Venture capital

Korea's venture capital investment falls 12% last year amid downturn

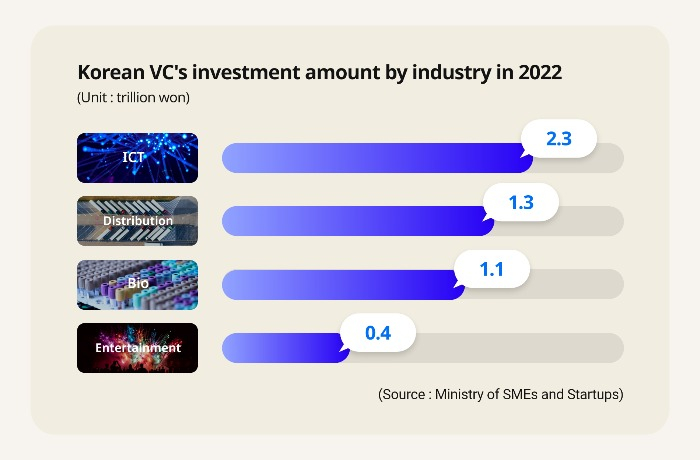

ICT services, distribution and services, and bio and medical care took the lion's share of 70.5% of the total investment

By Jan 30, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's venture capital investment last year fell more than 10% from a year ago due to the economic downturn caused by a series of global rate hikes, but the annual investment volume is still the second largest ever.

According to the Ministry of SMEs and Startups on Sunday, domestic venture capital investment last year amounted to 6.7 trillion won ($5.4 billion). The figure is down 11.9% from 2021 when it logged a record high of 7.6 trillion won, but still the second-largest annual capital investment volume after 2021.

It started the strong first quarter with 2.2 trillion won, up 68.5% from the same period in the previous year, followed by a slight growth of 1.4% in the second quarter.

Venture capital investment, however, finished the second half in a dramatic downturn, with the amount dwindling by 38.6% in the third quarter and 43.9% in the last one.

In particular, ICT services attracted the highest amount of 2.3 trillion won, down 3.2% from a year ago, followed by distribution and services with 1.3 trillion won (down 9.8% year-on-year). The bio and the medicinal sector saw investment plummet 34.1% from the previous year.

On the other hand, the video, performance, and music industries drew an investment of 460.4 billion won, an increase of 10.6% from the previous year.

This is because K-pop and Korean dramas have become popular in the global market and social distancing was lifted along with the easing of the spread of COVID-19.

Write to Joo-Wan Kim at Kjwan@hankyung.com

More to Read

-

Korean startupsSilicon Valley, Korean startups’ choice for global business

Korean startupsSilicon Valley, Korean startups’ choice for global businessJan 25, 2023 (Gmt+09:00)

1 Min read -

Venture capitalDisclosure obligations of venture capital accelerators to be strengthened

Venture capitalDisclosure obligations of venture capital accelerators to be strengthenedJan 02, 2023 (Gmt+09:00)

1 Min read -

Korean startupsDespite liquidity crunch, 5 verticals rake in venture capital investment

Korean startupsDespite liquidity crunch, 5 verticals rake in venture capital investmentOct 13, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN