Korean stock market

NPS pours $3.9 bn to buttress Korean stock market

South Korea’s largest institutional investor has targeted chip, defense, shipbuilding and F&B stocks

By Apr 14, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

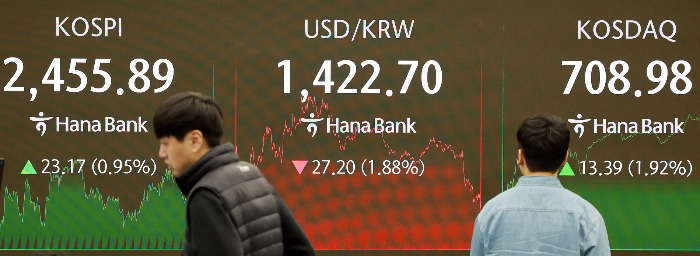

South Korea’s National Pension Service, the country’s largest institutional investor, has come to the rescue of the domestic stock market, which has been suffering from extreme volatility triggered by the US tariffs roller coaster.

According to the Korea Exchange (KRX), Korean pension funds, led by the NPS, have made net purchases of 5.55 trillion won ($3.9 billion) in Korean stocks so far this year.

They spent more than 1.5 trillion won per month in the first four months of this year, with the exception of March, when net buying dropped to 200.2 billion won.

Last Monday, when the Korean stock market plunged over the US tariff chaos, they net purchased 425.3 billion won worth of Korean shares, their second-largest daily net-buying amount in five years.

When the country’s benchmark Kospi index dipped below the psychologically important level of 2,500 on April 3, they net bought 273.4 billion won worth of local shares.

The NPS appeared to have wielded much of the power to stabilize the market this year, considering that its assets under management (AUM) account for the lion's share of the country’s entire pension fund AUM, and its asset allocation to stocks is far higher than that of other pension funds.

“In a bearish market, the NPS typically increases its exposure to large-cap, high-volume stocks,” said Frism Investment Advisory Inc. CEO Hong Chun-uk.

“Fund managers hired by the NPS appear to have actively cherry-picked blue-chip stocks that are less exposed to US tariff risk during market pullbacks.”

CHIP, BIO, DEFENSE AND SHIPBUILDING STOCKS ARE TOP PICKS

Korean pension funds gobbled up large-cap chip, bio, shipbuilding and defense stocks when they fell this month.

In the first two weeks of April, they net bought 260.7 billion won worth of Samsung Electronics Co. shares and 79.6 billion won worth of SK Hynix Inc., marking their No. 1 and No. 4 top picks during their declines.

Pension funds also scooped up 130.1 billion won worth of Samsung Biologics Co., seen as less exposed to U.S. trade policies due to its European market focus, along with 110.6 billion won worth of Korea’s top shipbuilder HD Hyundai Heavy Industries Co. and 64.6 billion won worth of the country’s leading defense stock Hanwha Aerospace Co.

According to the Financial Supervisory Service’s regulatory filing system, the NPS in the first quarter expanded its holdings in retail and F&B stocks expected to benefit from the Korean government’s anticipated supplementary budget, worth tens of trillions of won.

The NPS's stake in E-Mart Inc., Hyundai Department Store Co. and Orion Holdings Corp. rose to 12.58% from 10.01%, to 11.45% from 10.03% and to 10.63% from 10.53%, respectively.

Its holdings in BNK Korea Investment Holdings Co., BNK Financial Group Inc., LIG Nex1 Co. and STX Engine Co. also increased to 10% or more each.

BUYING POWER WANES

Yet following its aggressive buying spree in early 2025, the NPS is approaching its upper limit for domestic equity investments.

Its asset allocation for Korean stocks is capped at 13% through 2029.

As of April 7, its domestic stock holdings had reached 12.7%, according to Seoul-based market research firm Research Arum.

With limited room for additional stock purchases, Research Arum cautioned that the Korean equity market may face significant selling pressure once the NPS steps back.

Write to See-Eun Lee at see@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Shipping & ShipbuildingS.Korean shipbuilders rally as Trump hints at buying foreign ships

Shipping & ShipbuildingS.Korean shipbuilders rally as Trump hints at buying foreign shipsApr 11, 2025 (Gmt+09:00)

2 Min read -

Korean stock marketSouth Korean stocks, currency dive amid deeper US tariff turmoil

Korean stock marketSouth Korean stocks, currency dive amid deeper US tariff turmoilApr 07, 2025 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix aims to lock in all 2026 HBM orders by mid-2025

Korean chipmakersSK Hynix aims to lock in all 2026 HBM orders by mid-2025Mar 27, 2025 (Gmt+09:00)

2 Min read -

Pension fundsS.Korea’s pension fund NPS posts record return in 2024 on US stock rally

Pension fundsS.Korea’s pension fund NPS posts record return in 2024 on US stock rallyFeb 28, 2025 (Gmt+09:00)

2 Min read -

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earnings

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earningsJan 31, 2025 (Gmt+09:00)

4 Min read

Comment 0

LOG IN