Economy

S.Korea likely to suffer recession as Jan exports tumble

BOK may end its tightening campaign soon as the economy is expected to contract in Q1; semiconductor exports, sales to China drop

By Feb 01, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea is likely to head for a recession for the first time in three years as exports of Asia’s fourth-largest economy in January dropped for four months amid weakening global demand, resulting in a record trade deficit.

Exports lost 16.6% to $46.3 billion last month from a year earlier, showed data from the Ministry of Trade, Industry and Energy on Wednesday. The drop was the largest since May 2020. The country’s overseas sales fell by a revised 9.6% in December 2022, 14.1% in November and 5.8% in October.

Imports dipped 2.6% to $59 billion, generating an all-time high trade shortfall of $12.7 billion.

“Sluggish exports were one of the main reasons for the GDP contraction last quarter and we expect this to continue for several more months,” said an ING Senior Economist Kang Min Joo in a note, adding the economy is forecast to shrink by a seasonally adjusted 0.2% in the current quarter from the previous three months.

BOK MAY STOP RATE HIKES

In the fourth quarter of last year, the export-dependent economy contracted 0.4% on quarter, its first decline in two and half years, adding to concerns over a recession – two straight quarters of decline in gross domestic product. The economy reported such a severe slowdown in the second quarter of 2020 when COVID-19 rattled the world.

The gloomy expectations caused investors to bet the central bank may end its policy tightening in the near term.

South Korean government bond yields fell across the board after the January exports data with the highly liquid three-year debt yield down 5.7 basis points to 3.268% on Wednesday morning, according to the Korea Financial Investment Association.

Last month, the Bank of Korea raised its policy interest rate by a quarter point to 3.50%, marking its seventh hike in less than a year.

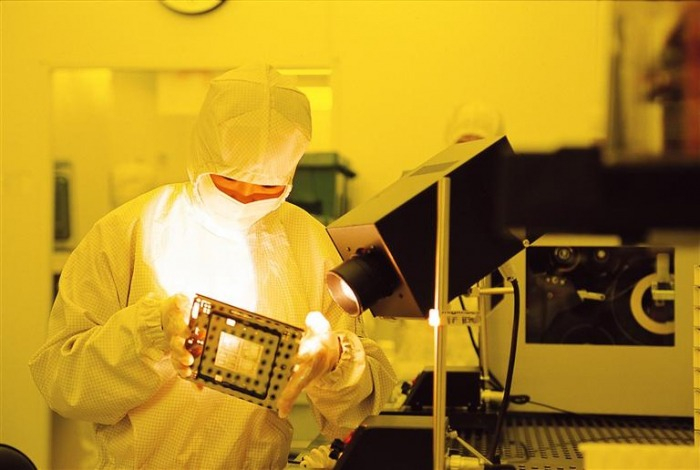

SEMICONDUCTOR, CHINA

Overseas sales of semiconductors, South Korea’s top export item, tumbled 44.5% in January from a year earlier, according to the trade ministry.

“Memory chip prices plunged on falling demand and accumulating inventories, significantly affecting overall exports,” the ministry said.

The country is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

SK Hynix, the global No. 2 player, decided to halve its investment fir this year after posting its first quarterly operating loss in a decade. The company also warned that the industry downturn will worsen in the first half as consumer tighten their spending on electronic gadgets while tech companies continue to deplete their inventories.

On the other hand, its bigger rival Samsung said on Tuesday it has no plans to cut semiconductor production even if it incurs temporary losses, cautiously expecting chip demand to begin recovering in the second half.

That could exacerbate the global semiconductor market condition, ING’s Kang said.

“This means that the large imbalance between supply and demand is unlikely to be corrected anytime soon and sector-wide inventory levels will continue to rise, resulting in further declines in unit memory chip prices.”

South Korea’s exports to China, the country’s largest overseas market, dropped 31.4% in January, extending its losing streak to an eighth consecutive month. Sales of semiconductors and petrochemical products to the world’s second-largest economy slid 46.6% and 22%, respectively.

Sales to the Association of Southeast Asian Nations (ASEAN) also suffered a fourth month of decline, falling 19.8%, while shipments to the US, the world’s top economy, skidded 6.1%.

Write to Ji-Hoon Lee at lizi@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung vows no chip output cut, eyes second-half demand recovery

EarningsSamsung vows no chip output cut, eyes second-half demand recoveryJan 31, 2023 (Gmt+09:00)

5 Min read -

EconomySouth Korea’s economic contraction deepens recession woes

EconomySouth Korea’s economic contraction deepens recession woesJan 26, 2023 (Gmt+09:00)

3 Min read -

-

-

EconomyKorea October current account surplus tumbles as exports slide

EconomyKorea October current account surplus tumbles as exports slideDec 09, 2022 (Gmt+09:00)

2 Min read -

EconomyKorea exports dip for 2nd month, growth slows to 1-year low

EconomyKorea exports dip for 2nd month, growth slows to 1-year lowDec 01, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN