Korean chipmakers

System on chips: Samsung’s new high-stakes foundry business

S.Korea's tech giant looks to logic chips as a buffer amid a protracted semiconductor industry slowdown

By Mar 09, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. is setting its sights on system on chips (SoCs) to continue to drive growth in its foundry business amid a protracted slowdown in the semiconductor industry.

In its business report released earlier this week, the South Korean tech giant forecasts the foundry market for high-performance automotive chips to grow at a brisk pace despite a broader industry downturn.

“The global foundry market will remain subdued in the first half. However, we expect a market recovery in the second half, propelled by the normalizing supply-demand situation and eased monetary tightening in major countries,” Samsung said in the report.

A system on a chip (SoC) is an integrated circuit that integrates several components such as the central processing unit (CPU), the graphics processing unit (GPU) and memory interfaces on a single substrate or microchip.

In electric vehicles and self-driving cars, high-performance SoCs work like the human brain to control their operating system. Notably, it is used in the advanced driver assistance system (ADAS), a key device in autonomous driving vehicles.

Samsung said it will strengthen its SoC research and development activities to advance related technology and increase sales.

WIDENING FOUNDRY CLIENT BASE

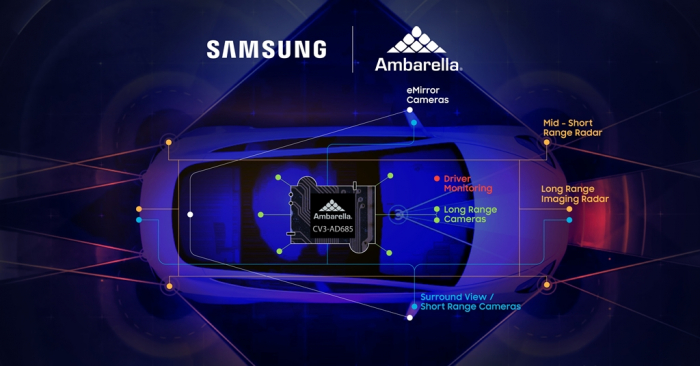

Last month, Samsung said it began applying its advanced 5-nanometer processing technology to manufacture automotive chips for US chip designer Ambarella Inc.

Under the deal, Samsung Foundry, the Korean chipmaker’s contract chipmaking unit, said it would produce the Santa Clara-based company’s automotive AI central domain controller, the CV3-AD685, which processes data for autonomous driving from Level 2 to Level 4.

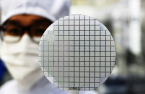

Samsung, the world’s second-largest foundry player after industry leader Taiwan Semiconductor Manufacturing Co. (TSMC), is striving to widen its foundry client base, from traditional fabless companies, including Qualcomm Technologies and Nvidia, to Big Tech such as Google and Microsoft, which want to make chips for their own devices.

Samsung said in December that its foundry business revenue exceeded that of its mainstay NAND flash chips – an indication that the company is gaining traction in its bid for a more significant role in the contract chip manufacturing segment.

Samsung’s System LSI Business division is in charge of producing SoCs, modems, power management integrated circuits (PMICs) and image sensors.

Samsung counts Audi, Volkswagen, BMW and Tesla among its automotive chip clients.

According to industry tracker IHS Markit, the global automotive chip market is forecast to grow to $108.2 billion by 2026 from $76 billion this year.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung eyes wider foundry client base with Ambarella deal

Korean chipmakersSamsung eyes wider foundry client base with Ambarella dealFeb 21, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Foundry: Driving force behind digital transformation

Korean chipmakersSamsung Foundry: Driving force behind digital transformationDec 01, 2022 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundry

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundryNov 29, 2022 (Gmt+09:00)

6 Min read -

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcing

Korean chipmakersSamsung mulls new foundry plant in Europe, to expand outsourcingOct 19, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN