Economy

Korea October current account surplus tumbles as exports slide

Financial markets see capital inflows in November for second month as sentiment for risky assets improves

By Dec 09, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

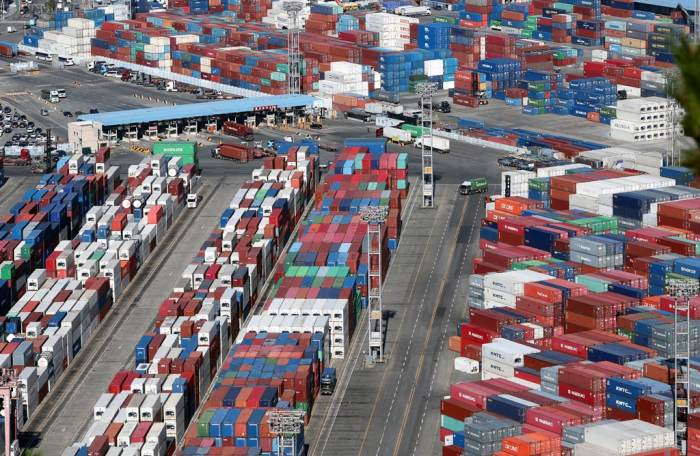

South Korea’s current account surplus plunged as exports fell for a second straight month, adding to concerns over a slowdown in Asia’s fourth-largest economy amid a global downturn.

The country reported a current account surplus of $883.4 million in October, sharply lower than $8 billion a year earlier, preliminary central bank data showed on Friday.

Goods exports skid 6% to $52.6 billion from a year earlier after dipping by a revised 1.1% in September, the first year-on-year fall in 23 months. Semiconductor exports declined 16.4% in October amid weak demand worldwide. South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

On the other hand, goods imports grew 8.5% to $54.1 billion with commodity intakes up 9.9%. Imports of gas and crude oil jumped 79.8% and 24.2%, respectively, while purchases of coal soared 40.2%.

The sluggish exports forced the goods account to swing to a deficit of $1.5 billion in October from a $466.2 million surplus in the prior month.

The government expected the current account to be volatile in the coming months.

“Exports are facing significant risks from a global economic slowdown and the domestic logistics disruptions, while imports are likely to decline due to falling oil prices,” said the first vice finance minister Bang Kisun in a statement. The domestic manufacturing sector faces ballooning losses across industries as the ongoing trucker strike disrupted the country’s supply chain and exports amid stalled talks between unionized workers and the government over minimum wage rules.

In the first 10 months of the year, South Korea logged a current account surplus of $25 billion in total, less than a third of the $75.4 billion a year earlier.

CAPITAL INFLOWS FOR SECOND CONSECUTIVE MONTH

South Korea reported capital inflows in November for a second straight month, according to separate data from the Bank of Korea.

The country’s financial markets saw an influx of $2.7 billion last month after inflows of $2.8 billion in the previous month.

Foreign investors bought a net $2.1 billion won in local stocks in November after purchasing a net $2.5 billion in the prior month. Bond markets also enjoyed inflows of $630 million after $280 million.

“Investor sentiment for risky assets improved as global central banks were expected to slow the pace of tightening and China eased its zero-Covid policy,” said the BOK in a statement.

Write to Do-Won Lim at van7691@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Foreign exchangeKorea won near 5-mth high as Powell signals slower hikes

Foreign exchangeKorea won near 5-mth high as Powell signals slower hikesDec 01, 2022 (Gmt+09:00)

2 Min read -

Supply chainKorea’s industrial losses balloon to $1.2 bn as truckers continue strike

Supply chainKorea’s industrial losses balloon to $1.2 bn as truckers continue strikeDec 01, 2022 (Gmt+09:00)

2 Min read -

EconomyFalling Korea current account surplus heightens economic woes

EconomyFalling Korea current account surplus heightens economic woesNov 08, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN