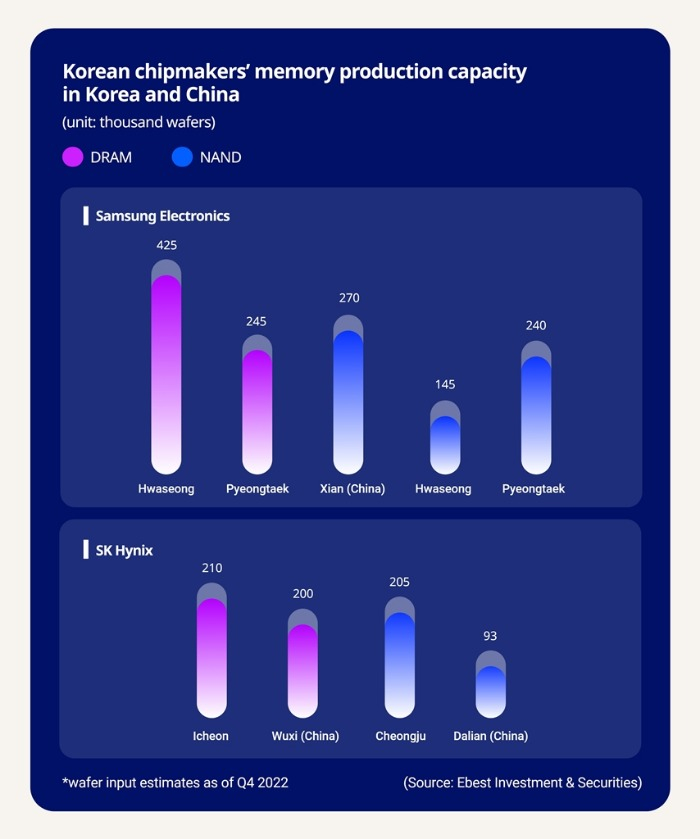

Korea is home to the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc.

The trade ministry said Korea’s chip exports bottomed in the first quarter and have steadily improved since then.

The November turnaround was helped by a rebound in memory chip contract prices in global markets in October, the ministry said.

The country’s chip exports will continue to post solid growth in the coming months, driven by strong demand from makers of smartphones and artificial intelligence (AI) servers, it said.

Of Korea’s total semiconductor exports, shipments of memory products such as DRAM and NAND chips reached $5.24 billion last month, up 36.4% from the year-earlier period.

SAMSUNG, SK HYNIX PIN HIGH HOPES ON AI CHIPS

Executives at Samsung and SK have expressed optimism for an imminent memory industry rebound, vowing to invest heavily in advanced chips such as high bandwidth memory (HBM), which is widely used to power generative AI devices that operate on high-performance computing systems.

The two Korean chipmakers, which have seen their semiconductor business losses snowball for most of this year, will likely post more than 20 trillion won ($15.4 billion) in combined operating profit for 2024, analysts said.

According to the World Semiconductor Trade Statistics (WSTS), the global memory market is forecast to rise to $129.8 billion next year, up 45% from $89.6 billion this year. That would mark the memory industry’s first growth in three years.

The overall semiconductor market, including memory chips, is expected to grow 13.1% year on year to $588.4 billion in 2024, the WSTS said.

TRADE SURPLUS FOR SIXTH MONTH

Buoyed by robust chip export growth, Korea’s overall November exports gained 7.8% from a year ago to $55.8 billion — this year’s monthly high. The growth rate represents the fastest since July 2022.

Overall imports fell 11.6% year on year to $52 billion, resulting in a $3.8 billion trade surplus and posting a surplus for the sixth straight month.

Ministry data showed Korea’s car exports climbed 21.5% on year to $6.53 billion last month. Ship exports spiked 38.5% to $1.55 billion while overseas sales of rechargeable batteries rose 23.4% to $900 million.

Of 15 major export items, however, three posted year-on-year declines.

Steel exports fell 11.1% to $2.65 billion and petrochemical products declined 4.4% to $4.6 billion. Computer shipments shed 29.4% to $610 million.

By destination, exports to China, Korea’s top trading partner, slid 0.2% to $11.4 billion in November, though the value marked the highest so far this year.

Shipments to the US, Korea’s second-largest export market, gained 24.7% to $10.9 billion.

Exports to the 10-country Association of Southeast Asian Nations (ASEAN) region reached $9.83 billion, up 8.7% from a year ago, while exports to the European Union increased 3.7% to $5.47 billion.

Write to Han-Shin Park at phs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returns

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returnsNov 30, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s semiconductor exports rebound in 1st 10 days of November

EconomyS.Korea’s semiconductor exports rebound in 1st 10 days of NovemberNov 13, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slow

Korean chipmakersSamsung to continue DRAM output cut until year-end; NAND recovery slowNov 09, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea exports snap year-long slide as chips regain momentum

EconomyKorea exports snap year-long slide as chips regain momentumNov 01, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN