Korean startups feel bite of funding drought in H1

VC funding in S.Korea nosedived more than 70% on-year in H1 2023 but will likely recover in H2

By Jul 07, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

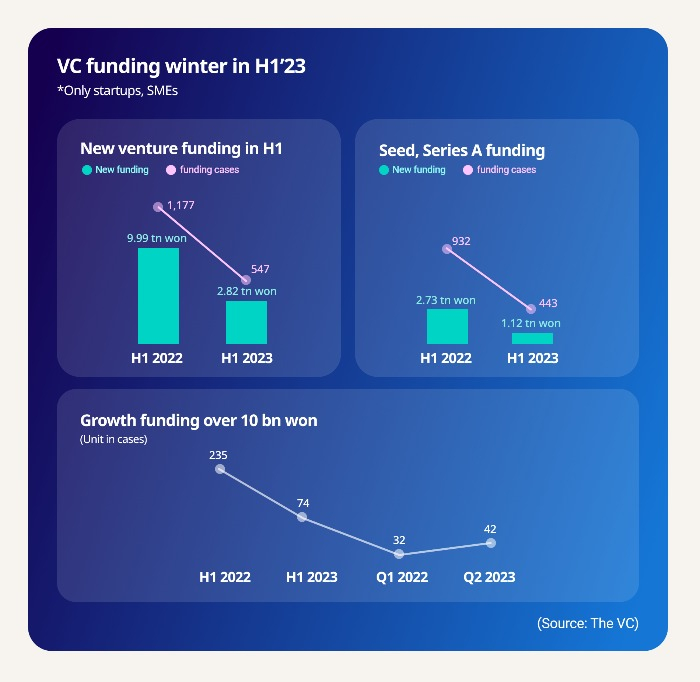

According to Korea-based startup and venture capital tracker The VC on Friday, Korean startups and SMEs attracted 2.82 trillion won ($2.2 billion) in total in the January-June period this year, down 72% from the same period last year.

Their total fundings were also more than halved from 1,177 cases to 547 over the same period.

Amid the lingering uncertainties about the global economic slowdown and monetary tightening move, most venture capitalists shifted into a wait-and-see mode early this year while seeking out entrepreneurs with proven technology to generate profit sooner, said analysts.

“The funding free fall kept investors away from the VC market but more active investment is expected in the third quarter when investment from funds formed between 2021 and 2022 is anticipated,” said Park Ki-ho, managing director at LB Investment Inc.

GROWTH-STAGE STARTUPS BEAR THE BRUNT

Early stage startups also took a hit from the ongoing funding winter in the first six months of this year.

Seed funding and Series A funding cases dropped 52% on-year to 443 in the cited period. Each investment averaged 2.5 billion won, down from 2.9 billion won a year ago.

Venture-funded and late-stage startups suffered the funding drought the most, with their total funding down 76% over the same period.

Companies attracting 10 billion won and more tanked to 74 from 235, falling about 70% over the same period and accounting for 13% of entire VC investment.

They made up 20% of the total VC funding in the same period last year, led by Bucketplace with 235.0 billion won, Socar Inc. with 183.2 billion won, Smartscore with 180 billion won and Qraft Technologies Inc. with 174.6 billion won.

But this year, Beyond Music Company and Kurly Inc. were the only companies that succeeded in raising 100 billion won or more, attracting 200 billion won and 100 billion won, respectively.

MANUFACTURING, CONTENT LOOK MORE PROMISING

Investors mostly shunned money-losing platform startups due to fierce market competition and bio companies with high risk.

The bio and medical sectors raised 2.22 trillion won in the first half of last year but only 439.5 billion won in the same period this year. This is a whopping 80% drop.

Investment in e-commerce companies also plummeted 70% over the same period.

But interest in manufacturing companies especially in the materials, components and equipment sectors and content startups remained solid thanks to the generative artificial intelligence chatbot boom and the Korean wave in global pop culture, respectively.

Semiconductor design platform company SEMIFIVE raised 67.5 billion won in a Series B funding round, and integrated content studio Playlist attracted 14.2 billion won from Altos Ventures Management Inc.

Investors expect the VC market to revitalize in the second half of this year.

There is already a sign of recovery in investor sentiment.

Monthly new funding has been on an upward trend, with 82 new investments in April, 87 in May and 105 in June.

In July, Evar Inc. Gint Co. and Intake Co. all succeeded in raising 22 billion won, 16.5 billion won and 8 billion won, respectively, in Series B funding rounds.

Write to Jong-Woo Kim at jongwoo@hankyung.com

Sookyung Seo edited this article.

-

Venture capitalKorean startup investments rapidly dry up in wake of SVB debacle

Venture capitalKorean startup investments rapidly dry up in wake of SVB debacleMar 27, 2023 (Gmt+09:00)

3 Min read -

Venture capitalKorea's venture capital investment falls 12% last year amid downturn

Venture capitalKorea's venture capital investment falls 12% last year amid downturnJan 30, 2023 (Gmt+09:00)

1 Min read -

Venture capitalDisclosure obligations of venture capital accelerators to be strengthened

Venture capitalDisclosure obligations of venture capital accelerators to be strengthenedJan 02, 2023 (Gmt+09:00)

1 Min read