Korean chipmakers

Samsung’s DRAM market share rises amid industrywide revenue drop

The Korean tech giant had the smallest fourth-quarter revenue decline among the top three DRAM players

By Mar 03, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, saw its DRAM market share rise in the fourth quarter of last year despite a significant revenue drop amid an industrywide slowdown.

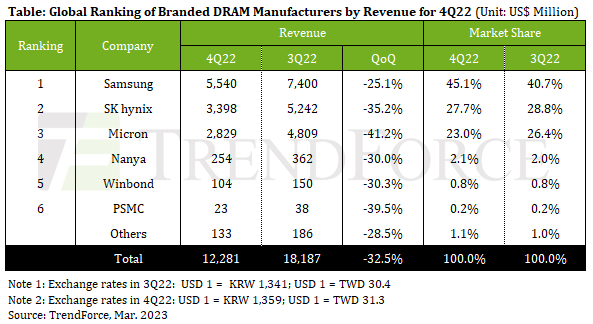

The South Korean tech giant posted DRAM sales revenue of $5.54 billion in the October-December quarter, down 25.1% from the previous quarter, according to market tracker TrendForce.

Its market share, however, increased to 45.1% from 40.7%.

“Samsung was the most aggressive in the price negotiations during the quarter, so it was able to raise shipments despite the general demand slump,” the Taiwan-based research firm said in a statement.

Even with the result, Samsung had the smallest revenue fall among the top three DRAM players, it said.

SK Hynix Inc., the second-largest DRAM manufacturer, posted a 35.2% decline in quarterly revenue to $3.4 billion with its market share also dropping to 27.7% from 28.8%.

Micron Technology Inc., the No. 3 DRAM player, saw its sales fall 41.2% on-quarter to $2.83 billion while its market share shrank to 23% from 26.4%.

TOP THREE POISED TO CUT OUTPUT

Overall, global DRAM revenue fell 32.5% quarter on quarter to $12.28 billion in the three months to December. The percentage is close to the 36% on-quarter decline seen in the final quarter of 2008, when the global economy was in the midst of a financial crisis, according to TrendForce.

The sharp decline in sales was due to DRAM’s weak average selling price and a freeze in buyer demand, which led to a significant inventory buildup for DRAM vendors in the third quarter, it said.

Regarding the top three suppliers’ plans for developing production capacity in 2023, Samsung is expected to optimize the legacy production lines of Line 15, which accordingly will experience a marginal drop in DRAM wafer input, TrendForce said.

SK Hynix, which earlier said it would cut production, will likely see its DRAM capacity utilization rate slide from 92% in the first quarter of this year to 82% by the second quarter, it said.

As for Micron, it is simultaneously scaling back production at its operation in Taiwan and the Hiroshima plant, it said.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairman

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairmanFeb 15, 2023 (Gmt+09:00)

2 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read -

EarningsSamsung vows no chip output cut, eyes second-half demand recovery

EarningsSamsung vows no chip output cut, eyes second-half demand recoveryJan 31, 2023 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms large

Korean chipmakersSamsung considers chip output cut as first-quarter loss looms largeJan 27, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by half

EarningsSamsung’s Q4 profit tumbles; cuts 2023 chip profit forecast by halfJan 06, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN