Samsung narrows gap with TSMC in foundry market share

TrendForce expects foundry players’ revenue to rebound in the third quarter on demand for high-end chips

By Sep 06, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s Samsung Electronics Co. has narrowed its market share gap with foundry leader Taiwan Semiconductor Manufacturing Co. (TSMC), posting impressive quarterly revenue gains.

According to Taiwan-based market tracker TrendForce, Samsung’s second-quarter market share in the foundry or contract chipmaking segment rose to 11.7% from 9.9% in the first quarter.

TSMC, the dominant foundry leader, saw its market share decline to 56.4% from 60.2% over the same period.

TrendForce noted an interesting shift in the electronics landscape in the second quarter: dwindling inventories for TV components, along with a surging mobile repair market that drove TDDI demand – a move that sparked urgent orders in the supply chain.

Those last-minute orders have served as a pivotal lifeline, propping up second-quarter capacity utilization and revenue for semiconductor foundries, it said.

TDDI, short for touch and display driver integration, is a technology that integrates touch and display drivers mainly used in LCD screen driver IC chips.

Demand for staple consumer products like smartphones, PCs and laptop notebooks, however, remained sluggish, perpetuating a slump in the use of expensive, cutting-edge manufacturing processes, while traditionally strong sectors – automotive, industrial control and servers – underwent inventory corrections, it said.

These trends have resulted in a sustained contraction for the world’s top 10 semiconductor foundries, which saw their combined revenue decline by 1.1% sequentially to $26.2 billion in the second quarter.

WEAK DEMAND IMPACTS TSMC

TSMC posted $15.66 billion in second-quarter revenue, down 6.4% from the first quarter, with contracting revenue from the 4-nanometer and 5 nm sectors.

With the iPhone’s latest production cycle as a strong tailwind, however, the foundry leader is expected to see a surge in demand for related components in the third quarter, resulting in a potential revenue rebound, according to TrendForce.

Samsung’s foundry business hit a high note in the second quarter with impressive revenue of $3.23 billion – a robust 17.3% on-quarter leap.

In the third quarter, however, the Korean chipmaker will likely be affected by a sluggish global economy, which will drive down demand for Android smartphones, PCs and laptops. As a result, Samsung’s 8-inch fab utilization rates will decline, it said.

SOFTER SEASONAL DEMAND

TrendForce expects seasonal demand in the latter half of the year to be softer than in previous years.

Nevertheless, anticipated orders for premium mainstream chips – such as application processors and modems – as well as peripheral ICs are set to bolster capacity utilization rates for Apple Inc.’s partners, it said.

Also, an uptick in orders for high-performance computing AI chips is expected to add momentum to high-value manufacturing processes.

TrendForce predicts that the top 10 global semiconductor foundries’ revenue is likely to rebound in the third quarter, followed by gradual growth thereafter.

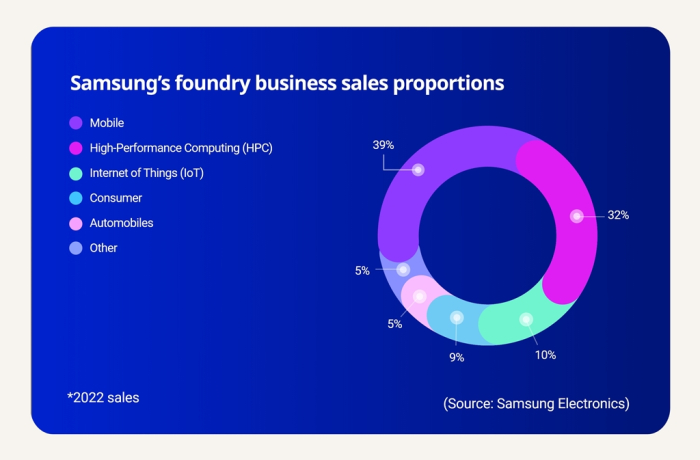

Samsung is the world’s top memory chipmaker but in the contract manufacturing business, it is a distant second with a single or low double-digit market share after TSMC.

Samsung has said it aims to raise the number of its foundry clients fivefold by 2027 compared to 2019.

The company plans to significantly increase its foundry capacity at its main Pyeongtack plant this year and begin operations at its Taylor, Texas plant by the end of 2024 to triple the company’s global contract chipmaking capacity by 2027 compared to 2022.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analyst

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analystJul 11, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung Electronics to aid foundry clients with state-of-the-art tech

Korean chipmakersSamsung Electronics to aid foundry clients with state-of-the-art techJul 05, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMC

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMCJun 28, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSystem on chips: Samsung’s new high-stakes foundry business

Korean chipmakersSystem on chips: Samsung’s new high-stakes foundry businessMar 09, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung eyes wider foundry client base with Ambarella deal

Korean chipmakersSamsung eyes wider foundry client base with Ambarella dealFeb 21, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Foundry: Driving force behind digital transformation

Korean chipmakersSamsung Foundry: Driving force behind digital transformationDec 01, 2022 (Gmt+09:00)

5 Min read -

Korean chipmakersShell-First: Samsung Foundry’s custom-tailored new operation strategy

Korean chipmakersShell-First: Samsung Foundry’s custom-tailored new operation strategyNov 30, 2022 (Gmt+09:00)

4 Min read