SK Hynix unsure about applying for US chip subsidies: CEO

The world’s No. 2 memory player will build a chip packaging plant in the US as planned, he says

By Mar 29, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc., the world’s second-largest memory chipmaker after Samsung Electronics Co., said on Wednesday it is unsure about applying for US government grants for its planned construction of a chip packaging plant in the country.

The South Korean chipmaker also said it would seek further exemption from US curbs on the import of chip equipment to China after the one-year grace period ends in October.

Asked by reporters at SK Hynix’s annual shareholders’ meeting if SK Hynix would apply for US chip subsidies, Vice Chairman and Chief Executive Park Jung-ho was circumspect. "The process is too complicated. We found (the process) demanding. We’ll think about what to do.”

But he said the company would build a semiconductor packaging factory in the US as announced earlier. Last year, SK Group, which owns SK Hynix, pledged a multi-billion-dollar investment in the US to construct chip research and development and facilities for advanced packaging in the US.

“Regardless of the federal money, the construction (of the packaging plant) will proceed as planned,” he said at the shareholders’ meeting held in Icheon, southeast of Seoul, where its main plants are located.

His comments on the US chip subsidies come as Korean government officials and industry executives are complaining about the excessive subsidy eligibility requirements contained in the detailed guidelines of the CHIPS and Science Act unveiled by the Commerce Department earlier this week.

Requests to disclose sensitive information, considered business secrets, to the US government could significantly reduce the appeal of receiving state funds to build new facilities in the country, Korean chipmakers said.

SEEKS TO EXTEND CHINA BUSINESS GRACE PERIOD

As part of efforts to contain China’s growing influence in the chip industry, Washington last October banned the import of advanced manufacturing equipment to China. The US government, however, granted Samsung and SK Hynix a one-year waiver, allowing them to continue to take chips and chipmaking equipment to their factories in China.

"Talks between the Korean and US governments should go well," Park said. “From our end, we will also buy time and adjust our management plans. We will apply for an extension when the one-year grace period expires."

Regarding the industry outlook, the SK Hynix CEO said chipmakers’ efforts to curtail supply worldwide over the past few months would lead to a market rebound in the near future.

“Inventories at our clients are declining. I expect the chip market to return to normal in the not-too-distant future,” he said.

He repeated that the company won’t further slash its chip investment in addition to its reduction plan announced earlier.

Last month, SK Hynix said it would significantly slash its investment for this year after posting its first quarterly operating loss in a decade. As announced last October, it said it would spend less than half its 2022 investment of 19 trillion won ($15.4 billion) this year.

His remarks came after Micron Technology Inc. on Tuesday reported its largest quarterly loss on record, citing the memory chip market meltdown.

The US chipmaker also said it would increase plans to shrink its workforce to a 15% reduction from the previous guidance of 10%.

MARKET REBOUND AROUND THE CORNER

However, Micron executives suggested a memory market turnaround is ahead, especially in the data center segment, adding that chip inventory issues peaked in the fiscal second quarter, which ended March 2, 2023.

Echoing Micron Chief Executive Sanjay Mehrotra’s views on the chip industry, Park said the rise of generative artificial intelligence programs like ChatGPT will help turn the market around.

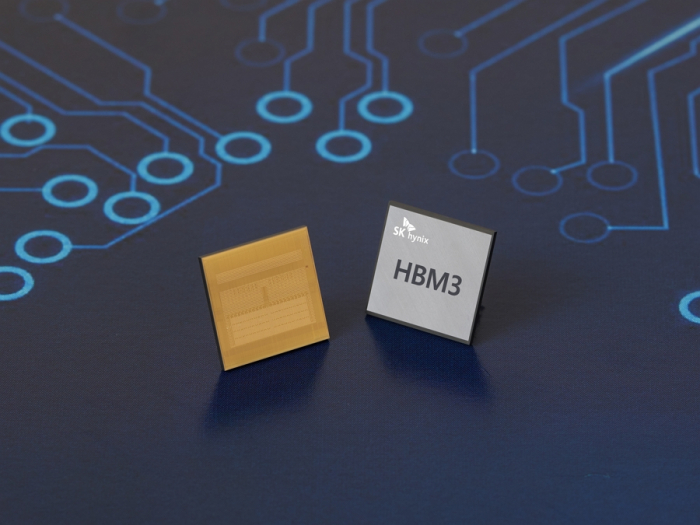

SK Hynix, alongside Samsung, is enjoying surging orders for high bandwidth memory (HBM) DRAM, which is used in AI accelerators, supercomputers and high-performance servers.

SK Hynix recently supplied its third-generation HBM DRAM to Nvidia Corp. for the graphics chipmaker’s A100 GPU used for ChatGPT, sources said.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in China

Korean chipmakersSamsung, SK Hynix face cap on tech level of chips made in ChinaFeb 24, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairman

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairmanFeb 15, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix: key beneficiaries of ChatGPT fever

Korean chipmakersSamsung, SK Hynix: key beneficiaries of ChatGPT feverFeb 13, 2023 (Gmt+09:00)

4 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read