SK Hynix beats Samsung to become global No.1 DRAM maker

The runner-up’s victory was driven by its unrivaled lead in the global HBM market

By Apr 09, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Hynix Inc. has snatched the crown from Samsung Electronics Co. to become the world’s largest memory chip supplier for the first time since its inception, thanks to its unrivaled leadership in the high-bandwidth memory (HBM) chip market.

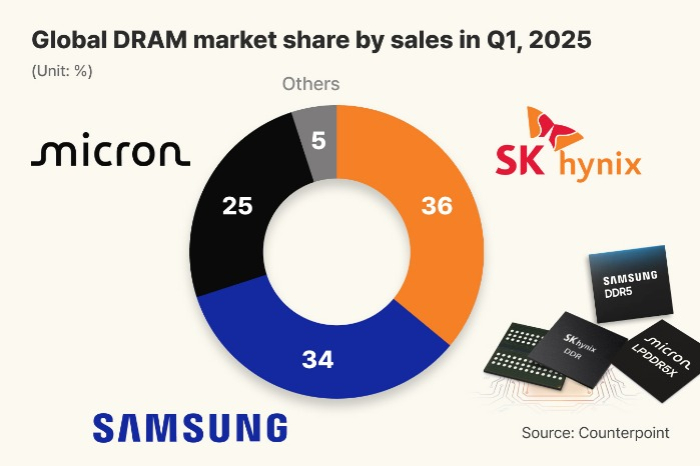

According to Counterpoint Technology Market Research on Wednesday, SK Hynix commanded the largest share of 36% in the global dynamic random-access memory (DRAM) chip market in the first quarter ending March 2025.

This is the first time SK Hynix has led the global memory market since its foundation in 1983.

All-time memory winner Samsung Electronics, which had conquered the market for more than three decades, was elbowed out to No. 2 with a 34% share, followed by Micron Technology Inc. with 25%.

The runner-up’s revolt was mainly driven by strong demand for HBM chips amid the unwavering artificial intelligence boom.

HBM chip is essential in running an AI accelerator, a key device required to train AI, alongside the graphics processing unit (GPU) and the central processing unit (CPU).

DOMINANT HBM MARKET LEADER

SK Hynix took over 70% of global HBM sales in the January-March quarter after exclusively delivering 12-layer HBM3E chips, the most up-to-date HBM, to the world’s most valuable AI firm Nvidia Corp.’s AI accelerators.

The South Korean chip giant’s victory comes after its undeterred investment in HBM development over the past 10 years.

When it developed HBM chips for the first time in the world in 2013, demand for the high-performance chips was low.

But the chipmaker has continued pouring in funds to advance its HBM technology, so when the AI boom arrived, it could easily dominate the HBM market with its forefront position.

“SK Hynix was well prepared to deal with an explosion in HBM demand,” said Choi Jeong-ku, an analyst at Counterpoint.

Its lead also came on the heels of waning demand for legacy memory chips and their falling prices due to Chinese players’ rapid ascent with cheaper alternatives.

The slowdown in the legacy memory chip market dealt a direct blow to Samsung Electronics, with about 80-90% of its chip sales relying on legacy chips.

But SK Hynix, with greater exposure to the HBM market, remained largely unscathed, analysts said.

ROSY OUTLOOK

SK Hynix is expected to maintain its lead in the overall DRAM market on solid HBM demand, while the legacy memory chip market is expected to take a big hit from US tariffs and China’s rapid rise in the market.

Chip market tracker TrendForce forecasts that the global HBM market will grow to $58 billion in 2026 from $38 billion this year.

Counterpoint also projected that the global HBM market will suffer less from the so-called tariff shock thanks to the strong AI demand.

SK Hynix delivered samples of the latest generation HBM, the 12-layer HBM4, to its key customers for the first time.

Backed by the strong HBM sales, SK Hynix is forecast to reap 31.59 trillion won ($21.4 billion) in operating profit this year, up 30% from the prior year.

Its crosstown rival, Samsung Electronics, is expected to report an operating profit of about 31 trillion won this year, combining all three key divisions – semiconductors, home appliances and smartphones.

Its chip division’s profit is estimated at about 15 trillion won after failing to supply its HBM chips to major players such as Nvidia due to a quality issue in the chips.

This is a big defeat for Samsung, which had kept its lead in the global memory chip market every year since 1992, when it developed 64 megabit (Mb) DRAM chips for the first time in the world.

The dethroned memory giant plans to regain the ground by supplying the latest HBM chip to its customers.

Samsung Electronics Vice Chairman and Co-CEO Jun Young-hyun, who oversees Samsung’s semiconductor business, last month unveiled a plan to ramp up the output of 12-layer HBM3E in the second quarter or the latter half at the latest to meet customer demand.

The company is also on course to supply next-generation HBM chips such as HBM4 and customized HBM4 chips as scheduled, he added.

SK Hynix, however, has further widened the gap with Samsung.

It already sold out its planned HBM output for this year and aims to lock in orders for its entire 2026 HBM output by the end of June, its chief executive said in late March.

Write to Eui-Myung Park at uimyung@hankyung.com

Sookyung Seo edited this article.

-

EarningsSamsung’s Q1 profit beats expectations; Q2 outlook murky on tariff war

EarningsSamsung’s Q1 profit beats expectations; Q2 outlook murky on tariff warApr 08, 2025 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix aims to lock in all 2026 HBM orders by mid-2025

Korean chipmakersSK Hynix aims to lock in all 2026 HBM orders by mid-2025Mar 27, 2025 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix ships world’s first 12-layer HBM4 samples early

Korean chipmakersSK Hynix ships world’s first 12-layer HBM4 samples earlyMar 19, 2025 (Gmt+09:00)

3 Min read -

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earnings

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earningsJan 31, 2025 (Gmt+09:00)

4 Min read -

EarningsSK Hynix surpasses Samsung with record-high profit in Q4

EarningsSK Hynix surpasses Samsung with record-high profit in Q4Jan 23, 2025 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix sharply narrows gap with Samsung’s market cap

Korean chipmakersSK Hynix sharply narrows gap with Samsung’s market capJan 22, 2025 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025Dec 03, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 months

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 monthsNov 04, 2024 (Gmt+09:00)

2 Min read