Samsung’s Q1 profit beats expectations; Q2 outlook murky on tariff war

Strong Galaxy S25 smartphones boosted its Q1 profit, while sales were just shy of an all-time quarterly high

By Apr 08, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, posted stronger-than-expected first-quarter operating profit on Tuesday, boosted by robust sales of its flagship Galaxy S25 smartphones and resilient memory chip shipments.

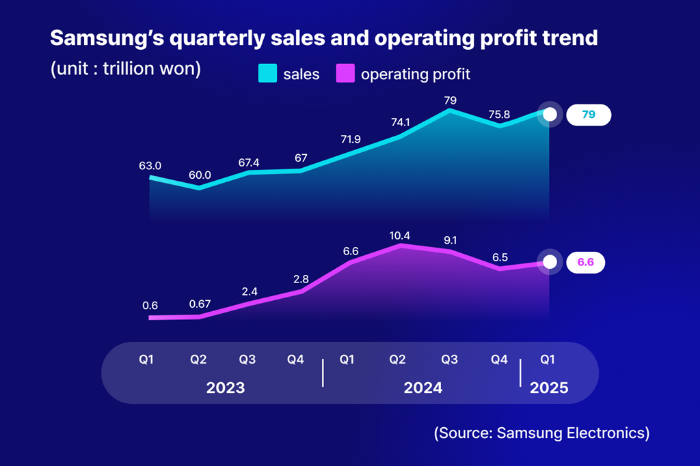

The Suwon, South Korea-based tech giant said in a regulatory filing that its operating profit in the January-March period is estimated at 6.6 trillion won ($4.5 billion) on a consolidated basis, narrowly down 0.15% from the year-earlier period. The estimate, however, beat market expectations of 4.94 trillion won.

Samsung estimated its first-quarter revenue at 79 trillion won, up 9.84% from a year earlier. If confirmed later this month, the figure would mark a first-quarter record for the company and come in just shy of its all-time high of 79.1 trillion won in the third quarter of 2024.

The company plans to announce detailed quarterly results, including net profit and divisional performance, later this month.

A BREAK FROM TWO QUARTERS OF EARNINGS FALLS

The stronger showing marks a break from two consecutive quarters of earnings contraction. In the fourth quarter of 2024, Samsung posted an operating profit of 6.49 trillion won, down sharply from its peak of 10.44 trillion won in the second quarter of that year.

The better-than-expected performance was driven in large part by the Galaxy S25 series, launched in February, which has emerged as a strong commercial hit.

The device reached 1 million domestic unit sales in just 21 days – the fastest in the Galaxy line’s history.

Analysts estimate the company’s Mobile eXperience (MX) division, responsible for smartphones, contributed around 4 trillion won to the first quarter’s operating profit.

Meanwhile, Samsung’s Device Solutions (DS) unit, which oversees its semiconductor operations, is estimated to have earned close to 1 trillion won.

The DS division performance masked a nuanced picture; while memory chips likely generated around 3 trillion won in profit, the System LSI unit and the foundry, or contract chipmaking, business likely incurred combined losses of some 2 trillion won, analysts said.

CHIP BUSINESS LIKELY BOTTOMED OUT IN Q1

Analysts said Samsung’s chip inventory likely has eased, aided by unexpectedly strong downstream demand.

In China, mobile phone makers’ handset sales increased 15% on-year in the first quarter, partly spurred by Beijing’s “trade-in” subsidies aimed at replacing older electronics.

On the supply side, preemptive shipping activities ahead of tougher US tariffs under the second Trump administration also helped buoy DRAM shipments.

Memory prices, meanwhile, are trending upwards as suppliers begin raising quotes amid tightening inventories. That has raised expectations that Samsung’s chip business likely bottomed out in the first quarter, with recovery set to gather pace later in the year.

UNCERTAIN Q2 OUTLOOK, HMB CHIP

Still, analysts remain cautious about the near-term outlook.

The positive impact of the launch of the Galaxy S25 is expected to fade into the second quarter, a traditionally slow season, while tariff war concerns add to economic uncertainty, analysts said.

“While we expect weaker display earnings due to seasonal factors and intensified competition, the rebound in memory shipments and rising DRAM prices, especially DDR5, should offer downside protection,” said SK Securities Co. analyst Han Dong-hee.

Expectations for high-margin products such as high-bandwidth memory (HBM) remain tempered.

Analysts expect Samsung’s HBM sales to remain subdued in the second quarter due to a lack of large customers, with competition from rival chipmakers intensifying in the AI-driven memory segment.

Even if Samsung obtains the HBM3E certification from Nvidia, competitors have already locked in major customers, including Nvidia, analysts said.

“The rebound in general-purpose memory prices could be shallower and shorter than the market hopes, given uncertainty in China,” said Hyundai Motor Securities Co. analyst Noh Geun-chang.

According to the recent market consensus, Samsung is forecast to post an operating profit of 6.14 trillion won in the second quarter, down 41% from a year earlier, while sales are likely to fall 2.2% on-year to 75.7 trillion won.

Write to In-Soo Nam at isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

Korean stock marketSouth Korean stocks, currency dive amid deeper US tariff turmoil

Korean stock marketSouth Korean stocks, currency dive amid deeper US tariff turmoilApr 07, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffs

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffsApr 03, 2025 (Gmt+09:00)

5 Min read -

Business & PoliticsSamsung's Lee meets with Xi amid Beijing’s balancing act vs Washington

Business & PoliticsSamsung's Lee meets with Xi amid Beijing’s balancing act vs WashingtonMar 28, 2025 (Gmt+09:00)

2 Min read -

ObituarySamsung Electronics' TV guru Han Jong-hee dies of cardiac arrest at 63

ObituarySamsung Electronics' TV guru Han Jong-hee dies of cardiac arrest at 63Mar 25, 2025 (Gmt+09:00)

3 Min read -

Leadership & ManagementSamsung Chairman Lee meets with Xiaomi CEO Lei Jun for partnership

Leadership & ManagementSamsung Chairman Lee meets with Xiaomi CEO Lei Jun for partnershipMar 24, 2025 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaul

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaulMar 06, 2025 (Gmt+09:00)

5 Min read -

Korean chipmakersSK Hynix’s HBM exports plummet, now susceptible to seasonal demand

Korean chipmakersSK Hynix’s HBM exports plummet, now susceptible to seasonal demandFeb 10, 2025 (Gmt+09:00)

3 Min read -

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earnings

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earningsJan 31, 2025 (Gmt+09:00)

4 Min read