Foreign exchange

NPS initiates strategic currency hedging to unleash up to $48.2 billion

The state-run fund will tap into the $65 billion forex swap line with the BOK to help stabilize the local foreign exchange market

By Jan 03, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The National Pension Service (NPS), South Korea’s state-run pension fund and the country’s largest institutional investor, is set to begin strategic currency hedging to unload as much as $48.2 billion through the end of this year to help curtail the strength of the greenback against the won.

According to investment banking industry sources on Friday, the NPS plans to activate its strategic currency hedging mechanism for the first time since introducing the system in late 2022.

Once the system is launched, the move will be equivalent to injecting up to $4 billion a month into the domestic foreign exchange market, totaling $48.2 billion, sources said.

Strategic currency hedging involves increasing the hedging ratio for all of the NPS’ overseas assets to as high as 10%.

The mechanism is triggered when exchange rate fluctuations fall outside a 99% confidence interval for more than five trading days. This is defined as extreme values representing less than 1% of historical exchange rates since 2001, calculated based on the daily market average rate, commonly known as MAR.

Sources said the conditions for activating the mechanism were met at the start of the new year.

HEDGING OVER 12 MONTHS

Rather than implementing the strategic hedge in one go, the NPS plans to spread it out over 12 months, at a rate of $4 billion per month, to minimize any negative impacts on the domestic foreign exchange market.

The hedge will be ended if the dollar-won exchange rate stabilizes around the low-1,400 won per dollar range, sources said.

In Seoul trading, the US dollar opened at 1,469.0 won on Friday, up from 1,466.6 won on Thursday, the first trading day of 2025.

If fully implemented, strategic currency hedging would release $48.2 billion into the domestic foreign exchange market — equivalent to 10% of the NPS’s overseas assets as of the end of October 2022.

The hedging process involves selling forward contracts, fixing future dollar receipts at a predetermined rate and selling them to banks. The banks, in turn, should borrow an equivalent amount of spot dollars from abroad and sell it in the domestic foreign exchange market, resulting in increased dollar supply.

TAPPING INTO FOREX SWAP WITH BOK

The NPS is expected to use its foreign exchange swap agreement with the Bank of Korea to carry out its strategic hedging.

When the NPS requires dollars for new overseas investments, it taps into the BOK’s foreign exchange reserves under an agreement and repays them later.

The state fund recently expanded its foreign exchange swap limit to $65 billion from $50 billion and extended its agreement with the central bank to the end of this year.

Industry officials said that although the NPS’ activation of the strategic hedging mechanism is unlikely to fundamentally alter the exchange rate dynamics, it is expected to temper the strength of the dollar to some extent.

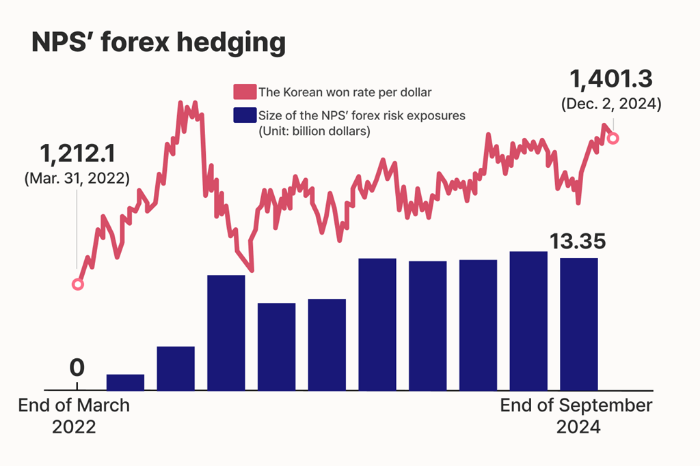

Separately, the pension fund is engaged in tactical currency hedging — another move that is expected to help stabilize the currency market.

Tactical hedging refers to adjustments made at the discretion of the NPS fund management committee, the state fund’s top decision-making body, while strategic hedging involves setting a uniform hedging ratio for all of its overseas assets.

As of the end of October 2023, the NPS undertook tactical hedging on $13.36 billion, or 2.77% of its overseas assets.

Tactical hedging is permitted to cover up to 5% of the NPS' overseas assets, for an additional injection of some $10.9 billion into the market if necessary.

Write to Byeong-hwa Ryu at hwahwa@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Foreign exchangeGlobal investment banks see Korean won staying weak in 2025

Foreign exchangeGlobal investment banks see Korean won staying weak in 2025Dec 31, 2024 (Gmt+09:00)

1 Min read -

Foreign exchangeSouth Korea to ease foreign exchange regulations, expand FX swap line

Foreign exchangeSouth Korea to ease foreign exchange regulations, expand FX swap lineDec 20, 2024 (Gmt+09:00)

4 Min read -

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025Dec 18, 2024 (Gmt+09:00)

4 Min read -

Foreign exchangeNPS incurs $500 million in missed gains due to improper forex hedging

Foreign exchangeNPS incurs $500 million in missed gains due to improper forex hedgingDec 03, 2024 (Gmt+09:00)

2 Min read -

Pension fundsNPS expects Korea’s WGBI inclusion to attract $56 billion in foreign funds

Pension fundsNPS expects Korea’s WGBI inclusion to attract $56 billion in foreign fundsNov 24, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN