Foundry player DB HiTek: An ugly duckling becomes a golden swan

The chipmaker is expected to post stronger earnings and revenue this year, driven by analog chips

By Apr 04, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

DB HiTek Co., one of South Korea’s leading foundry chipmakers, was once an ugly duckling in the industry, reeling under heavy debt and snowballing losses.

Founded in 1997 as a memory chipmaker under the corporate name of Dongbu Electronics, the company’s cumulative losses reached 3 trillion won ($2.5 billion) with 2.3 trillion won in debt at one point. In 2001, it transformed into a foundry player, making semiconductors for fabless firms, including chip designers.

Amid an industry boom, the company swung to a profit in 2015, and last year its turnaround was proven, joining the “one trillion won revenue club” for the first time.

DB HiTek posted 1.21 trillion won in annual sales in 2021. From three years earlier, sales increased 81%.

Operating profit surged to 399.1 billion won, rising nearly fourfold over the same period. Net profit soared to 316.9 billion won, also four times that of 2018.

NICHE MARKET

“We have focused on analog chips, often called the niche market. Our product portfolio diversification into semiconductors for smartphones, automobiles and image sensors for CCTVs has also worked,” said a company official.

Just like its bigger rivals – Korea’s Samsung Electronics Co. and Taiwan’s TSMC, the world’s largest foundry player – DB HiTek has been running its plants at full capacity since early last year to meet growing demand amid depleting supplies.

With an exacerbating supply crunch, electronics firms and automakers, in particular, were desperate to procure system chips used in graphic processing, data communication, signal conversion and computation.

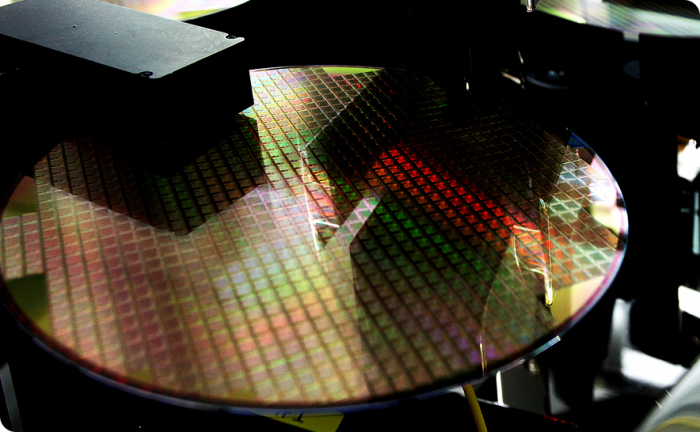

While big companies, including Samsung and TSMC, focused on 300-millimeter wafters to make chips for technologically advanced, high-end products, DB HiTek concentrated on 200 mm wafers, widely used to produce image sensors, power management integrated circuits (PMICs) and display driver integrated circuits (DDIs) – chips in growing demand with the rise of the gaming industry and the shift to a more work-from-home business environment.

ANALOG CHIPS SET TO BOOST SALES

Analysts expect analog chips to continue to boost DB HiTek’s sales in the coming years as high-end electronic devices used in Internet of Things, artificial intelligence, virtual reality, self-driving cars and big data centers all require such chips to switch analog signals into digital ones.

Amid persistent chip shortages, major foundries, including TSMC, Lam Research Corp. and DB HiTek, are also expected to raise their product prices by 10-20% by year-end.

According to the latest market consensus, DB HiTek is forecast to post 493 billion won in net profit on revenue of 1.55 trillion won this year, up 56% and 27%, respectively, from last year.

Shares of DB HiTek, listed on the main bourse, finished Monday 0.7% lower at 72,900 won.

Write to Shin-Young Park at nyusos@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung flexes foundry muscle amid supply chain woes

Korean chipmakersSamsung flexes foundry muscle amid supply chain woesDec 15, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung overtakes Intel as foundry looms as next battlefield

Korean chipmakersSamsung overtakes Intel as foundry looms as next battlefieldAug 02, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersDB HiTek in quandary over foundry ramp-up amid chip supercycle

Korean chipmakersDB HiTek in quandary over foundry ramp-up amid chip supercycleJun 23, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firms

Korean chipmakersSamsung loses ground in foundry market as TSMC ties in with Japanese firmsJun 01, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, TSMC up ante in US foundry competition

Korean chipmakersSamsung, TSMC up ante in US foundry competitionMay 24, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersKorean foundry firm DB HiTek sets new Q1 sales record

Korean chipmakersKorean foundry firm DB HiTek sets new Q1 sales recordMay 17, 2021 (Gmt+09:00)

3 Min read