Korea’s 1st institutionalized fractional art offering a smash hit

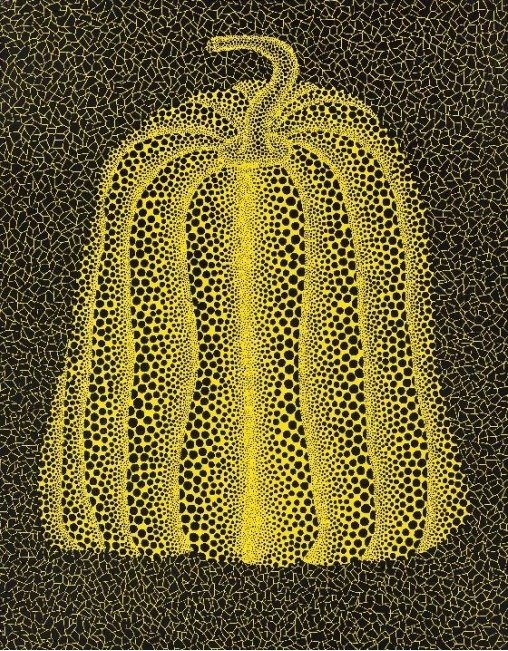

ArtnGuide’s fractional investment offering in Yayoi Kusama’s “Pumpkin” topped its initial target within an hour of opening

By Dec 19, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

South Korea’s first institutionalized fractional investing in a work of art proffered by Yeolmae Company, operator of South Korea’s fractional artwork investment platform ArtnGuide, has made a splash, heralding the rosy future of Korea’s fledgling fractional investment market.

According to ArtnGuide, the fractional public offering of Yayoi Kusama’s 2001 iconic “Pumpkin” has drawn more than 3 billion won ($2.3 million) in total as of Tuesday, more than double its initial subscription target of 1.23 billion won.

The platform operator Yeolmae said on Monday that its first institutional fractional art offering raised more than the initial target just one hour after the subscription began in the morning of the same day.

This is Korea’s first institutionalized fractional artwork investment after the Japanese contemporary artist’s work got the nod from the country’s top regulator, the Financial Supervisory Service (FSS), on Friday last week.

Yeolmae’s Founder and Chief Executive Officer (CEO) Kim Jae-wook expected that fractional investing in art as a legitimate alternative investment asset allows the country’s investors to have more diverse investment portfolios.

A slew of other fractional art investment offerings are slated for market debuts.

Art Together, a subsidiary of major Korean art auctioneer K-Auction, in the first week of this month submitted its registration statement for a fractional investment offering in another of Kusama’s pieces, also titled “Pumpkin” (2002) in a different size.

Seoul Auction Blue, operator of the fractional art investment app Sotwo, is also waiting for a cue from the FSS for fractional investments in “Dollar Sign” by Andy Warhol, while fine art fractional investment platform Tessa is expected to submit its registration to the FSS by the end of this month.

YAYOI KUSAMA’S 'PUMPKIN' IN ARTNGUIDE

Yeolmae submitted its registration statement for fractional investments in Kusama’s 2001 work to the FSS, with a plan to allow retail investors to buy 12,320 shares at 100,000 won per piece. The company purchased the piece at 1.12 billion won.

The public subscription of shares in Kusama’s 2001 “Pumpkin”, which opened on Dec. 18, will end on Dec. 22. The maximum number of shares each investor can subscribe is 300 shares, or 30 million won.

By subscribing to the shares, individual investors can hold fractional ownership in the artwork, and later take profits after the art is sold.

Its subscription is available in ArtnGuide, while investors should pay with virtual accounts at K-Bank, Korea’s internet-only bank.

Retail investors will be able to grab 90% of the entire shares, while the remaining 10%, or 1,232 shares, are already owned by Yeolmae.

The company will purchase any forfeited shares later.

A NEW ERA OF FRACTIONAL INVESTING IN KOREA

ArtnGuide’s fractional sale of Kusama’s “Pumpkin” marks another significant step forward in the Korean fractional investment market after the Financial Services Commission (FSC) in July revised the securities registration form.

The change, effective from Aug. 1 of this year, allows fractional investment platform operators to register as financial companies that can trade in fine art, cattle and music copyrights as investment securities.

About five fractional investment platform operators including artwork traders Tessa, Sotwo, ArtnGuide and Art Together, as well as one live cattle fractional investment operator, Bancow, were anticipated to register at that time.

The move comes as fractional investing or buying tiny shares of non-traditional assets, which offers an opportunity for smaller investors to participate, has become increasingly popular globally.

But it has risks like the unpredictability of when to exit as investors cannot cash out before the underlying art asset is sold.

Yeolmae plans to register an ensemble of another artist’s work in February next year to issue artists' work separately in phases, said Kim.

Write to Byeong-Hun Yang at hun@hankyung.com

Sookyung Seo edited this article.

-

RegulationsFractional investing to gain traction in Korea with green light from FSC

RegulationsFractional investing to gain traction in Korea with green light from FSCJul 31, 2023 (Gmt+09:00)

3 Min read -

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

2 Min read -

RegulationsKorea to legalize security token for fractional investment

RegulationsKorea to legalize security token for fractional investmentFeb 06, 2023 (Gmt+09:00)

3 Min read -

ArtsYeolmae and Company emerges as major player in secondary art market

ArtsYeolmae and Company emerges as major player in secondary art marketDec 01, 2022 (Gmt+09:00)

2 Min read -

Venture capitalKoreans' fractional investing craze spreads to cows

Venture capitalKoreans' fractional investing craze spreads to cowsApr 28, 2022 (Gmt+09:00)

1 Min read -

Korean startupsFractional copyright ownerships are securities: Seoul

Korean startupsFractional copyright ownerships are securities: SeoulApr 20, 2022 (Gmt+09:00)

3 Min read -

Venture capitalFractional investing platforms for art to Rolex lure VCs

Venture capitalFractional investing platforms for art to Rolex lure VCsNov 17, 2021 (Gmt+09:00)

4 Min read -

Korean startupsArt investment platform operator Yeolmae Co. raises $14 mn in Series B

Korean startupsArt investment platform operator Yeolmae Co. raises $14 mn in Series BMar 28, 2022 (Gmt+09:00)

1 Min read