Samsung set to rebuild with leader Lee cleared of all charges

He is expected to seek large-scale M&As and bold investments in growth sectors to regain investor confidence

By Feb 03, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. Chairman Lee Jae-yong was found not guilty of accounting fraud, stock manipulation and other criminal charges by a Seoul appeals court on Monday – a ruling that will remove long-running legal risks he has faced for a decade.

The Seoul High Court upheld the lower court's ruling last year dismissing all charges related to the controversial merger of two Samsung affiliates in 2015, which prosecutors said was designed to tighten his control of Samsung Group, the country’s top conglomerate.

Thirteen former senior Samsung executives, indicted by the prosecution at the time on similar charges, were also acquitted of criminal charges against them.

In January 2024, a lower court cleared Lee of all charges related to the $8 billion 2015 merger between two Samsung C&T Corp. and Cheil Industries Co.

Prosecutors later appealed to the Seoul High Court, seeking a five-year jail term, citing a separate ruling in August that said Samsung Biologics Co., an affiliate of Cheil Industries, breached accounting standards by overstating its assets to justify the merger.

Lee, widely known in international business circles by his English name Jay Y. Lee, has denied any wrongdoing.

MERGER: ‘LAWFUL ACT’

“The plan devised by the defendants for the merger was a standard and lawful response in the context of a management rights dispute,” said a Seoul High Court judge. “It is difficult to judge a Samsung report on the merger at the time as manipulated.”

The appeals court also ruled that the alleged accounting fraud involving Samsung Biologics and Samsung Bioepis Co. “cannot be regarded as fraudulent.”

Lee has been plagued by legal challenges for nearly a decade, raising investor concerns over the future of Samsung Group as it has struggled amid growing competition with rivals.

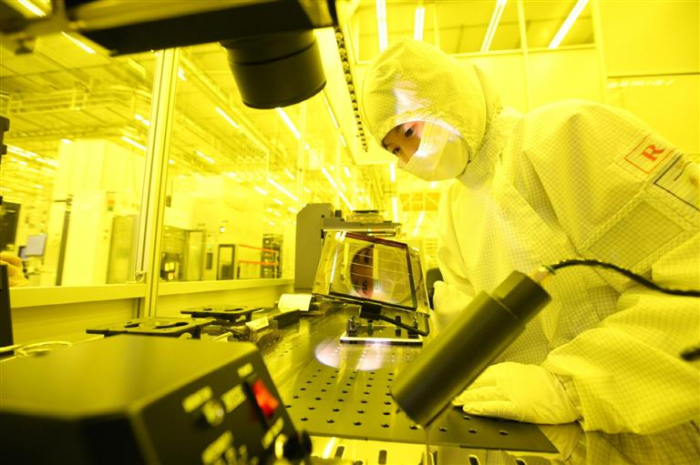

Samsung faces an uphill battle against Taiwan Semiconductor Manufacturing Co., better known as TSMC, in the foundry or contract chipmaking business; crosstown rival SK Hynix Inc. in the advanced AI chip sector, including high-bandwidth memory (HBM); and Apple Inc. in the high-end smartphone segment and Chinese competitors such as Xiaomi and Huawei in budget smartphones.

“It took a long time. With the latest ruling, I expect Lee to focus on his work as Samsung's leader,” Lee's lawyer said after the ruling.

It was not immediately clear whether the prosecution would appeal the appeals court decision to the Supreme Court.

REBUILDING SAMSUNG WITH EXECUTIVE RESHUFFLE, M&A

With Lee and Samsung’s top executives now able to fully focus on management, analysts expect the conglomerate to accelerate efforts to regain its semiconductor competitiveness and expand into new business areas through mergers and acquisitions.

Market watchers said Lee will likely undertake major organizational reforms, including establishing a new corporate control tower, restructuring the board, and replacing some affiliate executives to restore internal discipline.

A major change in Samsung’s corporate structure and executive reshuffles could come as early as next month ahead of its annual shareholders’ meeting, they said.

Samsung has been absent from the M&A market since it acquired Harman International Industries Inc. for $8 billion in 2017 when Lee was Samsung’s vice chairman.

Industry officials said Samsung will actively pursue M&As and make bold investments as it needs to increase its competitiveness in areas such as AI and robots.

“Now that he’s free from legal risks and able to commit himself to active management, we expect Samsung to seek large-scale M&A deals as well as aggressive investments in future growth areas,” said an industry executive.

Write to Chae-Yeon Kim, Jeong-Soo Hwang and Lan Heo at why29@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earnings

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earningsJan 31, 2025 (Gmt+09:00)

4 Min read -

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'Jan 23, 2025 (Gmt+09:00)

3 Min read -

EarningsSamsung Biologics posts record 2024 sales, operating profit as it goes global

EarningsSamsung Biologics posts record 2024 sales, operating profit as it goes globalJan 22, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG consider moving electronics plants to US from Mexico

Business & PoliticsSamsung, LG consider moving electronics plants to US from MexicoJan 21, 2025 (Gmt+09:00)

4 Min read -

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow Robotics

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow RoboticsDec 31, 2024 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech alliance

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech allianceMay 14, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read -

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung Electronics

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung ElectronicsOct 27, 2022 (Gmt+09:00)

1 Min read -

Samsung GroupJay Y. Lee absence raises risks for Samsung chip biz

Samsung GroupJay Y. Lee absence raises risks for Samsung chip bizApr 24, 2022 (Gmt+09:00)

6 Min read