Samsung to unveil QLC-based NAND in H2 to lead AI storage market

Already the dominant NAND player, Samsung’s new product targets large-scale enterprise servers and AI devices

By May 22, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co., the world’s largest memory chipmaker, plans to unveil a new high-capacity NAND memory chip in the second half to lead the fast-growing storage device market amid the artificial intelligence boom.

The South Korean chipmaker, which began mass production of 1 terabit (Tb) triple-level cell (TLC) ninth-generation V-NAND last month – the industry’s first to do so – expects demand for high-capacity data storage systems for AI devices to exponentially grow in the coming years.

The 290-layer V9 NAND is a cutting-edge product that succeeds Samsung’s 236-layer V8 flash products, targeting large-scale enterprise servers and AI and cloud devices.

“Given the high electricity costs for AI data centers, high-capacity memory is essential to storage servers,” Hyun Jae-woong, vice president of Samsung’s product planning team, said during an in-house interview published on Tuesday.

Samsung said it will unveil quad-level cell (QLC)-based NAND flash products in the second half.

QLC-based NAND will meet the growing demand for ultra-high-capacity solid state drives (SSDs) used in AI data centers, it said.

Industry officials said QLC NAND can store more data per cell than multi-level cell (MLC) and triple-level cell (TLC) devices, significantly enhancing storage performance.

TO WIDEN NAND PORTFOLIO TO ON-DEVICE AI, EDGE DEVICES

Hyun said Samsung plans to focus on NAND products for AI servers for now but will increasingly expand its portfolio to NAND flash for on-device AI, automotive and edge devices.

The chipmaker expects the SSD market to grow fast in line with the explosive growth of high-bandwidth memory (HBM), which provides much faster processing speed than traditional memory chips.

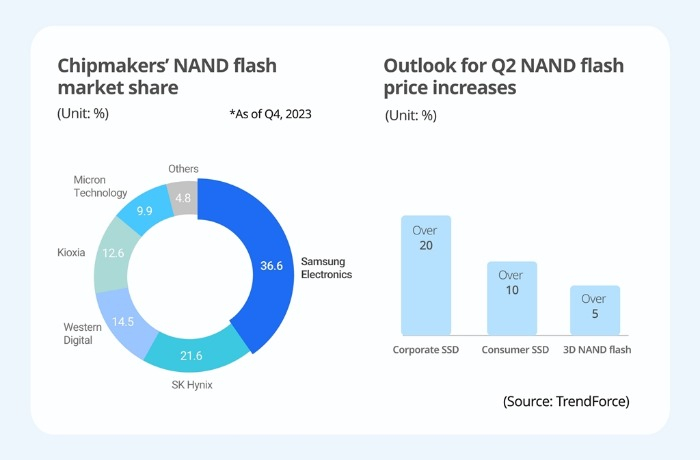

Samsung has been the NAND market leader since 2002, currently controlling about a third of the global market.

Competition for NAND-based storage devices is fierce as AI chips focus on inference, which requires large-capacity storage devices to store and process images and videos.

A NAND flash is a type of non-volatile memory chip that stores data even when the power is off. It is used in devices like smartphones, USB drives and servers.

Higher-density NAND chips will accelerate data-intensive environments and workloads such as AI engines and big data analytics. For 5G smartphones, the enhanced capacity can speed up launching and switching across multiple apps, making for a more responsive mobile experience and faster multitasking.

NAND MARKET TO GROW 38% IN 2024

According to market research firm Omdia, the NAND flash market is expected to grow 38.1% this year after falling 37.7% in 2023.

With the growing demand for NAND chips, Samsung’s NAND business swung to an operating profit in the first quarter.

To gain ground in the fast-growing market, Samsung has vowed to invest heavily in the NAND business.

Samsung’s NAND push comes as the company on Tuesday appointed Vice Chairman Jun Young-hyun as its new semiconductor business chief.

Despite its leadership in the overall DRAM market, in the HBM market, Samsung is struggling to catch up to its crosstown rival SK Hynix Inc., the world’s No. 2 memory maker and the dominant supplier of high-end HBM chips to Nvidia Corp.

Write to Chae-Yeon Kim at why29@hankyung.com

In-Soo Nam edited this article.

-

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisis

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisisMay 21, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix looks to expand AI memory leadership with new NAND chip

Korean chipmakersSK Hynix looks to expand AI memory leadership with new NAND chipMay 09, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEO

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEOMay 02, 2024 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chips

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chipsApr 30, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to produce 290-layer V9 NAND to win chip stacking war

Korean chipmakersSamsung to produce 290-layer V9 NAND to win chip stacking warApr 11, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung flexes NAND muscle with high-capacity microSD cards

Korean chipmakersSamsung flexes NAND muscle with high-capacity microSD cardsFeb 28, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung’s new NAND boasts industry’s highest storage capacity

Korean chipmakersSamsung’s new NAND boasts industry’s highest storage capacityNov 08, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flash

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flashSep 07, 2022 (Gmt+09:00)

3 Min read