Foundry boom

Samsung, other foundry players at full capacity as chip orders surge

By Jan 06, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

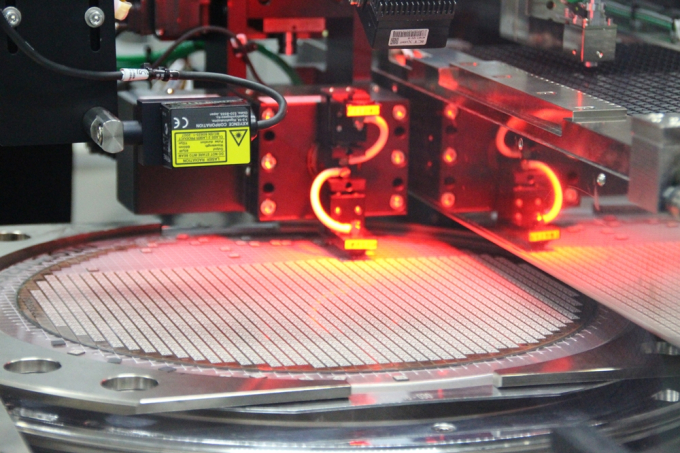

Samsung Electronics Co. and other global foundry players are running their plants at full capacity as makers of cars and electronic devices compete for chips amid depleting supplies.

Foundries, which make semiconductors for fabless firms, including chip designers, boosted their operation rates close to 100% in recent months, but still fell short of meeting rising demand, sounding alarm bells for their clients.

“Orders from fabless firms in Korea and abroad are flooding in. Our facilities are running at full capacity for the next six months at least,” said an official at Korean foundry company DB HiTek Co.

The foundry boom, which analysts and industry officials expect to persist throughout the year, was caused by surging chip orders as consumer demand for TVs, smartphones, laptops and cars has bounced back from the COVID-19 crisis sooner than expected.

With an exacerbating supply crunch, electronics firms and automakers are racing to procure system chips used in graphic processing, data communication, signal conversion and computation.

Demand for such chips has picked up alongside the growing popularity of 5G phones, smart cars running on system semiconductors and artificial intelligence-applied gadgets.

LONG QUEUES

Corporate customers that place orders for application processors (APs), graphic processing units (GPUs) and chips for vehicles with leading foundries such as Taiwan’s TSMC and Samsung Electronics have to wait for more than a year.

“Our production schedule is fully booked until the end of this year,” said a Samsung official.

He said the company is particularly having difficulties with deficient production lines that use 8-nanometer and sub-7-nm extreme ultraviolet (EUV) lithography technology.

The situation is similar with second-tier foundry players.

Smaller foundries mainly produce chips with 8-inch wafers, focusing on low-tech analog semiconductors that convert natural signals such as light and sound into digital ones and power semiconductors that control power. Those chips are used in TVs and other home appliances, which are in greater demand amid the pandemic lockdown.

DISRUPTIONS AT CARMAKERS, ELECTRONICS FIRMS

Global chip shortages are already disrupting production at some automakers and electronics companies.

Audi AG and the Volkswagen Group are known to be cutting production at their plants in China and other countries in the first quarter of this year due to a lack of semiconductors for vehicles.

In Japan, home appliance manufacturers have reportedly put the launch of new products on hold for about 10 weeks due to a shortage of Bluetooth chips.

“Demand for system chips keeps growing with the advancement of 5G-related technologies. The foundry boom may last for more than a year,” said a foundry firm executive.

Analysts say the current tight supply situation has several causes, but more fundamentally it stems from a lack of equipment that can manufacture sophisticated chip products with fine processing technology.

Production of APs, GPUs and automotive chips require ultra-micro fabrication processes using below 7-nm lithography.

The Netherlands-based ASML, the world’s only maker of EUV lithography machines, can produce only about 40 units a year, pitting global foundry players such as TSMC and Samsung against each other to procure EUV scanners.

In October last year, Samsung Vice Chairman Jay Y. Lee visited ASML to discuss the purchase of such machines.

Second-tier foundries that produce display driver ICs (DDICs), power management ICs (PMICs) and sensors using 8-inch wafers with 30-nm technology are also under strain. They are unable to expand production lines as equipment makers have stopped making outdated 8-inch machines.

SHORTAGES TRIGGER PRICE HIKES

Amid severe shortages, suppliers are raising chip prices.

TSMC recently eliminated a 3% discount policy for large corporate customers. Taiwan's United Microelectronics Corp. (UMC) and Vanguard International Semiconductor Corp. (VIS) have also raised their service prices by more than 10%.

These price hikes have caused a chain reaction, prompting fabless firms and other back-end processing companies to also raise the prices of their products.

NXP Semiconductors N.V., a Dutch automotive chipmaker, plans to notify major automakers of price hikes, while ASE, a Taiwanese packaging company, raised prices by 20% in the fourth quarter of 2020 and is considering a further increase in the first quarter.

"With Taiwanese companies raising prices, Korean companies are also gauging the right time to follow suit,” said a Korean packaging firm official.

Write to Jeong-Soo Hwang and Su-Bin Lee at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SemiconductorsSamsung overtakes TSMC as top chipmaker by market cap

SemiconductorsSamsung overtakes TSMC as top chipmaker by market capDec 27, 2020 (Gmt+09:00)

4 Min read -

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chips

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chipsDec 17, 2020 (Gmt+09:00)

3 Min read -

Foundry expansionSamsung Electronics buys land in Austin, eyes foundry expansion

Foundry expansionSamsung Electronics buys land in Austin, eyes foundry expansionDec 09, 2020 (Gmt+09:00)

2 Min read -

Executive reshufflesSamsung promotes young executives to lead memory, foundry businesses

Executive reshufflesSamsung promotes young executives to lead memory, foundry businessesDec 02, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN