Earnings

Samsung to focus on HBM, other high-end chips after weak Q4 earnings

The tech giant expects overall memory market demand to recover in the second quarter

By Jan 31, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

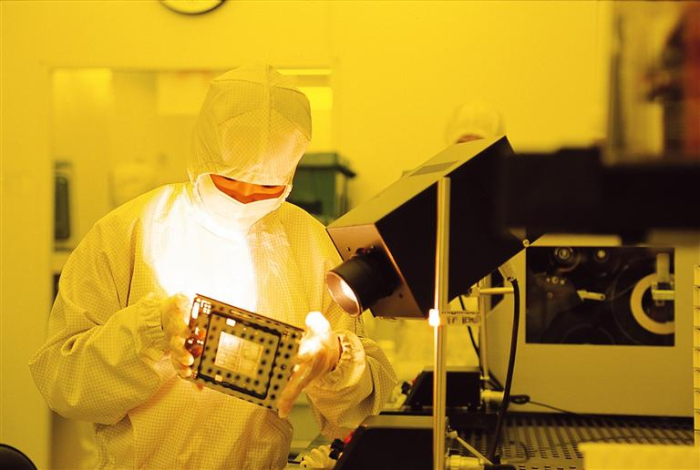

Samsung Electronics Co., the world’s largest memory chipmaker, on Friday vowed to cut its production of legacy chips and increase sales of premium products, including high-bandwidth memory (HBM), this year after posting weaker-than-expected earnings for the fourth quarter of 2024.

Analysts said Samsung could see its semiconductor business fall into negative territory, posting huge losses as early as the first quarter, due to the steady DRAM price declines, HBM chip supply delays, a slowdown in demand for enterprise solid state drives (eSSDs) and increased losses in its foundry business, as well as growing regulatory risks related to US President Doland Trump's protectionist policies.

“In the first quarter of 2025, our memory business will shift its business portfolio to more high-value-added products by accelerating the migration to cutting-edge nodes in response to demand for high-performance and high-density products,” the South Korean tech giant said in a statement.

For DRAM, Samsung said it will increase the share of DDR5 and LPDDR5X shipments by accelerating the transition to the 1b nanometer process. As for NAND, it is in the middle of technology migration from V6 to V8 while increasing sales of V7 QLC-based server SSDs.

Samsung said it expects overall memory market demand to recover in the second quarter.

While reducing the portion of legacy DRAM and NAND chips, Samsung vowed to strengthen its business competitiveness by increasing the portion of high-value-added products such as HBM, DDR5, LPDDR5X, GDDR7 and server SSDs based on advanced process nodes.

FOUNDRY OUTLOOK

In the first quarter of this year, Samsung’s foundry, or contract chipmaking, business is expected to post weak earnings due to sluggish mobile demand and its fixed-cost burden stemming from lower factory utilization rates.

The company said its foundry business will concentrate on advancing leading-edge process development and enhancing process maturity to expand opportunities in AI and high-performance computing (HPC) applications.

For the entire year, Samsung said its foundry business will continue to secure orders from major customers by ramping up and stabilizing its 2 nm GAA technology while bolstering its 4 nm technology and design infrastructure to meet the growing need for such technology in the mobile and HPC segments.

SMARTPHONE BUSINESS

While overall earnings improvement may be limited due to weakness in the semiconductor business, Samsung aims to pursue growth through increased sales of advanced AI-powered smartphones this year.

Samsung said its Mobile eXperience (MX) business under the Device eXperience (DX) division, which oversees mobile phones and home appliances, plans to increase sales of flagship models, particularly the newly launched Galaxy S25 series, to lead the AI smartphone market.

In 2025, it said the MX business will reinforce its mobile AI leadership by providing more personalized, differentiated AI experiences while strengthening its foldable lineup to generate new customer demand.

While prices of major components are expected to increase this year due to advancements in hardware specifications, the MX business aims to improve profitability by continuing to build out Galaxy AI and expand sales centered on flagship products, it said.

Q4 2024 EARNINGS

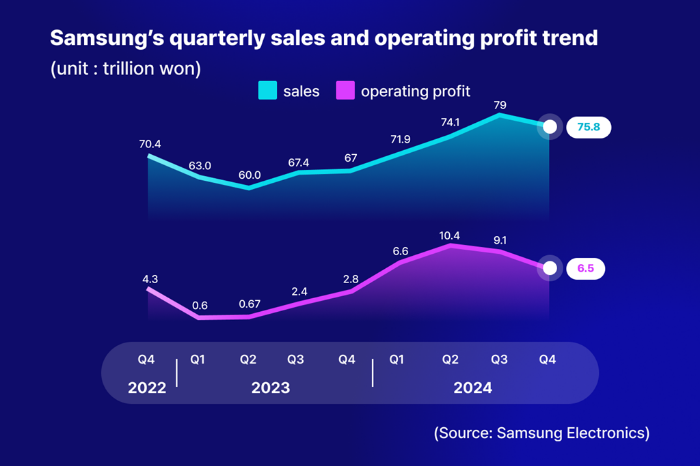

On Friday, Samsung said its net profit in the fourth quarter of 2024 totaled 7.75 trillion won ($5.4 billion), up 22% from 6.34 trillion won in the year-earlier period.

Fourth-quarter operating profit more than doubled to 6.5 trillion won, while sales gained 12% on-year to 75.8 trillion won on a consolidated basis.

Compared to the previous quarter, however, Samsung’s operating profit fell 29.3% in the October-December quarter, while sales declined 4.2%.

For the entire 2024, its net profit surged 122.5% to 34.45 trillion won, while operating profit rose nearly fivefold to 32.72 trillion won from 6.57 trillion won.

Annual revenue rose 16.2% to 300.87 trillion won, marking its second-highest yearly figure after an all-time high in 2022.

Samsung spent 10.3 trillion won on research and development in the fourth quarter and a record 35 trillion won on R&D projects throughout 2024.

Earlier this month, the company posted preliminary fourth-quarter results. It expected 6.5 trillion won in operating profit on sales of 75 trillion won.

MEMORY PERFORMANCE

On Friday, Samsung said its DS division, which oversees its semiconductor business, posted 2.9 trillion in operating profit on sales of 30.1 trillion won in the fourth quarter of 2024.

It said its memory business achieved record-high fourth-quarter revenue, backed by a higher blended DRAM average selling price due to the increased sales of HBM and high-density DDR5 for servers.

Memory operating profit, however, decreased slightly compared to the previous quarter as a result of increased R&D expenses to secure future technology leadership, as well as the initial ramp-up costs to secure production capacity for cutting-edge nodes, it said.

Samsung’s MX and networks businesses posted 2.1 trillion won in operating profit on consolidated sales of 5.8 trillion won for the fourth quarter.

(Updated with analysts' views on Samsung’s first-quarter performance)

Write to In-Soo Nam at isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.

More to Read

-

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'Jan 23, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG consider moving electronics plants to US from Mexico

Business & PoliticsSamsung, LG consider moving electronics plants to US from MexicoJan 21, 2025 (Gmt+09:00)

4 Min read -

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow Robotics

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow RoboticsDec 31, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung foundry ‘relief pitcher’ Han Jin-man vows to improve 2-nm yields

Korean chipmakersSamsung foundry ‘relief pitcher’ Han Jin-man vows to improve 2-nm yieldsDec 09, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip development

Korean chipmakersSamsung Electronics, TSMC tie up for HBM4 AI chip developmentSep 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN