Korean chipmakers

Samsung to fill the void as TSMC trims spending?

Chipmakers' output cuts are still less than falling demand: TrendForce

By May 10, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

While the world’s largest foundry chipmaker TSMC Co. appears to be slowing its pace of facility investment to cope with excess inventory, its cautious spending could be a good opportunity for Samsung Electronics Co., said market watchers.

At a Tuesday board meeting, Taiwan Semiconductor Manufacturing Co. (TSMC) finalized a plan to spend $366.1 million to build foundry facilities and install relevant systems.

The figure represents a drastic cut compared to the $10.46 billion the company in February earmarked for capital expenditures, including spending for its US subsidiary in Arizona.

For all of 2023, TSMC proposed to trim its capex by 12% to $32 billion, compared to last year’s $36.3 billion.

But analysts and Taiwanese media speculated that TSMC's capex spending might be further curtailed to $28 billion in 2023.

The latest batch of investments underpins such speculation.

Still, TSMC’s spending on the foundry business would be more than twice Samsung's 10 trillion to 15 trillion won ($7.6 billion-$11 billion) earmarked for the contract chipmaking division in 2023.

Drawing a distinction between the two companies, however, Samsung reaffirmed its spending plan for 2023 late last month, betting on a second-half recovery in the semiconductor market.

While its rivals have slashed their investment to resolve the supply glut, Samsung said it will continue to spend heavily to use the current market downturn as an opportunity to expand its market share lead so it can take advantage of an eventual rebound in demand.

In March, TSMC posted a 15.4% drop to 145.4 billion Taiwanese dollars ($4.7 billion) in sales from a year earlier. It marked its first year-on-year drop in monthly revenue since May 2019.

For the entire year, the foundry leader is forecast to suffer its first revenue decline since 2015.

Samsung appears to be in the same boat. In the first quarter of this year, it reported the worst quarterly loss for its semiconductor business in more than a decade.

The world’s No. 1 memory chipmaker has been slashing wafer production primarily for DDR4 DRAM chips from the end of the first quarter, according to industry officials.

But chipmakers will likely continue to struggle with high stockpiles at their clients until the end of the first half of this year, they said.

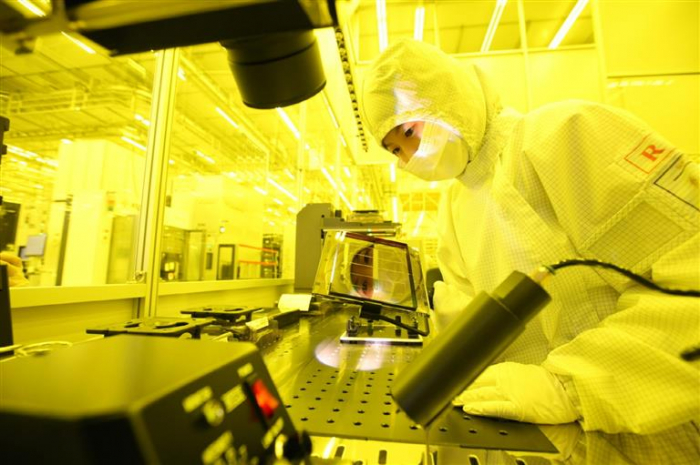

Despite weakening demand, Samsung is believed to have significantly improved its production yield of 4-nanometer chips to 70-90%.

According to media reports, US semiconductor company AMD has signed up with Samsung, instead of TSMC, to produce some central processing units based on the 4-nm process node.

The enhanced production yield and the reported contract with AMD might account for Samsung’s confidence about its contract chipmaking.

Samsung’s semiconductor business head Kyung Kye-hyun said at a lecture last week that it can overtake TSMC within five years.

Samsung accounted for 15.8% of the foundry market as of the end of 2022, after TSMC with a share of 58.5%.

DOUBLE-DIGIT PRICE DROPS

On Wednesday, market tracker TrendForce revised its forecast for memory chip prices lower.

DRAM prices are projected to contract by up to 18% in the current quarter from three months ago. NAND Flash prices are forecast to drop by 8 to 13% during the period, according to the research house.

Major chipmakers such as Samsung, SK Hynix Inc., Micron Technology and Kioxia have been cutting wafer production since the fourth quarter of last year.

But TrendForce said their production cuts are less than the dwindling demand.

Write to Ik-Hwan Kim and Jeong-Soo Hwang at lovepen@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Korean chipmakersSamsung Electronics to overtake TSMC within 5 years: chip president

Korean chipmakersSamsung Electronics to overtake TSMC within 5 years: chip presidentMay 04, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung foundry backlogs top $74.6 bn for logic chip biz goal

Korean chipmakersSamsung foundry backlogs top $74.6 bn for logic chip biz goalApr 30, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung bets on H2 recovery with heavy spending after record chip losses

EarningsSamsung bets on H2 recovery with heavy spending after record chip lossesApr 27, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN