Arts

Yeolmae and Company emerges as major player in secondary art market

The value of the artworks the company has purchased this year is forecast to exceed $38.5 mn, more than doubled from last year

By Dec 01, 2022 (Gmt+09:00)

2

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

Aman, Rosewood, Banyan, IHG rush to open luxury hotels in Seoul

Samsung Heavy Industries succeeds autonomous vessel navigation

Biden exempts graphite from EV mineral sourcing rule in win for Korea

South Korean startup Yeolmae and Company, which operates ArtnGuide, has recently emerged as a significant player in the art market.

ArtnGuide is an online platform that allows users to pool money to collectively purchase famous works of art to sell them at a premium later.┬Ā

The accumulated value of the artwork the company has purchased this year is forecast to exceed 50 billion won ($38.5 million), more than a two-fold jump from last year.┬Ā

The figure is approximately 10% of the countryŌĆÖs secondary art market.┬Ā

In an interview with The Korea Economic Daily, YeolmaeŌĆÖs Founder and Chief Executive Officer (CEO) Kim Jae-wook explained what sets the platform apart from similar services is that it puts the sales and profit margins above all.┬Ā

ŌĆ£In other words, individual investors join forces to buy and sell paintings as if working as a single institutional investor,ŌĆØ said Kim.┬Ā

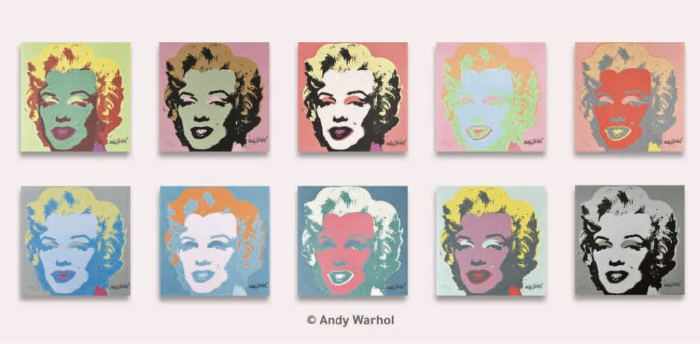

Founded in 2016, the startupŌĆÖs online platform divides up the ownership of pieces by famous artists such as Kim Whanki, Yayoi Kusama, and Pablo Picasso to make the parts available for sale.┬Ā

Users on the platform pool money together to purchase a work of art and when the piece goes up in value, it can be sold at a premium. The individual investors will then receive the profit.

The end buyer does not pay an additional fee for the transaction.

SECONDARY MARKET

Industry insiders say the company has made the alternative investment in visual art more accessible to the general public, which was widely considered to be reserved for the wealthy with ample disposable income.┬Ā

With the lower barrier, the liquidity in the market has shot up.┬Ā

The art market is divided into primary and secondary markets.┬Ā

The primary market refers to the selling of pieces that have never been sold before. The secondary market is the re-selling of artwork that has been valued and sold before.┬Ā

As such, the latter typically deals with artworks by artists who have a substantial reputation.┬Ā

The higher name value also adds to the ease of entry for those not working in the art industry but who want to invest regardless.┬Ā

According to Kim, financial experts make up the largest group of users on ArtnGuide: ŌĆ£Fund managers and pension officers, who have restrictions on stocks trading, are the most frequent buyers on our platform. From the first purchase to re-sell, it takes us about three to 10 months.ŌĆØ┬Ā

A physical gallery on average keeps an art piece for several decades before selling it again.┬Ā

Yeolmae Company conducted a resell on around 100 pieces of art.┬Ā

ŌĆ£The average rate of return for a piece of art has been 30% for investors and 45% for Yeolmae,ŌĆØ said Kim.

PAINTING A NEW LEAF

The next project for Yeolmae is the launch of a securities product.┬Ā

In an unprecedented move for the art industry, the startup applied for approval to operate a finance innovation service to the Financial Services Commission in June.┬Ā

Yeolmae raised 17 billion won in a Series B round earlier this year and aims to do an initial public offering (IPO) in 2024.

Write to Lan Heo at why@hankyung.com

Jee Abbey Lee edited this article.

More to Read

Comment 0

LOG IN