Foundry expansion

DB HiTek in quandary over foundry ramp-up amid chip supercycle

If it decides to build a new plant, it would be completed in 2024, when the market is forecast to stabilize

By Jun 23, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

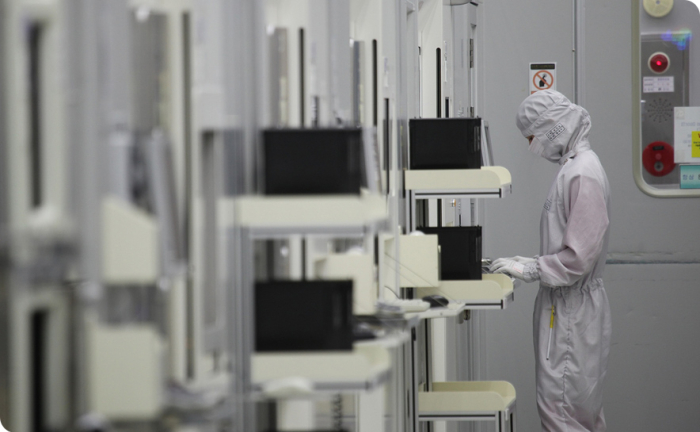

DB HiTek Co., one of South Korea’s leading foundry chipmakers, is enjoying the current market boom, which is forcing makers of cars and electronic devices to compete for chips amid depleting supplies.

Just like its bigger rivals Samsung Electronics Co. and SK Hynix Inc., DB HiTek is running its plants at full capacity. Still, the company barely meets soaring demand.

Its clients are publicly asking DB HiTek to expand its facilities in Eumseong county, North Chungcheong Province, and increase supplies. However, the company is hesitant to begin building another plant because it is unsure if it can finish construction before the current boom is over.

“We are in talks over whether to ramp up our facilities or lease the land to other companies for other purposes,” said a DB HiTek official.

The company is currently laying the groundwork for the development of an industrial complex near its Eumseong plant – an area large enough to accommodate seven more foundry production lines.

Industry officials said it won’t be easy for DB HiTek to aggressively expand its foundry facilities as it usually takes a few years to build a new chipmaking plant.

MARKET TO STABILIZE WHEN RAMP-UP IS COMPLETED

Even if it decides to build one now, the construction would be completed in 2024, when the chip supply and demand situation could stabilize given the competitive ramp-up of facilities by chipmakers around the world.

Once the market stabilizes, foundry players will need to find new customers that prefer steady supplies through long-term contracts.

High construction costs are also keeping the company from jumping to a conclusion.

It costs at least 2 trillion won ($1.76 billion) to build a foundry plant. DB HiTek had 120.7 billion won in cash and cash equivalents at the end of the first quarter and it may have to resort to heavy loans to build a factory, according to industry officials.

Foundries, which make semiconductors for fabless firms, including chip designers, have boosted their operation rates close to 100% in recent months, but are still falling short of meeting rising demand amid higher prices, sounding alarm bells for their clients.

According to the DigiTimes, a Taiwanese chip industry newspaper, the prices of automotive chips, among the most sought-after chips these days, are 15% higher than those of chips for home appliances and electronic gadgets.

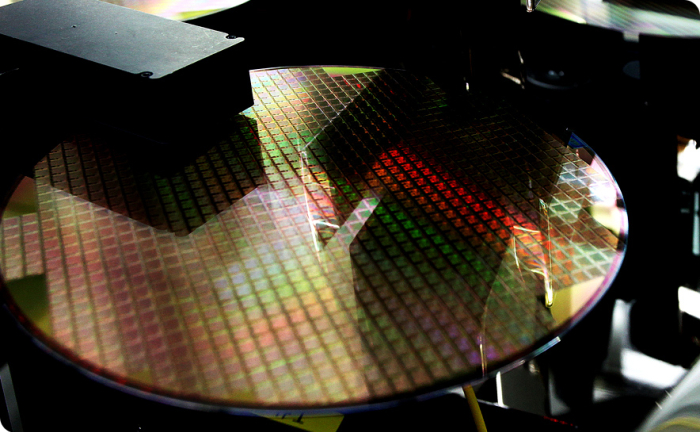

DB HiTek’s first-quarter business report showed the price of chips with a 0.13-micrometer process stood at $5,511, about 2.6 times higher than at the end of 2020.

Automotive chips are usually made with a 0.13-micron process and 0.18-micron technology.

In the first quarter, DB HiTek manufactured 377,244 units of the 8-inch wafer, up 58% from the year-earlier period.

RECORD SALES

The company is expected to produce over a record 150,000 wafers this year.

Last month, DB HiTek reported the highest quarterly revenue since its establishment in 1997.

It posted 60.6 billion won in operating profit on revenue of 243.7 billion won in the first quarter.

For the full year, DB HiTek is forecast to post an operating profit of 278.8 billion won on sales of 1.06 trillion won, up 31% and 13% from the previous year, respectively, according to the market consensus.

“The company will join the 1 trillion won club (in revenue terms) this year on the back of strong foundry chip prices,” said a local brokerage analyst.

Write to Su-Bin Lee at lsb@hankyung.com

In-Soo Nam edited this article.

More to Read

-

[Exclusive] DealsSK Hynix push for takeover of Key Foundry to boost foundry production

[Exclusive] DealsSK Hynix push for takeover of Key Foundry to boost foundry productionMay 17, 2021 (Gmt+09:00)

2 Min read -

Foundry businessKorean foundry firm DB HiTek sets new Q1 sales record

Foundry businessKorean foundry firm DB HiTek sets new Q1 sales recordMay 17, 2021 (Gmt+09:00)

3 Min read -

Foundry boomSamsung, other foundry players at full capacity as chip orders surge

Foundry boomSamsung, other foundry players at full capacity as chip orders surgeJan 06, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN