Fractional investing to gain traction in Korea with green light from FSC

Now that fractional investing is subject to regulatory supervision, investors will be protected from fraud

By Jul 31, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Come September, South Korean investors will be able to freely and safely buy and sell fractions of artwork and even live cows just as they do with traditional securities such as stocks, bonds and investment certificates.

Fractional investing or buying tiny shares of non-traditional assets has become increasingly popular globally. And now the Korean financial regulator has officially cleared the final hurdle for such transactions by institutionalizing those assets as tradable securities.

The Financial Services Commission (FSC) said on Monday it is revising the securities registration form as of Aug. 1 to allow fractional investment platform operators to register as financial companies that can trade in fine artwork, cattle and music copyrights as investment securities.

With the revision, at least five fractional investment platform operators are expected to register with the regulator as early as this week, industry officials said.

The five are four online artwork trading platforms – Tessa, Sotwo, ARTnGUIDE and Art Together – and one live cattle fractional investment operator, Bancow.

“We have already established a fractional trading system. We’ve been awaiting the FSC’s final go-ahead. We’ll start our business as early as September after submitting a registration form in August,” said a local fractional investment firm.

FRACTIONAL INVESTING: HOW IT WORKS

Fractional investing has become a trend as it opens up a new investment channel – people can make investments with a small sum of money and still anticipate favorable returns.

It's all the more attractive amid skyrocketing real estate and stock prices, which have raised the entry barriers for those without deep pockets.

The majority of fractional traders are currently young people in their 20s and 30s – those who missed out on an opportunity to invest in real estate or promising stocks, as well as aficionados of music and art.

The process is for a fractional investing platform to collect art with money from a pool of small investors, share their ownership and later distribute the profit from selling the art.

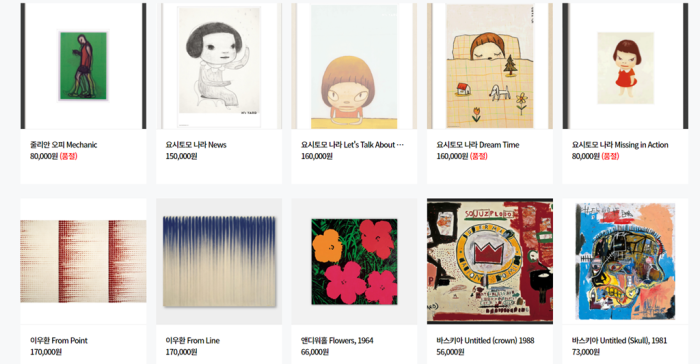

Retail investors can buy fractions of tangible and intangible goods and luxury items, such as celebrated artwork, limited-edition sneakers and music copyrights and even live cows through the mobile apps of fractional investment platform operators and securities firms.

COME INTO THE LEGAL SYSTEM

Last year, the FSC scrutinized the legitimacy of Musicow, Korea’s first music copyright trading platform, as the business hadn’t been regulated under the Capital Markets Act. The regulator briefly suspended its business before categorizing tradable fractional ownership of music copyrights as investment securities.

Musicow buys the copyright of a song from the original creator and divides the claims into small fragments to sell part of the copyright fees to its members on the platform.

Its users can buy or sell a stake in copyrights on its platform like trading investment securities. Musicow pays the fractional investors copyright royalties on a monthly basis.

Fractional investing poses some risk, such as volatility. It's common for royalties to spike when a song becomes popular – only to plunge once the hype fizzles. Also, investors may not be able to sell their shareholdings if there isn't enough trading volume.

Now that trading platforms are under regulatory supervision just as brokerage houses are, retail investors will be better protected from fraudulent transactions, industry officials said.

Fractional investment platform operators will be obligated to make public information such as what tangible or intangible assets they purchase and how much they spend on them.

The government has yet to decide whether to apply the same tax system to fractional investments as that for stocks or funds.

Write to Sang-Hoon Sung at uphoon@hankyung.com

In-Soo Nam edited this article.

-

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

2 Min read -

RegulationsKorea to legalize security token for fractional investment

RegulationsKorea to legalize security token for fractional investmentFeb 06, 2023 (Gmt+09:00)

3 Min read -

Venture capitalKoreans' fractional investing craze spreads to cows

Venture capitalKoreans' fractional investing craze spreads to cowsApr 28, 2022 (Gmt+09:00)

1 Min read -

Korean startupsFractional copyright ownerships are securities: Seoul

Korean startupsFractional copyright ownerships are securities: SeoulApr 20, 2022 (Gmt+09:00)

3 Min read -

Venture capitalFractional investing platforms for art to Rolex lure VCs

Venture capitalFractional investing platforms for art to Rolex lure VCsNov 17, 2021 (Gmt+09:00)

4 Min read -

Wealth managementSongs and art: Fractional investing bedazzles millennial investors

Wealth managementSongs and art: Fractional investing bedazzles millennial investorsMay 17, 2021 (Gmt+09:00)

3 Min read