IntelŌĆÖs foundry revamp sets off alarm bells for Samsung, TSMC

Sandwiched between bigger rival TSMC and fast-follower Intel, Samsung will likely boost investment and hire more talent

By Jun 22, 2023 (Gmt+09:00)

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

Intel Corp.ŌĆÖs announcement to restructure its manufacturing business to become a leading foundry player is setting the stage for a bigger showdown with current market leaders Taiwan Semiconductor Manufacturing Co. (TSMC) and Samsung Electronics Co.

While TSMC and Samsung, the worldŌĆÖs two largest contract chipmakers, are trying to dismiss IntelŌĆÖs plan to become the top foundry by 2030 as being ŌĆ£ambitious,ŌĆØ the move underscores an intensified rivalry and potentially lower margins among the three, analysts said.

David Zinsner, IntelŌĆÖs chief financial officer, said during an investor call on Wednesday that the US chipmakerŌĆÖs internal business units will now have a customer-supplier relationship.

Under the plan, the largest US chipmakerŌĆÖs foundry unit, known as Intel Foundry Services (IFS), will treat its internal product businesses like any other customer, charging them market-based pricing for chip manufacturing.

Based on that model, Intel hopes to leapfrog Samsung as the worldŌĆÖs second-largest foundry next year with its manufacturing revenue of more than $20 billion, the CFO said.

While IntelŌĆÖs vision for the No. 2 foundry spot pales when compared to market leader TSMCŌĆÖs estimated 2024 sales of $85 billion, the US chipmaker aims to rise to the top by 2030.

FROM CPU MANUFACTURING TO FOUNDRY

Intel, the worldŌĆÖs largest microprocessor maker, controlling more than 90% of the central processing unit (CPU) market, quit its foundry business in 2017.

But in March 2021, it vowed to reenter the contract chip manufacturing market to challenge TSMC and Samsung ŌĆō dominant foundry players for years.

IntelŌĆÖs renewed interest in foundry comes as the US government wants to regain semiconductor supremacy by shifting the chip business hub back to the US from Asia.

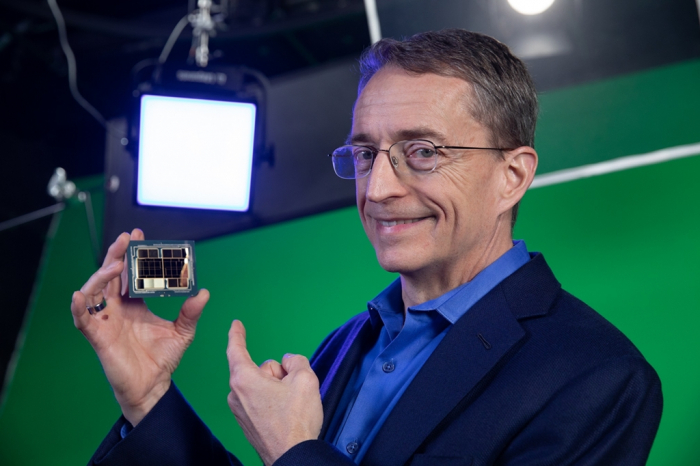

Intel is building two foundry production lines in Arizona with a $20 billion investment. Intel Chief Executive Pat Gelsinger said the company will use those factories, set to start operations in 2024, to make its own chips but also open them to outside customers in its foundry business model.

If Intel catches up with TSMC and Samsung, it will compete for contracts to build high-performance chips from companies such as Apple, Nvidia and Qualcomm, which donŌĆÖt currently run their own manufacturing facilities and opt for the Taiwanese and Korean firms to make chips of their own design.

Intel, while announcing billions of dollars of investment in the chip business, said it aims to produce a 1.8-nanometer chip by 2024 ŌĆō a move industry watchers say could be far-fetched.

SIGNIFICANT CHALLENGE

Samsung had no immediate response to IntelŌĆÖs restructuring plan.

But analysts said TSMC and Samsung will likely face a significant challenge considering IntelŌĆÖs capabilities and the US governmentŌĆÖs aggressive support to nurture its own chip giants.

ŌĆ£Samsung says ŌĆśno worriesŌĆÖ to IntelŌĆÖs ambitions. But it could be just a matter of time before Samsung faces an uphill battle,ŌĆØ said an industry official.

Samsung is the worldŌĆÖs top memory chipmaker. In the contract manufacturing business, however, it is a distant second with a low double-digit market share after TSMC, which controls more than half of the global foundry market.

Under its Vision 2030, Samsung plans to invest a total of 133 trillion won ($116 billion) to become the worldŌĆÖs top foundry player by then.

The company operates contract chipmaking facilities in Giheung, Hwaseong and Pyeongtaek in Korea; and Austin in the US state of Texas, with its $17 billion Taylor fab set to begin manufacturing by the end of 2024.

TALENT HIRING WAR IN US

In the US, Samsung, TSMC and Intel are competing to hire chip talent as they are aggressively expanding facilities.

Samsung, through its local office in Austin, has started recruiting 2,000 new researchers and factory workers in 343 sectors, including those for the Taylor plant.

TSMC, which promised a $40 billion investment in Arizona to build two fabrication plants, is in the middle of hiring 4,500 people in 62 sectors while Intel plans to recruit 6,700 people for its foundry plants in Arizona and Ohio.

According to consulting firm McKinsey, the chip talent shortage in the US is expected to reach 390,000 people by 2030.

Samsung has for decades been a key partner and rival for Intel, which in recent years was striving to flex more muscle in the semiconductor industry, particularly in the foundry sector.

For a number of electronic devices, SamsungŌĆÖs memory chip modules and IntelŌĆÖs processors are closely linked, thus compatibility and interoperability are key to the two companiesŌĆÖ next-generation products.

When Intel CEO Gelsinger visited Seoul last year, he met with Samsung Chairman Jay Y. Lee.

The two leaders explored ways to strengthen their partnership, including possible collaboration in the design and manufacture of next-generation chips and the foundry business, according to Samsung.

Write to Jeong-Soo Hwang and Ik-Hwan Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSystem on chips: SamsungŌĆÖs new high-stakes foundry business

Korean chipmakersSystem on chips: SamsungŌĆÖs new high-stakes foundry businessMar 09, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung eyes wider foundry client base with Ambarella deal

Korean chipmakersSamsung eyes wider foundry client base with Ambarella dealFeb 21, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix to benefit from IntelŌĆÖs Sapphire Rapids CPU

Korean chipmakersSamsung, SK Hynix to benefit from IntelŌĆÖs Sapphire Rapids CPUJan 11, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsungŌĆÖs foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsungŌĆÖs foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Foundry: Driving force behind digital transformation

Korean chipmakersSamsung Foundry: Driving force behind digital transformationDec 01, 2022 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundry

Korean chipmakersSamsung sets sights on GAA tech to overtake TSMC in foundryNov 29, 2022 (Gmt+09:00)

6 Min read -

Business & PoliticsSamsung leader Lee, Intel CEO Gelsinger discuss chip alliance

Business & PoliticsSamsung leader Lee, Intel CEO Gelsinger discuss chip allianceMay 30, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersIntelŌĆÖs jump into foundry sets off alarm bells for Samsung, TSMC

Korean chipmakersIntelŌĆÖs jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read