Korean startup investments rapidly dry up in wake of SVB debacle

S.Korean startups’ March funding is set to mark the lowest monthly investment in five years

By Mar 27, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The shock from the collapse of American startups’ main financing artery Silicon Valley Bank (SVB) has been deeply felt in the South Korean startup sector, rapidly depleting the cash hoard of local startups already grappling with the cooldown of the initial public offering market amid growing recession fears.

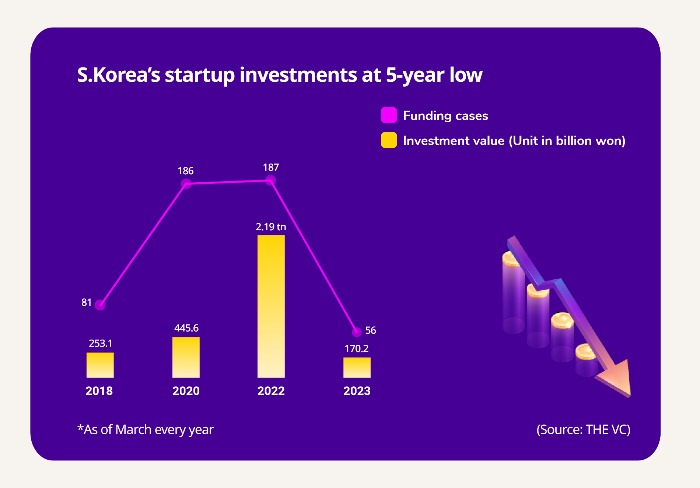

Korean startups raised 170.2 billion won ($130.7 million) in funding between March 1 and 26, less than one-tenth of what they secured in March last year, according to data compiled by THE VC, a Seoul-based startup investment data provider, on Sunday.

It is projected to mark the smallest monthly funding amount for startups in Korea since March 2018 after contracting to 304.8 billion won in January and 205.7 billion won in February.

Total funding cases over the cited period also shrank to 56 versus 187 in March last year.

Investor sentiment has rapidly turned sour in the Korean venture capital market following SVB’s sudden bankruptcy in mid-March.

The worst is yet to come, warned market analysts. According to Bloomberg Intelligence on Friday, the SVB collapse would lead to “a haircut of possibly $500 billion” in the $2 trillion venture capital industry’s portfolio, casting ominous clouds over a startup ecosystem already struggling with funding from IPOs.

The Korea Venture Capital Association’s Chairman Yoon Gun-soo urged the Korean government to come up with bolder measures to stabilize the local VC market, such as further lowering the entry bar for tech startups to go public to help them secure funds.

EXPIRATION OF 5 TRILLION WON IN VENTURE FUNDS

Korean startups are urgently in need of new funding as 218 venture funds with a total investment value of 5.35 trillion won will expire this year, according to the Disclosure Information of Venture Capital Analysis (DIVA) on Sunday.

If startups fail to extend these funds, the value of their shares would plunge while the value of the portfolios held by the funds’ investors, such as pension funds, would also decrease.

Venture funds are in negotiations with limited partners to extend their expiration dates to prevent capital from shrinking further at a time when it is hard for startups to return investments through public listings, an official from a VC said.

The share value of unlisted popular startups like RIDI Corp., Korea’s No. 1 eBook provider, and Bucketplace, the country’s leading lifestyle app developer, are already nearly halved from their peak but investors are reluctant to buy them.

If IPO market conditions are further aggravated, unlisted startups’ share value would be further shaved.

SAPPING VC FUNDING

Amid growing uncertainties in the startup financing market, the local venture capital market remains subdued.

There are four newly registered VCs with Korea’s Ministry of SMEs and Startups so far this year. It jumped to 42 in 2022 from 19 in 2019.

On the contrary, Hudson Henge Investment Co. early this year returned its VC license to end its VC business after the number of closed local VCs increased to eight from three over the same period.

STARTUPS SHIFT TO PRIVATE CREDIT

Startups are now eyeing private credit to raise funds amid dwindling VC investment.

Korean fashion shopping app Ably operator Ably Corp. last week announced that it secured 50 billion won via venture debt, which comes with warrants that give its holders the option to purchase the company’s stock at a specific price within a specific period.

VCs also opt for convertible bonds (CB) or bonds with warrants that give interest payments for their investments and a rise in equity value with new share purchases.

Venture debts accounted for 10.7% of the entire Korean VC investment in the fourth quarter of last year from 2.5% in the second quarter.

Many VCs and private equity firms are relying more on alternative financing via private credit to avoid true price discovery since the SVB fiasco, Bloomberg Intelligence analyst Gaurav Patankar wrote in a note on Friday, adding that the time has come for “zombie companies with frothy valuations” to go through “restructuring, price discovery and of course retooling of their business models.”

Write to Lan Heo and Jong-Woo Kim at why@hankyung.com

Sookyung Seo edited this article.

-

Korean startupsSeoul to run $3.9 billion fund for startups over 4 years

Korean startupsSeoul to run $3.9 billion fund for startups over 4 yearsFeb 09, 2023 (Gmt+09:00)

2 Min read -

Venture capitalKorea's venture capital investment falls 12% last year amid downturn

Venture capitalKorea's venture capital investment falls 12% last year amid downturnJan 30, 2023 (Gmt+09:00)

1 Min read