Pension funds

S.Korea’s pension fund NPS posts record return in 2024 on US stock rally

The 15% investment return rate represents the state fund’s record annual gains for the second consecutive year

By Feb 28, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The National Pension Service (NPS), South Korea’s state-run pension fund and the country’s largest institutional investor, said on Friday it posted an all-time high 15% return from its investment activities in 2024, buoyed by a US stock rally and gains from alternative investments.

The strong performance, its highest since the launch of the NPS fund in 1988, followed its previous record high of 13.59% in 2023.

At last year’s return rate, the state pension fund earned 160 trillion won ($110 billion) in investment gains, with its total assets under management rising to 1,213 trillion won, or $830.3 billion, at the end of 2024.

Most global state-run pension funds post an annual return rate of less than 10%, industry officials said.

The pension fund’s cumulative returns since its inception stood at 783 trillion won at the end of 2024, posting an average annual return rate of 6.82%.

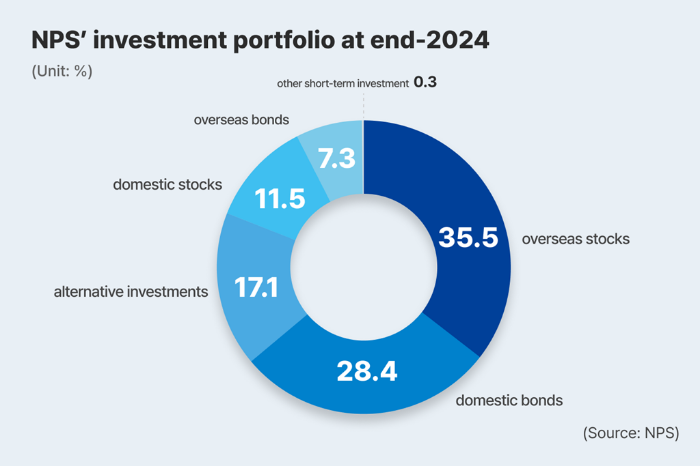

PERFORMANCE BY ASSET CLASS

By asset class, overseas equities delivered an impressive 34.32% return, followed by overseas bonds at 17.14% and alternative investments at 17.09%. Domestic bonds yielded a solid 5.27% return.

Domestic equities, however, posted a 6.94% loss in 2024, turning from a 22.12% gain the previous year. Korea’s main Kospi stock market fell 9.63% in 2024.

The NPS credited its decent overseas equity investment gains to the US Federal Reserve’s rate cuts and a strong rally in US tech stocks.

In 2023, the Korean pension fund posted a 23.89% return from its overseas equity investment.

Its domestic stock investment faced headwinds amid political uncertainties and concerns about big tech firms’ dim earnings outlook, according to the NPS.

The state fund’s investment in overseas bonds brought about a 17.14% return, boosted by decent interest income and higher dollar-won exchange rates.

Its domestic bond investment benefited from the Bank of Korea’s monetary easing, which helped boost bond prices, leading to its 5.27% investment return.

ALTERNATIVE INVESTMENTS

Alternative investments, including real estate, infrastructure and private equity, continued to perform well, with returns surging to 17.09% in 2024 from 5.8% in 2023.

“Last year’s decent performance came as a result of our diversified asset allocation strategy and strengthened partnerships with global investment firms,” said NPS Chairman Kim Tae-hyun

“We will continue to diversify our domestic and international portfolio, strengthening strategic partnerships with global asset managers and expand our overseas office capabilities.”

The state fund’s 2024 performance released on Friday is subject to the final review of a risk management team before the NPS’ Fund Management Committee announces finalized figures around the end of June.

Write to Gyeong-Jin Min at min@hankyung.com

In-Soo Nam edited this article.

More to Read

-

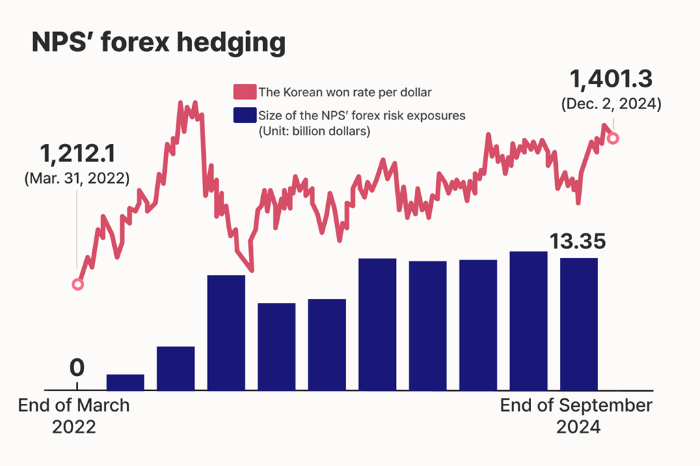

Foreign exchangeNPS initiates strategic currency hedging to unleash up to $48.2 billion

Foreign exchangeNPS initiates strategic currency hedging to unleash up to $48.2 billionJan 03, 2025 (Gmt+09:00)

3 Min read -

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025Dec 18, 2024 (Gmt+09:00)

4 Min read -

Pension fundsNPS expects Korea’s WGBI inclusion to attract $56 billion in foreign funds

Pension fundsNPS expects Korea’s WGBI inclusion to attract $56 billion in foreign fundsNov 24, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rally

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rallyMay 30, 2024 (Gmt+09:00)

1 Min read -

Pension fundsNPS logs record return rate in 2023 on stocks’ bull run

Pension fundsNPS logs record return rate in 2023 on stocks’ bull runFeb 28, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN